With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

WisdomTree Physical Bitcoin (BTCW) and WisdomTree Physical Ethereum (ETHW), will give investors access to Bitcoin and Ethereum while being fully backed by the actual assets.

Edited by Julia Sakovich

Updated

2 mins read

Edited by Julia Sakovich

Updated

2 mins read

The winds of change are blowing through the European crypto scene. In a move that could greatly boost the institutional use of cryptocurrencies, WisdomTree, a well-known exchange-traded product (ETPs) provider, has gained approval from the UK’s Financial Conduct Authority (FCA) to list two physically backed cryptocurrency ETPs on the London Stock Exchange (LSE).

These ETPs, the WisdomTree Physical Bitcoin (BTCW) and WisdomTree Physical Ethereum (ETHW), will give investors access to Bitcoin and Ethereum while being fully backed by the actual assets. This is a major development, as it offers a regulated and secure way for institutional investors wary of the crypto market due to regulatory uncertainty.

“FCA approval could lead to greater institutional adoption of the asset class,” said Alexis Marinof, head of Europe at WisdomTree. He highlights the regulatory constraints and uncertainties that have been hindering institutional involvement in crypto. Marinof believes the FCA’s approval could eliminate these barriers.

This move by WisdomTree is not its first venture into the European crypto market. The company has already established a presence on Deutsche Börse Xetra, the Swiss Stock Exchange SIX, and Euronext exchanges in Paris and Amsterdam. Their existing offerings provide European investors with access to a variety of crypto ETPs, including physically-backed Bitcoin, the Crypto Market, and Crypto Altcoins.

WisdomTree is not alone in recognizing the increasing demand for crypto exposure in Europe. ETC Group, another player in the ETP space, launched a product tracking the Compass Ethereum Total Return Monthly index ETO in February on Deutsche Börse Xetra. In April, they further expanded their offerings with a Bitcoin product.

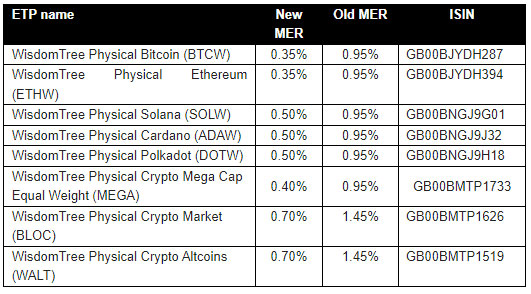

WisdomTree has reduced fees for its WisdomTree Physical Bitcoin ETP, cutting the management expense ratio (MER) from 0.95% to 0.35%. This move aims to enhance competitiveness, offering the most cost-effective physically-backed Bitcoin ETP in Europe without crypto lending, which adds risks for investors.

Photo: WisdomTree

The FCA’s approval of WisdomTree’s physically-backed Bitcoin and Ethereum ETPs on the LSE is a key moment for the European crypto market. This regulatory approval, along with lower fees, sets the stage for greater institutional adoption of cryptocurrencies.

As established companies like WisdomTree keep innovating and expanding their offerings, we can expect a more mature and accessible crypto ecosystem to develop in Europe, attracting more investors and supporting the growth of digital assets.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.