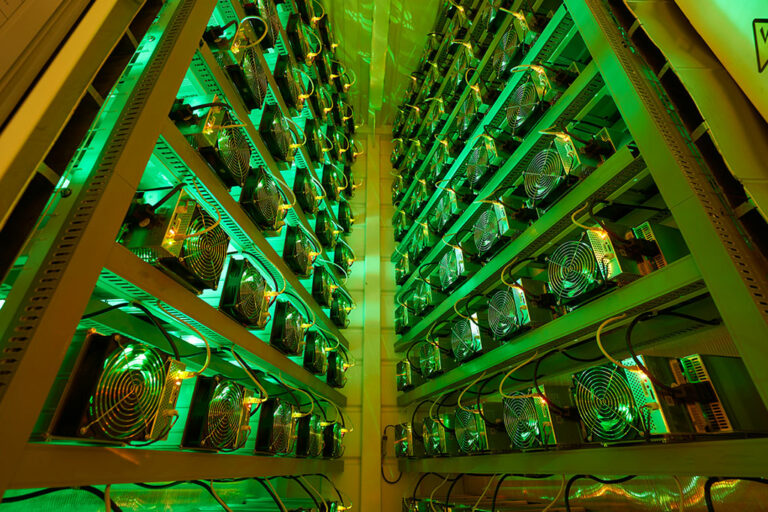

The heightened energy demands have led to a sharp increase in electricity costs, a primary expense for Bitcoin mining operations.

The recent Bitcoin (BTC) halving event has significantly impacted the operational costs for BTC miners in the United States, driving energy expenditures to a staggering $2.7 billion.

According to Best Brokers’ post, this surge in cost stems from the halving process, which reduced the reward for mining new Bitcoin blocks by half, effectively doubling the computational effort, and consequently, the energy consumption required to generate the same amount of the cryptocurrency.

Bitcoin Miners Reconsidering Strategies Due to High Energy Costs

Paul Hoffman, the Best Brokers analyst, emphasized the significant energy usage of Bitcoin mining, pointing out that 20,822.62 gigawatt-hours (GWh) of electricity have been utilized in the current year. This level of expenditure is noteworthy, given the average commercial electricity rate of $0.1281 per kilowatt-hour (kWh) as of February.

Additionally, 116,550 Bitcoin valued at $8.2 billion have been mined worldwide, with US miners contributing 44,102 BTC (37.84% of the total). The heightened energy demands have led to a sharp increase in electricity costs, a primary expense for Bitcoin mining operations.

Before the halving, it took 407,059.01 kWh of electricity to mine one BTC, costing about $52,144.26. However, after the halving, the energy required multiplied to 862,625.55kWh, increasing the cost to about $110,503.61 per Bitcoin. This shift in energy costs has forced many US miners to reconsider their strategies. Today, some are opting to relocate to states with lower electricity rates or invest in renewable energy sources to mitigate expenses.

Impact of Bitcoin Halving Event 2024

The halving event is expected to have a major financial effect on Bitcoin mining firms, causing a substantial reduction in annual revenue amounting to billions of dollars. Before this year’s halving, experts at JPMorgan Chase & Co (NYSE: JPM) an American investment banking leader, pointed out miners’ difficulties, including production costs, decreased earnings, and electricity-related issues.

Before the halving, several mining companies scouted for sustainable options with a Texas-based Bitcoin mining firm Giga Energy partnering with Argentinian firms. As the sector braces for consolidation, publicly-listed Bitcoin miners are expected to gain market share, leveraging greater access to funding and equity financing.

Post-halving events have been completed without disrupting the functioning of the Bitcoin blockchain. However, miners now rely increasingly on transaction fees as a source of revenue amidst dwindling rewards. Meanwhile, there are 64 expected halving events before reaching the 21 million cap around 2140 when all Bitcoin blocks would be mined.

However, the price trajectory of Bitcoin has remained unchanged a little despite speculations and projections by different analysts before the halving. For instance, Bitwise CEO Hunter Horsley predicted the digital asset might soar to $100,000 after the halving event. Market watchers say it is still too early but a bullish run is anticipated in the coming days.

At the time of writing, the price of Bitcoin is pegged at $67,761.34, down by 0.67% in the past 24 hours.

next