Why $SOL Is Rising 9.3% as Solaxy’s ICO Approaches $28M amid Layer-1 Support from Solana Founder

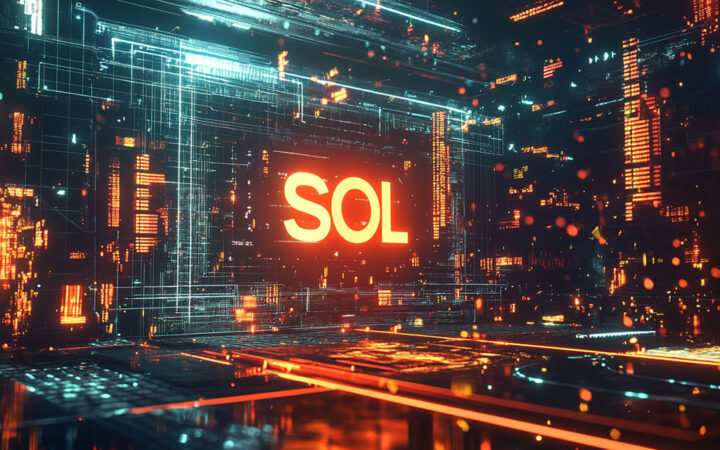

Solana ($SOL) climbed 9.3% in the past 24 hours as the broader crypto market found relief following reports that US President Donald Trump may implement more targeted and less severe tariffs than initially expected.

Adding to the positive sentiment is fresh investor capital flowing into the presale of Solana’s first Layer-2 chain, Solaxy ($SOLX), which has now raised $27.69 million as of Monday.

Early investors in Solaxy appear to be embracing the broader optimism despite Solana founder Anatoly Yakovenko’s stance that, unlike Ethereum, Solana doesn’t require Layer-2 solutions.

However, the nearly $28 million in presale funding tells a different story. Backers support a solution designed to address Solana’s ongoing congestion challenges and enhance key growth areas like decentralized finance (DeFi) and gaming.

$SOLX is currently available for $0.001674 per token for the next 48 hours before the price increases in the 63rd funding stage. Buyers can also avail themselves of the 147% staking reward currently available to token holders who lock up their $SOL for 12 months. The yield is determined dynamically depending on the amount deposited into the staking smart contract.

VanEck Predicts Solana Could Reach $520 in 2025 – Could Solaxy Be the Key Catalyst?

For weeks, markets have been eager for clarity as Trump appeared to adopt a tough posture on trade policies. However, recent reports suggesting a more measured approach to tariffs have sparked positive reactions in both stocks and crypto assets.

The Dow Jones Industrial Average climbed 1.2%, the Nasdaq Composite rose 1.9%, and the S&P 500 gained 1.5%.

In the crypto space, Solana ($SOL) stood out as one of the top-performing assets over the past 24 hours, alongside Bitcoin ($BTC) and Ethereum ($ETH), both up 4.7%, and Ripple ($XRP), which gained 3.6%.

Source: CoinGecko

Overall, the cryptocurrency market added 3.22% to its total market capitalization, which is now $2.86 trillion. Trading volumes also jumped 56.28% to approximately $67.07 billion.

Investors are closely watching the upcoming US Core PCE Price Index, US Personal Income, and US Personal Spending reports due Thursday and Friday respectively. These data points could indirectly impact crypto prices, especially if they reveal signs of economic instability or weakening consumer confidence.

