April 18th, 2025

Fireblocks’ cloud support comes at a time when more and more institutional investors and corporations are joining the crypto space.

The report noted that former FTX Group officials including SBF commingled customer deposits and corporate funds, and misused them with unnecessary spending.

The 30-day window of opportunity opened on Sunday, June 25th, and would run till July 23rd.

The suit was filed at the United States Bankruptcy Court for the District of Delaware.

Michigan Rep. Bill Huizenga pointed out that the documents shared by the SEC contained minimal information, mainly consisting of public briefings on the collaborative efforts between the SEC and the Justice Department in the case of SBF.

SBF is expected to return for a court hearing later this year, when all the investigations will be tabled for the judge to rule on the matter.

Instead of accepting or acknowledging the license return, the commission insists that BlockFi undergo administrative proceedings. The bankrupt crypto exchange was left with no option but to sue Jorge Perez, the Connecticut banking commissioner.

Earlier this year, the Seattle-based crypto exchange Bittrex announced its intent to wind down all its operations in the United States following heightened regulatory scrutiny by the SEC.

The DoJ prosecutors have eliminated five charges relating to fraud, conspiracy, and bribery initially levied against the disgraced FTX founder.

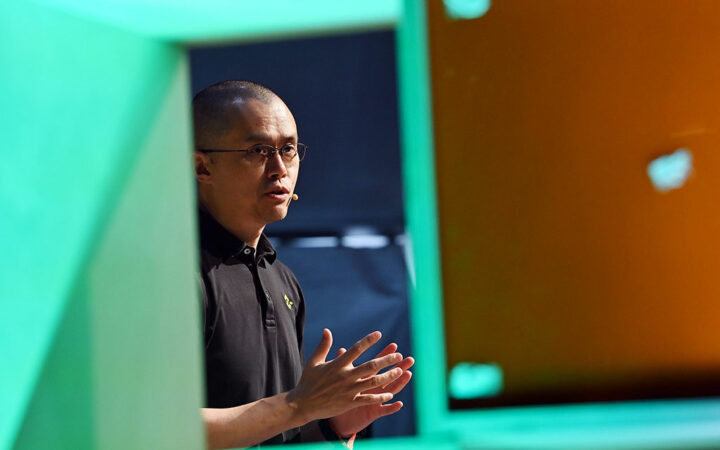

Several market analysts, including Dylan LeClair and Cory Klippsten, CEO of Swan Bitcoin, have voiced concerns about Binance’s alleged activities in manipulating the market.

The Metropolitan Museum of Art in New York City cited ethical concerns surrounding the cryptocurrency exchange’s operations while has announcion its decision to return $550,000 in donations received from FTX.

USDT has become the most traded stablecoin, especially after the de-pegging of Circle’s USD Coin (USDC) earlier this year.

Lawyers representing SBF say that these documents from the former FTX law firm contain information that could absolve the former CEO.

The Bahamas government’s response will determine whether to go on with or drop some of the cases.

According to Temasek, despite the absence of any misconduct, both its senior management team and investment body assumed collective accountability and accepted a reduction in their compensation.