With the amendment sailing through unopposed, Emmer emphasized the potential roles of other government bodies, such as the Department of Justice and the Treasury, in managing any possible misconduct within the crypto industry.

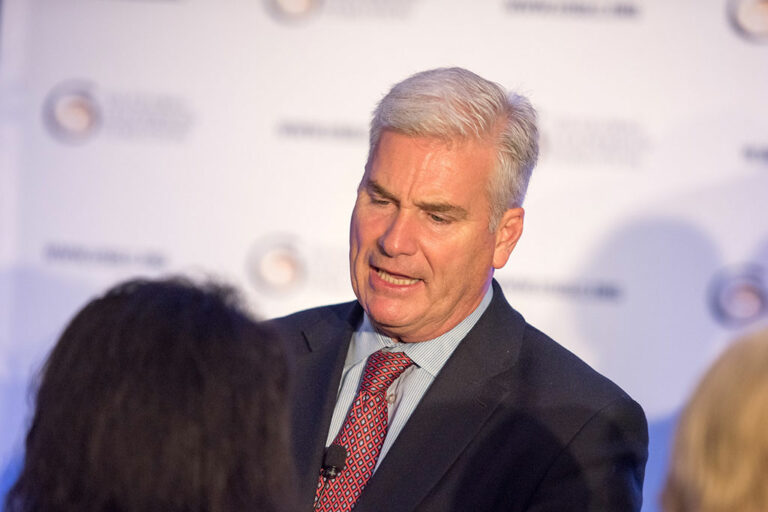

United States Congressman Tom Emmer is advocating for a significant change that aims to limit the powers of the Securities and Exchange Commission (SEC) in its dealings with the cryptocurrency industry.

On Wednesday, November 8, Emmer proposed to amend the Financial Services and General Government Appropriations Act (HR 4664) bill to include a clause that prohibits the financial watchdog from using public funds to pursue any enforcement actions against the crypto industry until Congress passes appropriate legislation in the future, granting the agency the power to oversee the sector.

SEC Chair Is Effective as He Is Incompetent

During the congressional hearing, Emmer expressed his concerns regarding the allocation of taxpayer resources by SEC Chair Gary Gensler towards seemingly trivial matters while crucial issues within the crypto sphere remain unaddressed. The Congressman emphasized the need for clearer guidance and more effective utilization of regulatory resources.

“At a time when clear guidance is desperately needed, Chair Gensler instead spends taxpayer resources, praising himself for targeting celebrities like Kim Kardashian, while Sam Bankman-Fried was running a Ponzi scheme right under his nose,” Emmer said.

The proposed amended bill passed unopposed, with the lawmakers agreeing to stop SEC’s enforcement abuses against the emerging economy.

“SEC Chair Gensler cannot continue to abuse the powers of his agency to fulfill a political agenda of driving the new and promising digital asset industry offshore”, explained he.

In a statement on Twitter, the Congressman called the SEC’s chair ineffective and incompetent, noting that the agency has no authority or jurisdiction to police the industry.

.@GaryGensler is as ineffective as he is incompetent. Fortunately, my nonpartisan appropriations amendment to reign in SEC enforcement abuses against the digital asset industry passed the House today with no opposition.

Congress will hold unelected bureaucrats accountable. pic.twitter.com/TGaaW8I0Eu

— Tom Emmer (@GOPMajorityWhip) November 8, 2023

US Senator Proposes to Slash SEC Chairman’s Salary

With the amendment sailing through unopposed, Emmer emphasized the potential roles of other government bodies, such as the Department of Justice and the Treasury, in managing any possible misconduct within the crypto industry. The move is part of a broader push by Republican lawmakers to tighten budgetary reins across federal agencies.

As the November 17 deadline for budget expiration approaches, the amendment to the Financial Services and General Government Appropriations Act joins a series of initiatives that seek to reshape the digital assets’ regulatory landscape.

In addition to Emmer’s amendment, other bills are awaiting Congressional attention, including the Financial Innovation and Technology for the 21st Century Act, the Blockchain Regulatory Certainty Act, the Clarity for Payment Stablecoins Act, and the Keep Your Coins Act.

Earlier this week, Representative Tim Burchett proposed an amendment that would drastically slash the SEC chairman’s salary to a mere $1. Additionally, he advocated for reducing the salaries of other officials who have drawn the ire of the Republican Party.

Meanwhile, Deputy Treasury Secretary Wally Adeyemo has emphasized the need for Congress to take swift action to address the potential misuse of crypto in funding illicit activities, especially those related to terrorism.

next