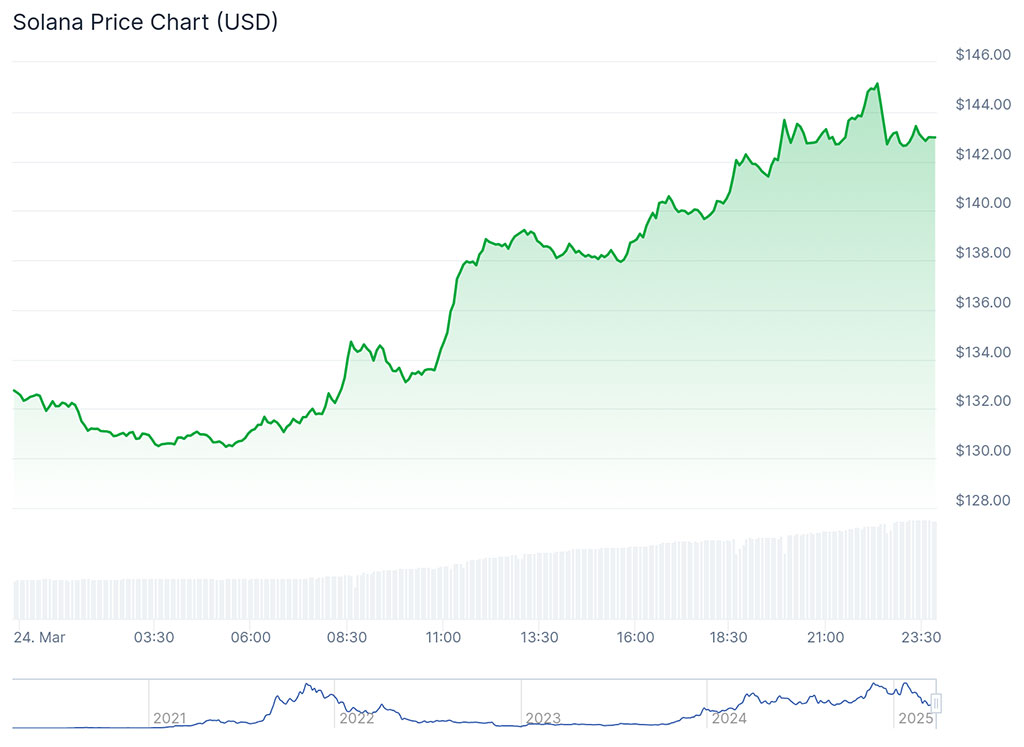

Such outcomes may prompt the Federal Reserve to pivot toward more accommodative monetary policies – a move that could expand the US money supply and potentially lift crypto prices, particularly Solana.

Last month, investment firm VanEck predicted that $SOL could reach $520 by year-end, citing expected US M2 growth as a key factor. While $SOL at $143 may seem far from that target, its previous all-time high of $293, set just in January, suggests that VanEck’s prediction is not unrealistic.

Source: St. Louis Fed

That rally was partly driven by the rise of Official Trump ($TRUMP) and Official Melania ($MELANIA) tokens, which spurred increased demand and congested the Solana network – a longstanding issue.

This is why Solaxy, Solana’s first Layer-2 solution, has gained traction. With its presale seeing a huge uptick in momentum, investors appear confident that Solaxy can mitigate congestion while supporting Solana’s specialized use cases.

Anatoly Yakovenko Questions Layer-2s – But Solaxy Might Change His Mind

Indeed, Yakovenko appeared to take a shot at Ethereum Layer-2s by highlighting their reliance on slower Layer-1 data availability.

He also emphasized that Solana doesn’t require Layer-2s, arguing that Layer-1 solutions can be faster, cheaper, and more secure – making additional scaling layers unnecessary in Solana’s case.

However, despite Solana’s high throughput and low transaction costs due to its core design, network congestion remains an issue that can undermine its reliability compared to some other blockchains.

Solaxy addresses this challenge by offering significantly faster TPS and even lower transaction costs. Beyond decongesting Solana by processing transactions off-chain, Solaxy is designed to support niche use cases such as high-frequency trading – a sector that could have thrived during the surge in meme coin trading involving $TRUMP and $MELANIA.

Solaxy could also become a testing ground for Web3 gaming, a space where Solana continues to gain traction as a preferred platform for crypto game launches.

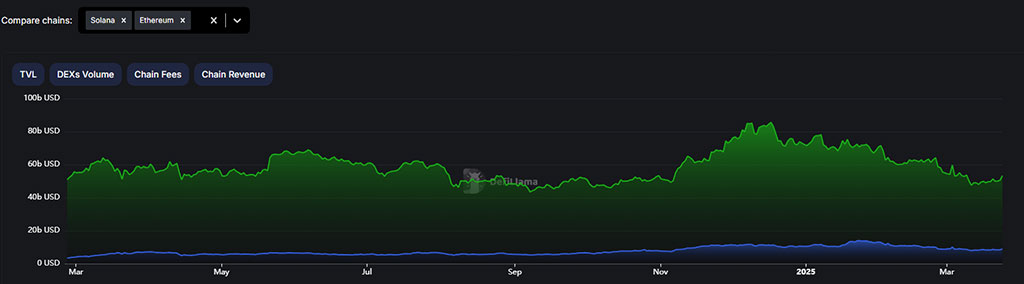

In DeFi, where Solana is steadily expanding its presence, Solaxy’s Layer-2 functionality could further accelerate growth.

Source: DefiLlama

Furthermore, Solaxy has the potential to bridge Solana with other blockchains. Currently, Solaxy is compatible with Ethereum, with $SOLX functioning as an ERC-20 token. This cross-chain functionality is expected to extend to Solana soon, enabling Solaxy to connect the two ecosystems seamlessly.

That’s the kind of utility a Layer-2 like Solaxy can offer – one that could challenge Yakovenko’s view on Solana’s need for Layer-2 solutions.

Solaxy Aims to Challenge Yakovenko’s View – Join the $SOLX Presale Today

Solaxy and its early supporters are championing the vision of an improved Solana – which is why Solaxy recently shared this post on X:

If you want the same old problems stick with $SOL…

If you want Speed, Security and Scalability it’s time to join $SOLX 🛸🔥 pic.twitter.com/6HzCZwfyKO

— SOLAXY (@SOLAXYTOKEN) March 24, 2025

Ultimately, it’s the community that shapes Solana’s future. If you believe Layer-2 solutions are essential for enhancing Solana’s capabilities, consider joining Solaxy’s journey by visiting the Solaxy presale website and connecting your wallet – such as Best Wallet.

Best Wallet’s multi-chain support offers a seamless way to manage $SOLX, which is currently available on Ethereum. The wallet recently expanded to support Bitcoin and is preparing for its upcoming Solana integration.

You can download Best Wallet today from Google Play or the Apple App Store.

Stay updated with Solaxy’s latest developments by joining the project’s X and Telegram communities.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.