April 18th, 2025

Bitcoin (BTC) price has suffered bearish sentiments in the past few weeks fueled by heightened selling pressure from whales.

The Bitcoin and Gold ETF will use leverage to “stack” the total return of its Bitcoin strategy holdings with the total return of its gold strategy holdings.

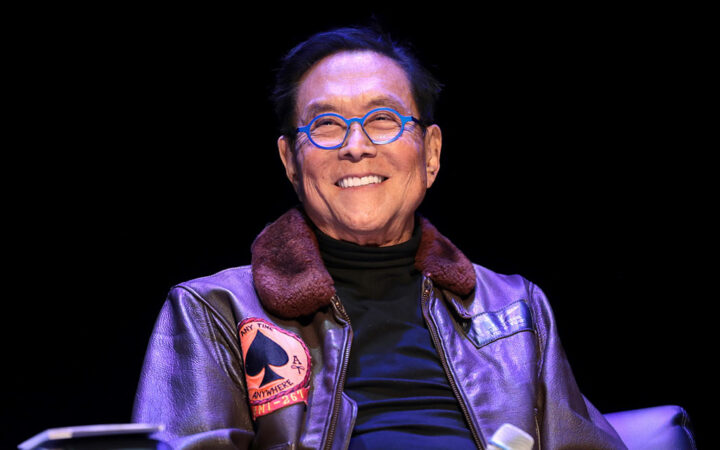

Recently, BTC has been demonstrating a downtrend with prices falling below $60,000. While many may perceive this sentiment as an opportunity to exit the market, Kiyosaki called it a perfect time to buy more of the coin.

Although the intakes are currently happening at a much slower rate than before, these ETFs have still impressed so far.

Bitcoin price has established a robust support level between $60K and $61K, despite the accelerated selling pressure led by the US and the German government.

According to the announcement, State Street Bank and Trust will manage the day-to-day operations and administration of the new ETFs.

Despite the mixed performance of spot bitcoin ETFs, the overall outlook remains positive. As of June 26, 2024, the combined net inflows for these 11 funds since their January launch stands at $14.42 billion.

Bitcoin’s recent price drop to 3.34% triggers major outflows from leading Bitcoin ETFs, with Grayscale’s GBTC fund losing $90 million.

Bitcoin (BTC) price has signaled further market correction as investors show midterm disinterest in the crypto space.

Andrew Campion, GM of Investment Products and Strategy at ASX, said trading Bitcoin via an ETF on ASX allows Australians to use traditional brokerage accounts, simplifying the investment process for Australians.

With the Federal Reserve keeping interest rates unchanged to 5.25%, the massive outflows recorded by the US spot Bitcoin ETFs bring the total assets under management (AUM) to under $15 billion.

The recent notable cash outflows from US-based spot Bitcoin ETFs have increased overall crypto fear leading to ongoing altcoin selloff.

The bearish sentiment wasn’t limited to the US. Even on the global scale, digital asset investment products saw their largest outflow of over $600 million in almost three months.

Through the partnership between BounceBit and Free Tech, users can seamlessly swap BBTC and BBUSD with over 50 top blockchains.

Favorable regulatory changes, such as the approval of spot Bitcoin ETFs, have contributed a lot to fueling this trend.