Ethereum Price Prediction: Will Vitalik’s New Strategy Push ETH to $10,000 in February?

/PlutoChain/ – Vitalik Buterin’s latest strategy focuses on improving Ethereum’s scalability and decentralization, which brought speculation that ETH could hit $10,000 soon.

Meanwhile, PlutoChain ($PLUTO) could make its own impact. As a Layer-2 solution for Bitcoin, it could bring instant transactions, lower fees, and Ethereum compatibility to the network.

By allowing Ethereum-based apps to integrate with Bitcoin, PlutoChain may help bridge two of the biggest blockchains and unlock new possibilities for users.

Let’s check out the deets.

ETH Price Prediction: Ethereum’s Scaling Plan May Be the Catalyst for a $10,000 ETH

Vitalik Buterin has laid out a plan to scale Ethereum by strengthening Layer-2 networks, expanding blob scaling, and reinforcing ETH’s role as the backbone of the ecosystem.

In a recent blog post, he emphasized that Ethereum’s long-term success depends on faster adoption of L2 solutions and greater interoperability between them. He also suggested that L2 networks should allocate a portion of their fees to support ETH, which only strengthens its economic importance.

By increasing Ethereum’s transaction capacity and reducing fees, these upgrades could drive more adoption, making ETH even more valuable.

If demand for Ethereum’s network grows alongside these improvements, ETH could be on track for a major price surge — potentially even hitting $10,000 in the near future.

PlutoChain ($PLUTO) Is a Hybrid Layer-2 Solution That Could Transform Bitcoin’s Scalability and Ecosystem

While Bitcoin maintains its position as the cornerstone of crypto, its technical limitations have become increasingly apparent. Despite widespread adoption, Bitcoin’s network continues to face significant challenges with transaction speeds, escalating fees, and network congestion.

Though platforms like Ethereum and Solana have implemented solutions to these scaling problems, Bitcoin’s infrastructure has remained relatively static.

PlutoChain ($PLUTO) could address these limitations through Layer-2 implementation that might enhance Bitcoin’s throughput while preserving its security model. By operating as a parallel network, PlutoChain could alleviate congestion and optimize transaction processing without compromising Bitcoin’s core architecture.

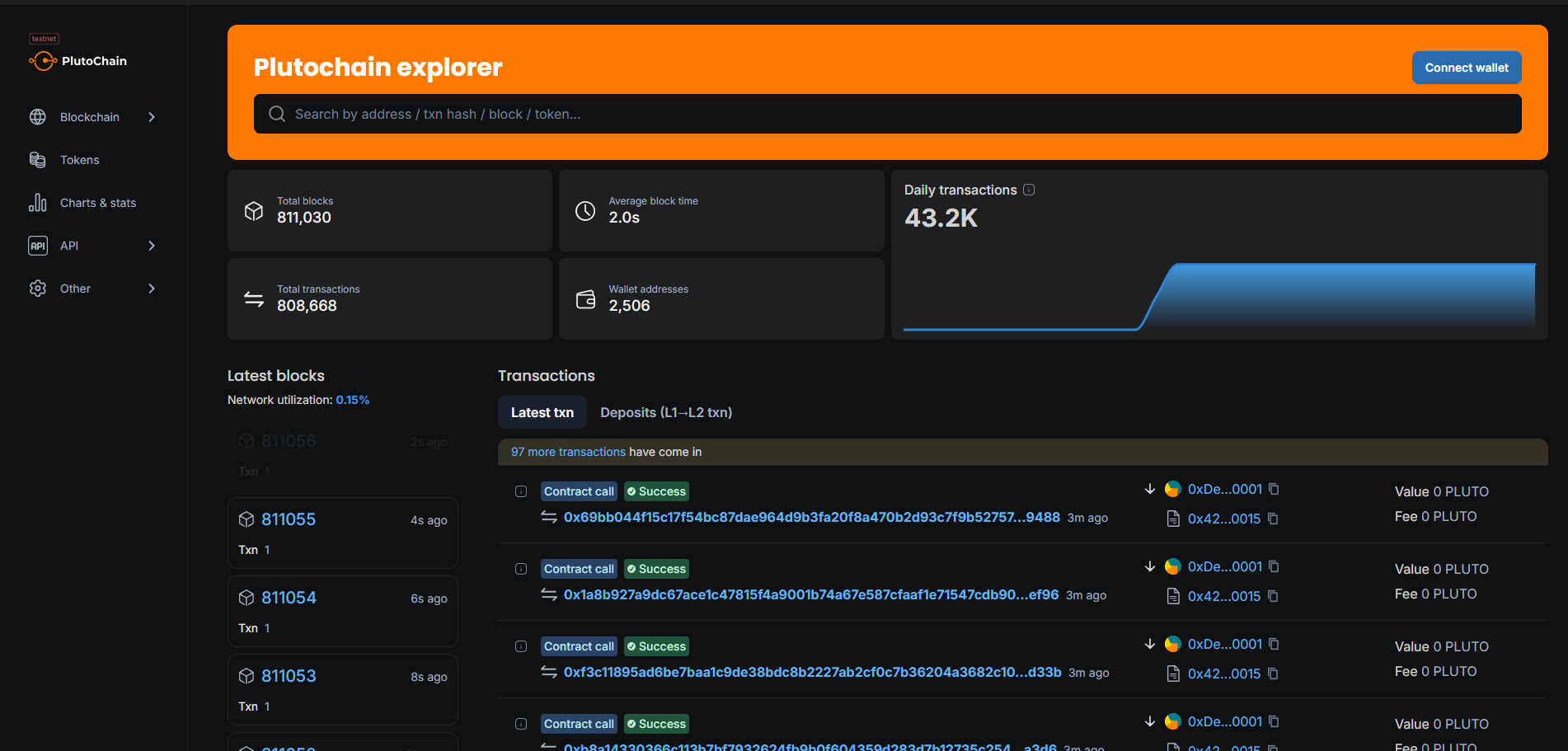

The technical specifications are compelling – PlutoChain offers block time of just 2 seconds through its Layer-2 protocol. This acceleration might transform Bitcoin’s utility for time-sensitive applications like point-of-sale payments and cross-border transfers.

Aside from performance improvements, PlutoChain could substantially reduce transaction costs, which may bring adoption across both retail and institutional sectors.

A key technical advantage lies in PlutoChain’s full EVM compatibility, which could enable seamless integration between Bitcoin and Ethereum’s robust ecosystem of DeFi protocols, NFT platforms, and AI-driven applications. The platform’s capability has been demonstrated through the testnet processing 43,200 transactions per day without performance degradation.

Security infrastructure has been validated through comprehensive audits by SolidProof, QuillAudits, and Assure DeFi, complemented by ongoing code reviews and network stress testing.

PlutoChain implements a decentralized governance model where users directly influence platform evolution, from feature proposals to voting on strategic initiatives and technical upgrades.

The Bottom Line

Vitalik Buterin’s latest strategy could be a turning point for Ethereum, making it more scalable, efficient, and economically robust. If adoption of Layer-2 solutions accelerates and ETH’s role strengthens, a $10,000 price target may not be out of reach.

Meanwhile, PlutoChain ($PLUTO) is trying to tackle Bitcoin’s biggest challenges. It could enable instant transactions, lower fees, and Ethereum compatibility, bringing new utility to Bitcoin’s ecosystem.

This article does not offer financial advice. Cryptocurrencies can be unpredictable and carry risks. It is important to conduct thorough research before acquiring any crypto asset. Forward-looking statements carry risks and are not guaranteed to be updated.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.