April 18th, 2025

Konstantin Rabin, financial expert and crypto enthusiast, takes a look at how regulatory institutions are different in terms of Bitcoin regulation and whether they will come to an agreement at all.

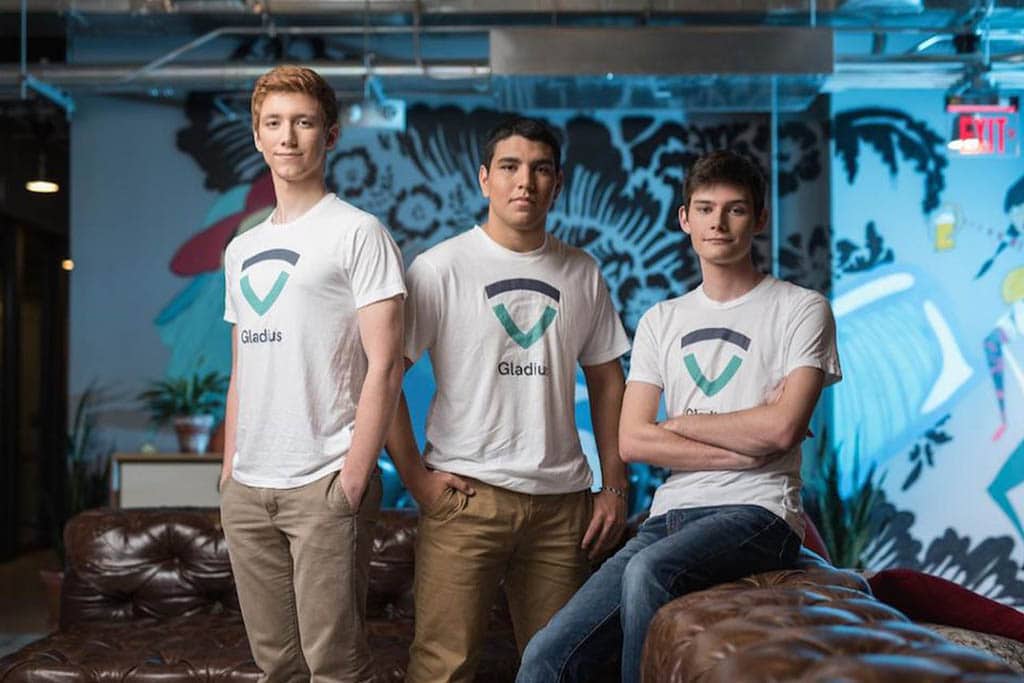

Gladius Network LLC self-reports to the SEC for overseeing an unregistered ICO enabling them to avoid penalties provided that they pay all the investors who request for a refund.

On April 5th, 2019, the SEC will have to announce their decision to either approve, deny or extend the decision-making period on Cboe/VanEck/Solid X’s Bitcoin ETF.

Here’s a look into the growing popularity of Security Tokens and the regulatory path for the token issuers lying ahead.

Digitex Futures, a non-custodial, zero-fee futures exchange with ultra-sleek user interface, and decentralized account balances hits a whooping 1 million signups for its waitlist.

Crypto mom Hester Pierce says that she can speculate the timing of Bitcoin ETF arrival, but doesn’t expect it to happen anytime this year.

The crypto-darling SEC commissioner Hester Peirce is explaining delays in a regulatory toolset for token offerings as she mobilizes financial authorities to work on a deliberate approach to digital assets.

According to Ric Edelman, the founder of Edelman Financial Engines, ETFs will eventually meet the demands of the SEC and get the Commission’s approval.

Autonomous technology startup Nuro said on Monday it raised $940 million from SoftBank Group Corp, which valued the Silicon Valley-based company at $2.7 billion.

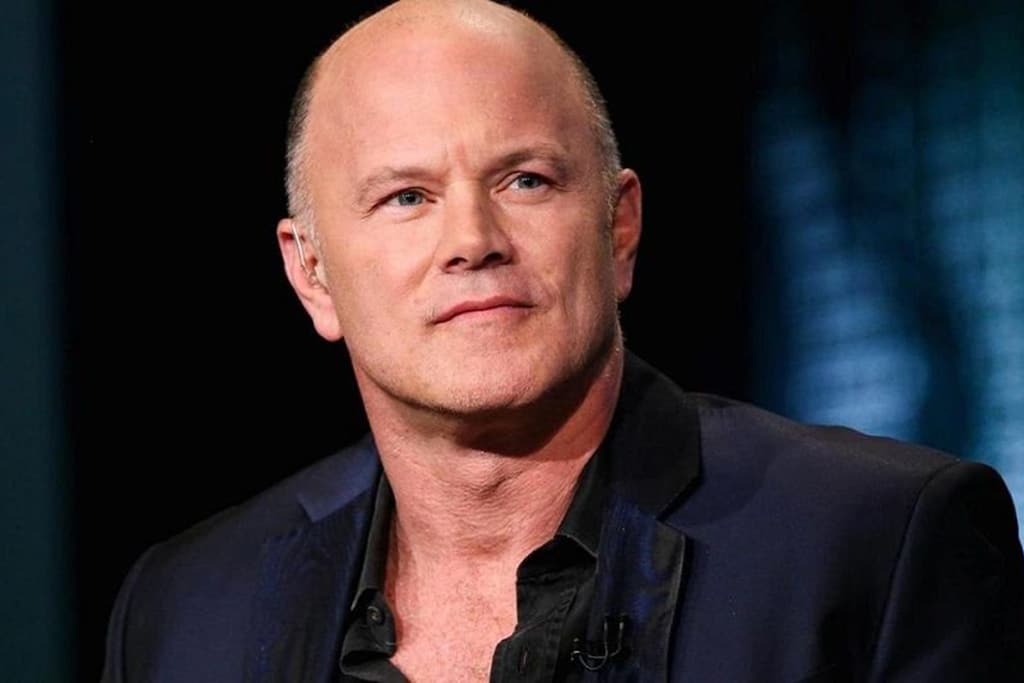

Mike Novogratz, the chief executive of the TSX-listed Galaxy Digital, made a surprising remark that came straight out of left field saying that he doesn’t understand why large macro funds don’t have a 1% position in Bitcoin (BTC).

SEC Commissioner Robert J. Jackson recently did an interview with Congressional Quarterly, a publishing company who report primarily on the United States Congress, where he expressed views that an SEC-approved Bitcoin ETF is inevitable.

While the notorious US deadlock is officially over, it hardly affected the whole crypto industry and now the new scenarios urge companies look for faster and more reliable ways to attract funding. Here’re the most promising alternatives.

In this guest post, Max Hasselhoff, integration engineer from Bytecoin and long-standing crypto enthusiast, takes a look at some of the biggest stories happening in the sphere of crypto technology integration.

Slack is going public. It is planning to list its shares directly and let the open market play the crucial role in setting prices.

Analysts predict that amidst the long pending work, regulatory agencies won’t give any attention to crypto investment products in the near time.