Solana Price Prediction: Will SOL Reach $600 Amid DeFi Expansion and Institutional Adoption?

/PlutoChain/ – With DeFi adoption booming and institutional users taking notice, the big question is: Can SOL hit $600? Its fundamentals are stronger than ever, and the majority of users are watching technical charts and on-chain data for signs of a breakout.

Meanwhile, PlutoChain might draw attention for a different reason — it could tackle Bitcoin’s biggest weakness: scalability.

PlutoChain could open new doors for DeFi, dApps, and interoperability simply by speeding up transactions and enabling smart contracts on Bitcoin’s network.

Let’s break it down below!

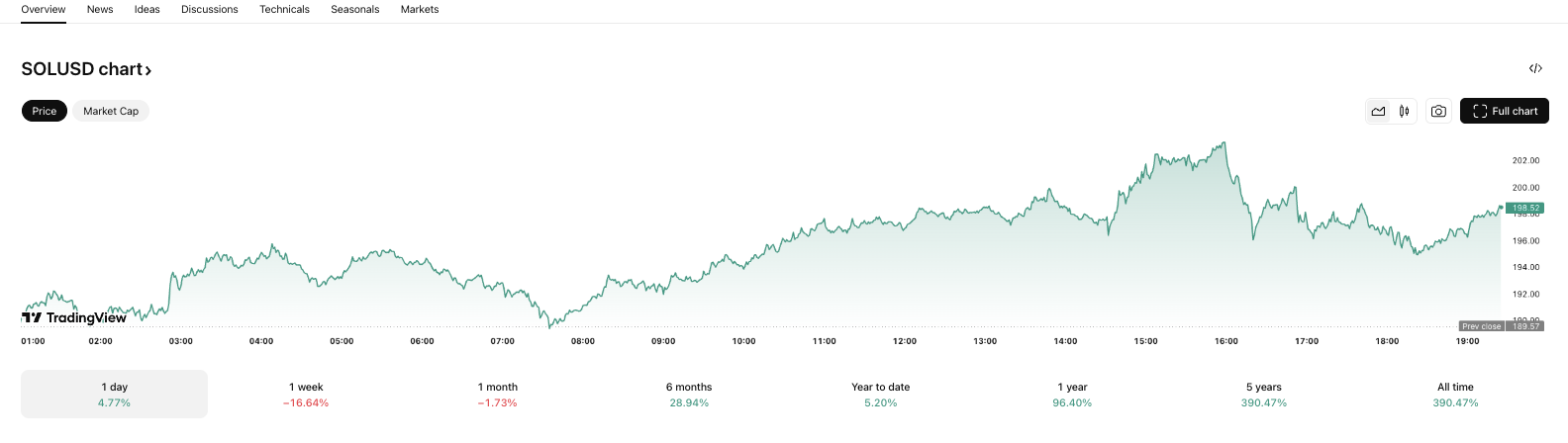

Solana’s Price Outlook – Can It Hit $600?

Solana has been on a roll and is gaining momentum as DeFi adoption surges and big investors jump in. But can it really hit $600? Some Binance analysts suggest it’s possible, but breaking through key resistance levels will be the real test.

With more DeFi projects launching on Solana, demand for SOL is rising fast. Institutions are also paying attention, especially as Solana becomes a go-to network for NFTs, payments, and financial applications.

On-chain data shows that whales are accumulating, which could fuel the next leg up. If market conditions stay bullish, SOL might just be headed for new highs.

PlutoChain is Pushing Bitcoin Beyond Just a Store of Value

Bitcoin may be the leading digital asset, but let’s face it — it’s slow, expensive, and not built for DeFi. That’s exactly what PlutoChain might fix in the future.

