April 18th, 2025

There is a number of factors that will affect the COVID-19 vaccine price. They include technology, single or a double vaccine dose, as well as what yields from manufacturing facilities might be.

Amidst the ongoing economic and healthcare crisis, the Republican Party in the U.S. has unveiled the second round of stimulus package plan. The government is willing to pass the legislation by July 31 and has sought support from the Democratic Party for proceeding ahead.

Data from AstraZeneca’s clinical trials of its COVID-19 vaccine candidate AZD1222 shows promising results but AZN share price has refused to be positively impacted.

The next round of U.S. stimulus checks may come really soon. The only issue here is how fast Republicans and Democrats will come to an agreement.

Following the company’s announcement about the success of its COVID-19 vaccine, Synairgen stock has increased significantly. Now it is nearly 470% up.

This year the gold price is 18.38% up. Analysts are predicting further growth. At the moment of writing, it is trading $1,810.40 per ounce.

Johnson & Johnson (JNJ) stock price is rising as the company is moving forward with its vaccine trials.

Moderna (MRNA) stock is up over 18% in the pre-market after adding 4.54% yesterday. The spike is attributed to the announcement that the coronavirus vaccine trial demonstrated a robust immune response.

In a letter dubbed ‘Millionaires for Humanity’, a group of global millionaires asked governments to raise taxes for people like them to deal with the COVID-19 impact.

Pfizer and BioNTech stocks have jumped in response to receiving ‘Fast Track’ status on their coronavirus vaccine candidates. PFE and BNTX prices are rising.

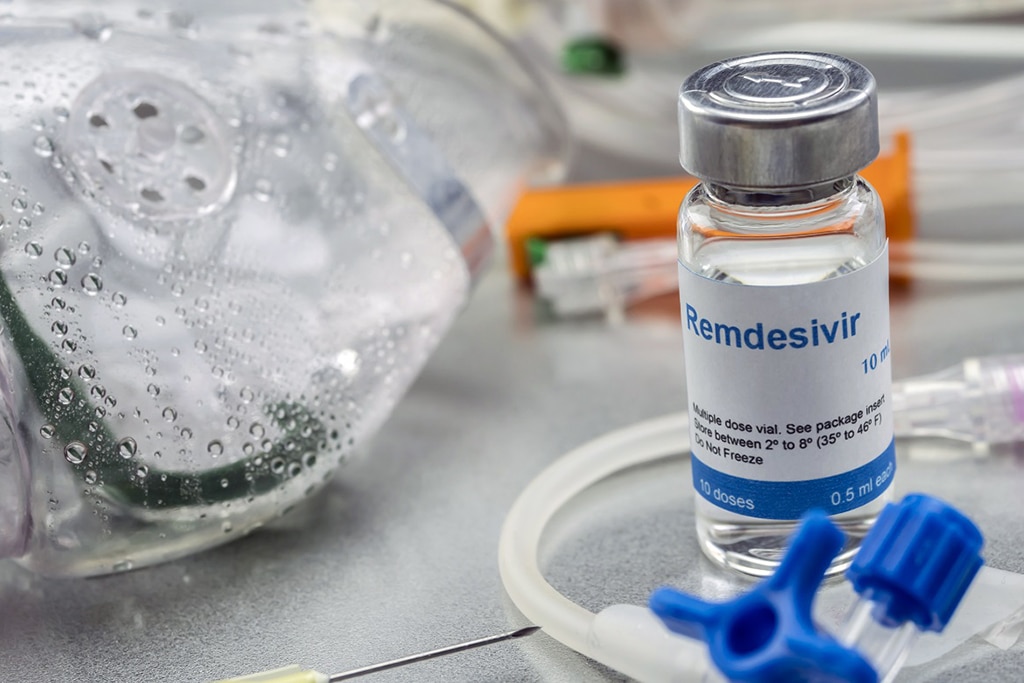

Gilead Sciences (GILD) stock is slightly down despite the progress that the company made in testing of its remdesivir drug that can be used as the coronavirus treatment.

NVAX stock price is skyrocketing these days as Novavax is getting one step closer to the development of its coronavirus vaccine.

Last week’s growth in Chinese markets has spiked a bullish run in U.S Wall Street. Hopes for a full economic recovery are gaining momentum.

The Shanghai stock market that gained nearly 6% last week has managed to add another 5.7% after that report.

Against the popular opinion, JPMorgan says that a win of Joe Biden in the U.S. Presidential Election 2020 could be a positive for the markets. JPMorgan predicts that his victory can ease tariffs on China and boost infrastructure spending.