April 18th, 2025

The recent approval of spot Ethereum (ETH) ETF has triggered an intensified crypto cash rotation from Bitcoin to the altcoin industry.

The approval of spot Bitcoin ETFs in the US led to a 70% surge in Bitcoin prices in two months. If history repeats, Ether could reach its all-time high near $6,000 by July’s end.

Xangle, a Seoul-based crypto data provider, argues that the Korean regulations stop efforts to restore the Korean stock market and address the “Korea Discount”, in which Korean stocks trade at lower valuations than their global peers.

ETF analyst James Seyffart noted that while the 19b-4 filings have been approved, the funds still need to pass another scrutiny stage for the S-1 documents to be reviewed.

A total of $13.43 billion has flowed into spot BTC ETFs since the approval of the digital assets in January, but the current capital flowing into the investment products remains significantly low compared to their peaks in March.

Sigel stated that the first-come-first-serve approach by the SEC would help the issuers plan their product launches in a much better way.

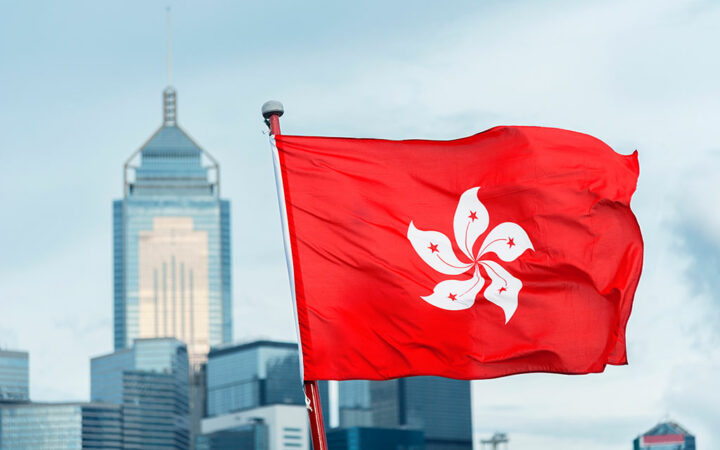

Despite being first in the market, Hong Kong’s Ethereum ETFs fail to gain enough traction with daily trading volumes dropping to their lowest.

Solana’s potential ETF approval could skyrocket its market presence, leveraging its high-speed, low-cost transactions for mainstream adoption.

Bitcoin ETFs in Hong Kong have also shown strong performance.

The rally in Bitcoin price and spot Bitcoin ETF inflows comes as the US SEC decision date for spot Ethereum ETFs inch closer.

Despite this positive trend, overall flows for these ETFs remain below their March peak.

This new software, FinTax, will make tax calculations for crypto assets easy.

Grayscale’s Bitcoin Investment Trust (GBTC) witnessed the first net inflow of $4.64 million since its conversion in January after it had experienced huge net outflows.

New Bitcoin addresses have been shrinking in the recent past, an indication more users are opting to tap on spot BTC ETFs for easier liquidity and enhanced security.

The performance of these Hong Kong-based ETFs has been disappointing compared to the success of the US-based spot ETFs, which hold $55 billion in total value.