April 18th, 2025

Link has moved from a trading price of $12 on January 11, 2021, to a current position of $22 with a market cap of near $9 billion.

The cryptocurrency market is still northbound as Bitcoin sets new ATH every other week.

However, the total number of Ethereum locked up in DeFi plunged from 9.4 million ETH in mid-late October to the current 6.8 million ETH locked up at the time of writing.

While all companies across all sectors can not boast of milestone achievements this year, the few highlights of top news is an indication that the year was not doomed after all and market analysts are projecting a better recovery and growth in the coming year 2021.

Right now, the whole community is waiting for a DeFi remedy to be created and Shadow Staking could possibly become the DeFi safety standard in this sphere.

Money On Chain and RSK are further making the case for BTC being the hub around which defi revolves, the future is looking bright for Bitcoin.

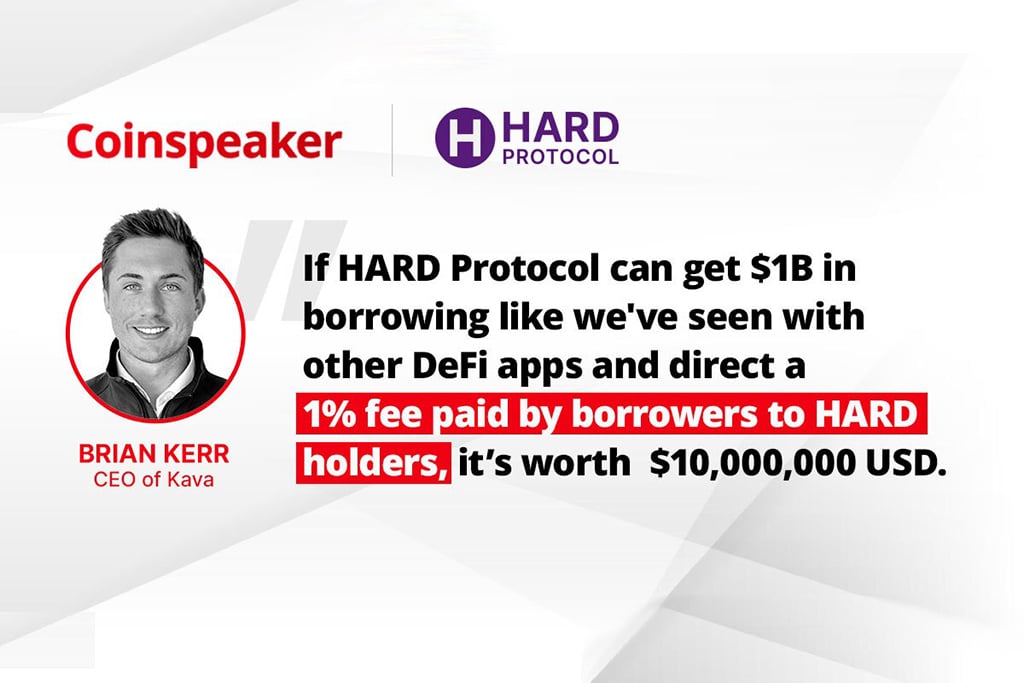

For those holding HARD, it is not just the governance of Hard protocol that is at stake. Controlling the economic makeup of Hard’s forecasted $3 billion valued platform and implementing a 1% fee policy could generate around $30 million to HARD holders.

Bridge Mutual noted that all stablecoin insurance claims will be reimbursed immediately.

This year has seen a lot of surprises in the sector as its previous all-time high of over $12 billion was recorded in October 2020.

Ethereum-based lending protocol Aave is migrating from its LEND tokens to AAVE tokens as a part of the Aavenomics proposal, allowing AAVE holders to control the Protocol.

The Open DeFi Alliance supported by the Shanghai Science and Technology Committee seen new members with some of the top DeFi protocols forming a consortium that focuses on innovation, risk management, and liquid strategies.

Coinbase Custody, a subsidiary of the Coinbase cryptocurrency exchange has announced a set of coins and digital assets it is set to provide custody support for provided regulatory approved in defined jurisdictions permit.

Bloq announced an easy-to-use platform dubbed Vesper that would automate DeFi investments. Vesper is simpler than yield farming as it saves time as well as money spent on transaction fees since it entails a handful of steps instead of a dozen.

The new funds raised by Aave will be used for attracting more institutions towards the decentralized finance (DeFi) market as well as further expanding its presence in the Asian market.

DeFi markets are seeing a sharp correction amid heavy profit-booking in the market. Over the last week, top DeFi tokens registered double-digit corrections. The positive indicator is DeFi users have multiplied by 3x over the last three months.