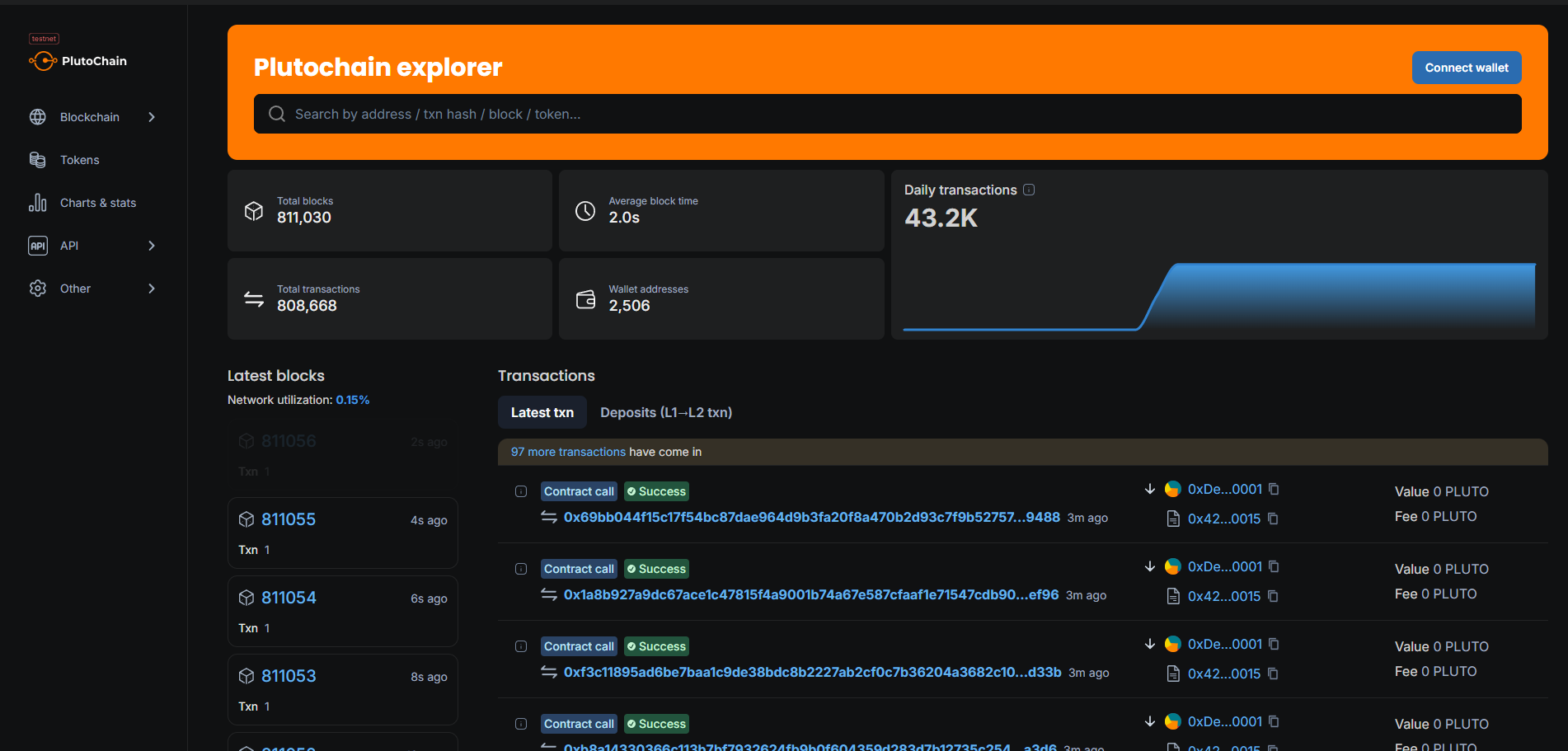

As a hybrid Layer-2 scaling solution, PlutoChain offers a 2-second block time on its own L2 chain and handles 43,200 transactions per day (proven during its testnet phase).

But, it doesn’t stop at speed. PlutoChain is also EVM-compatible, which means Ethereum-based dApps, DeFi protocols, and smart contracts can now operate on Bitcoin’s network.

Imagine seamless DeFi, NFT marketplaces, and cross-chain functionality, all potentially powered by Bitcoin’s security but with Ethereum’s flexibility. That could be a complete game-changer.

Decentralization is another major focus. PlutoChain lets its community propose and vote on network upgrades, which could ensure users have a real say in its development. When it comes to security, PlutoChain doesn’t cut corners — it undergoes strict audits from SolidProof, QuillAudits, and Assure DeFi to keep the network safe.

PlutoChain might turn BTC into more than just digital gold by bridging Bitcoin to DeFi, NFTs, and cross-chain applications. It could make it a fully functional ecosystem, and whales could be taking notice.

Final Words

Solana’s growing presence in DeFi and increasing institutional interest are key factors that could push its price toward $600.

At the same time, PlutoChain’s advancements in Bitcoin Layer-2 scaling and interoperability could continue to attract attention.

PlutoChain could expand Bitcoin’s overall utility by adding smart contracts to its secure network, making it a project that might be interesting to keep an eye on in the following weeks.

Please remember that this article is purely informational and not financial advice. Any and all cryptocurrencies are volatile, with prices prone to rapid changes. Always do your own research and consult an expert before joining any crypto venture. We are not liable for any outcomes based on the information in this article. Statements about the future entail risks and may not reflect updates.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.