UltrAlpha to Permanently Lock-up 150 Million UAT Tokens

10:00pm EDT Thur, AUGUST 22, 2019 – UltrAlpha (UAT), the comprehensive innovative professional digital asset management service platform, announced the permanent lock-up of 150 million UAT tokens from the pending release portion. The total supply of UAT is thus reduced by 30% from 500 million to 350 million. With less supply in circulation, this movement by UAT can potentially lead to positive market reaction.

Photo: UltrAlpha Platform / Twitter

Who Is UltrAlpha

Built by seasoned professionals and executives from traditional finance, internet and blockchain industries, UltrAlpha serves as a professional investment management service platform for both asset managers and potential investors in the emerging digital asset industry. UltrAlpha also introduced UAT tokens, the platform’s native utility token, for payment and other key functions integrated with platform ecosystem.

The team leverage their well-rounded industry experience in the selection of quality products and the offering of value-added services towards users. For the design of toke economics, they have conducted industry research and incorporated many best-practice features with the aim to effectively balance supply and demand and support token value on the longer term basis. The permanent lock-up of 150 million UAT tokens indicates that part of this control mechanism is being implemented.

The Permanent Lock-up Details and Updated Token Economics

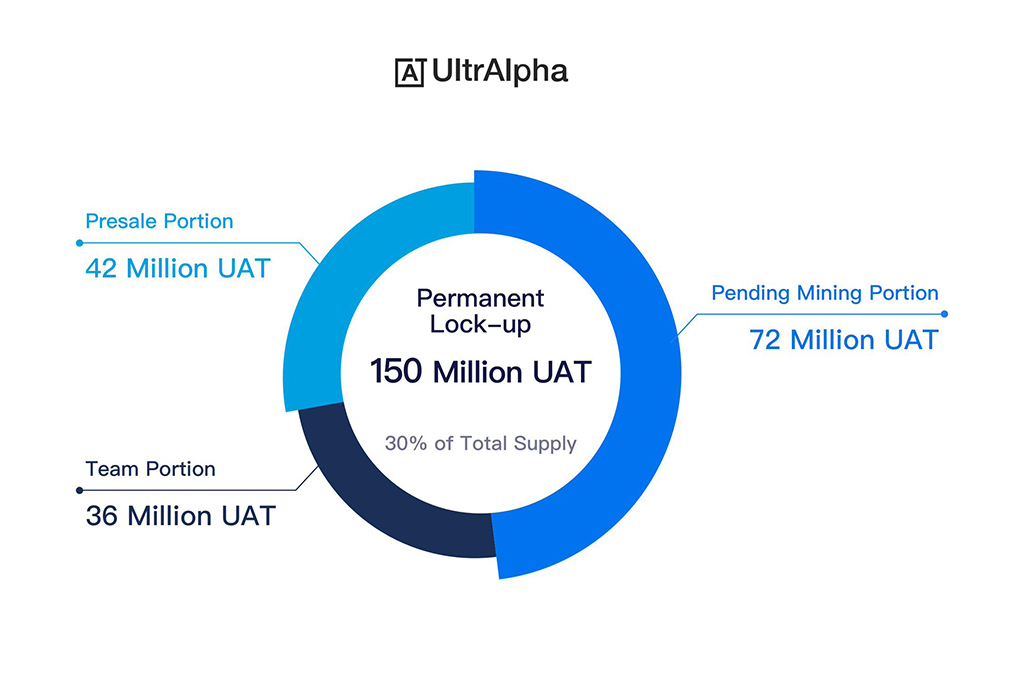

To further explain the details, UltrAlpha (UAT) will permanently lock up 150 million UAT tokens (30% of total supply) from the pending release portion per following schedule.

- 30 million UAT from pending mining portion and 15 million UAT from team portion will be permanently locked up. The release ratio among mining: presale: team will remain 1:1:0.5.

- Per discussion, UltrAlpha strategic investors will permanently lock up 42 million UAT from their presale portion in support of the project. In addition, 21 million UAT from team portion and 42 million UAT from pending mining portion will be subject to permanent lock-up.

As a result, total of 150 million UAT tokens will be subject to permanent lock-up, including 72 million from pending mining portion, 42 million from presale portion and 36 million from team portion.

The remaining pending release tokens are also on schedule to be unlocked and released. For every UAT mined, one UAT will be released and unlocked from presale portion and half UAT from team portion. And every time when UAT is listed on a certified top-tier digital asset exchange or trading platform, 5% of presale portion (approximate 10 million UAT) will be subsequently unlocked and released. Following the release ratio, respective tokens from pending mining portion and team portion will be subject to permanent lock-up.

Expected Positive Effect on Token Supply Demand

From token economics perspective, this move to permanent lock-up of 150 million UAT will effectively reduce the overall supply of UAT in circulation and support overall long-term holding value.

Furthermore, the economic value of UAT is tightly integrated with various utility functions on the platform which has built-in deflation mechanism. Every transaction fee for all services on UAT platform will be paid in UAT token, subsequently subject to permanent lock-up. For each investment product from 3rd parties, 10% of net trading PL will be set aside to purchase UAT from secondary market in support of ecosystem development.

In summary, the 150 million UAT permanent lock-up is expected to have positive impact on the development of UAT token value with less circulation supply. As the user demand for UAT token increases along with the continuous expansion of third-party investment products, this strategy has successfully laid out a solid foundation for future growth of UltrAlpha service platform over longer term in the ever changing digital asset industry.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.