April 29th, 2025

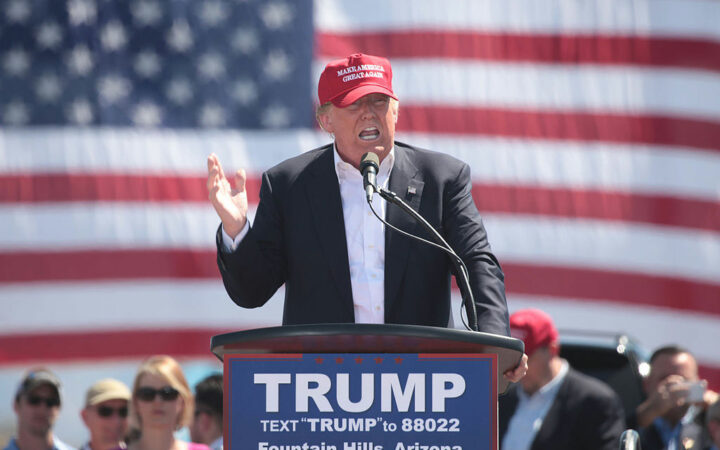

After Trump’s recent comments and overwhelming promise of supporting the crypto industry, some crypto market analysts says that the former President has a hit of retracing on his commitments.

The CBDC Anti-Surveillance State Act mandates that any development of a digital US dollar must receive explicit approval from Congress.

Over the past five years, central banks worldwide have shown significant interest in issuing CBDCs. According to research by the Atlantic Council, as of March 2024, 134 countries are exploring a CBDC, with 38 ongoing pilot projects.

According to the ABA, the House should support Rep. Emmer’s anti-CBDC bill because issuing a CBDC will disrupt the financial clime.

The Banco Central do Brasil (BCB) acknowledges the complexity of regulating the diverse crypto sector.

To set up their digital yuan wallets, Hong Kong residents just need their local phone numbers. Hong Kong is currently conducting this pilot program for e-CNY within the Greater Bay Area.

Analysts says that the major reluctance towards using digital yuan in China is because the CBDC doesn’t provider absolute privacy to its users.

The Architecture Community aims to enhance interoperability between wCBDC and tokenized assets, where wCBDC acts as a digital bridge to facilitate smooth interbank settlements for tokenized assets.

The SEC in the Philippines is set to unveil crypto guidelines that will guide trading and other related activities in the country.

Qian was appointed the first head of the central bank’s digital currency research institute in 2017.

South Korea will begin a pilot test project of its CBDC to determine usability and functionality for programmed transactions.

In the report, the Israeli Finance Ministry explained that during the just-concluded pilot, the country tokenized digital bonds into security tokens compatible with ERC1155 smart contracts. This move allowed for seamless atomic transfers upon payment receipt.

Patex has launched its PATEX token on CEXs and DEXs for interested users and traders to enjoy several perks and advantages in the ecosystem.

The proposed digital shekel is different from other CBDCs in at least two ways. These are its interest-bearing nature and the separation of the role of banks from the provision of wallets and payment services.

Hungary’s move to embrace cryptocurrencies comes at a time when the global crypto market is making a comeback after a year-long market crisis.