April 16th, 2025

On the same day when Pfizer announced the results of the vaccine trial, the company’s CEO Albert Bourla sold 132,508 shares (or 62% of his stock) at the price of $41.99.

All tech companies like Zoom Video, Amazon, Netflix, and Shopify entered major correction on Monday as Pfizer and BioNTech announced that its COVID-19 vaccine candidate has delivered a 90% efficacy rate.

Following the positive news about the Pfizer COVID-19 vaccine efficacy, the stock market has responded with big jumps.

The major reason why the economy took a down-plunge was as a result of the COVID-19 pandemic, the move to stock up on Bitcoin as a hedge against the imminent economic crash now seems to be a smart step.

Markets remain on the edge a day before the U.S. Presidential elections. Volatility is growing as this week has some big announcements from the Federal Reserve and policymakers. The surge in COVID-19 in the U.S. and Europe puts major pressure on the markets.

The British health regulators will monitor clinical data in real-time while having an active dialogue with the drugmaker to accelerate the approval process.

Although there was a notable decline in jobless claims in the United States, those people who expected to receive a stimulus payment before the elections were frustrated after the lawmakers failed to make a deal on it.

Massachusetts-Based biotechnology company Moderna Inc (NASDAQ: MRNA), one of the top pharmaceutical companies in search of a COVID-19 vaccine, has released its Q3 financial earnings while confirming its preparations to meet up with the expected surge in demand for its vaccine once approved.

According to the latest analysis, major U.S. equity benchmarks Like Dow Jones recorded a decline of 180 point. This decline has been linked to the 83,000 new coronavirus cases recorded in Sun Belt State over the weekend.

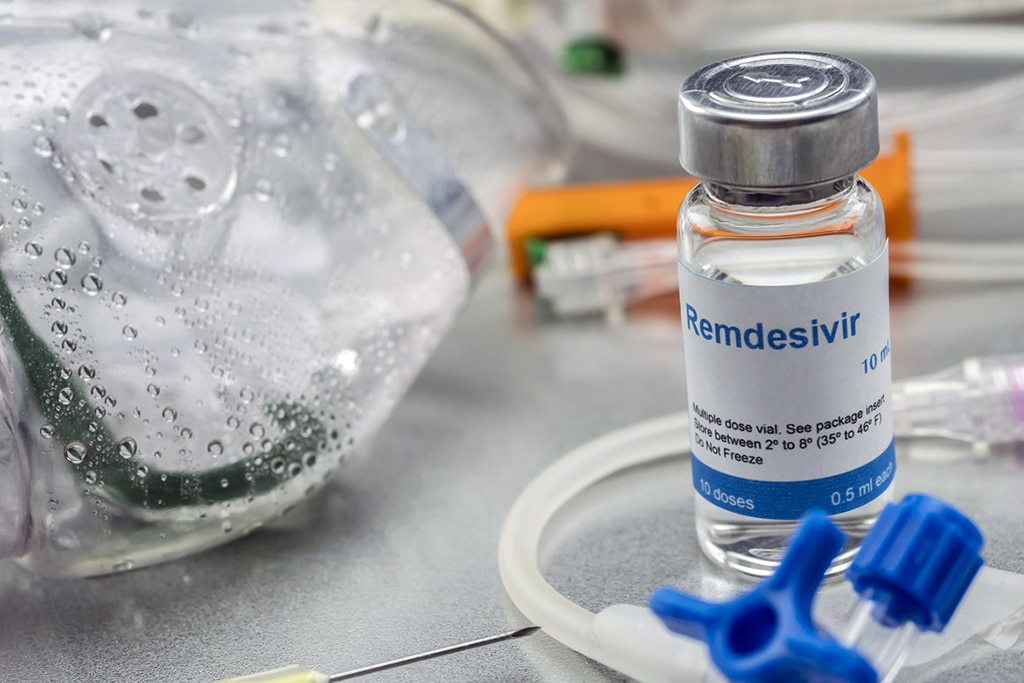

Gilead Sciences Inc revealed on Thursday that the Food and Drug Administration (FDA) has given the approval to Remdesivir as the first official treatment for COVID-19 in the United States.

The increasing rise in COVID-19 cases may further stir a boost in the demand for Remdesivir despite the WHO claims.

A new set of COVID-19 restrictions will strain Ryanair (RYA) as well as other airline companies globally.

The adverse event which has caused a halt in the clinical trials influenced investor’s confidence yesterday as JNJ shares lost 2.29% to close at $148.36.

Analysts have agreed that the primary concern for investors at the current moment mostly revolves around whether Trump’s illness will affect a presidential race in which he continues to lag behind Democratic challenger Joe Biden.

President Trump and the First Lady tested positive for COVID-19 a few days after the first presidential debate with Democratic presidential candidate, Joe Biden.