Stellar Set to Skyrocket? Rare Macro Signal Appears after 2 Years

Stellar (XLM), the 14th-largest digital asset, may be gearing up for a significant breakout, according to a rare macro signal that hasn’t appeared in over two years.

Prominent crypto analyst Ali Martinez recently took to X (formerly Twitter) to highlight a potential game-changing shift in the altcoin’s price trajectory.

For the first time since January 2022, the SuperTrend indicator signals a potential macro trend shift in #Stellar $XLM! pic.twitter.com/V9g9abQm0x

— Ali (@ali_charts) April 5, 2025

For the first time since January 2022, the SuperTrend indicator on the weekly chart has flipped bearish to bullish – a signal many traders interpret as the dawn of a new uptrend.

The SuperTrend indicator, which overlays buy/sell signals based on average price action and volatility, has turned bullish after a prolonged downtrend stretching from early 2022.

On the weekly chart shared by Martinez, Stellar has now printed its first “Buy” zone since its long bear phase began. The last time this signal appeared, XLM went on a sustained rally, and bulls are hoping history might repeat itself.

A bullish flip after two years of bearish sentiment suggests that Stellar could be entering a multi-month rally phase – assuming key resistance levels are cleared.

Stellar (XLM) Price Analysis – Where Is XLM Heading Now?

At the time of writing, Stellar is trading at $0.2201, down nearly 12% in the past 24 hours amid wider crypto market weakness, CoinMarketCap data shows.

The daily chart below shows that XLM’s price has broken below the lower Bollinger Band at $0.2308.

Source: TradingView

The Relative Strength Index (RSI) sits at 14, deep in the oversold territory (below 30). This increases the likelihood of a near-term rebound as buyers may step in hopes of a price increase.

The immediate resistance is at the 20-day EMA, currently at $0.2406, is the first resistance bulls need to reclaim. A close above this level could open the door to a short-term recovery.

Another resistance is around $0.3076 and a weekly close above $0.33–$0.35 would confirm the SuperTrend breakout and could lead to a retest of $0.45–$0.50, especially if market sentiment improves.

Conversely, failure to hold support at $0.20 could see XLM revisit the $0.17–$0.18 range, a key accumulation zone from late 2023.

Notably, the MACD indicator confirmed a bearish divergence recently after the MACD line (blue) dropped below the signal line (orange), turning the histogram red. However, the distance between the two lines is now shrinking, suggesting that buyers are buying the dip.

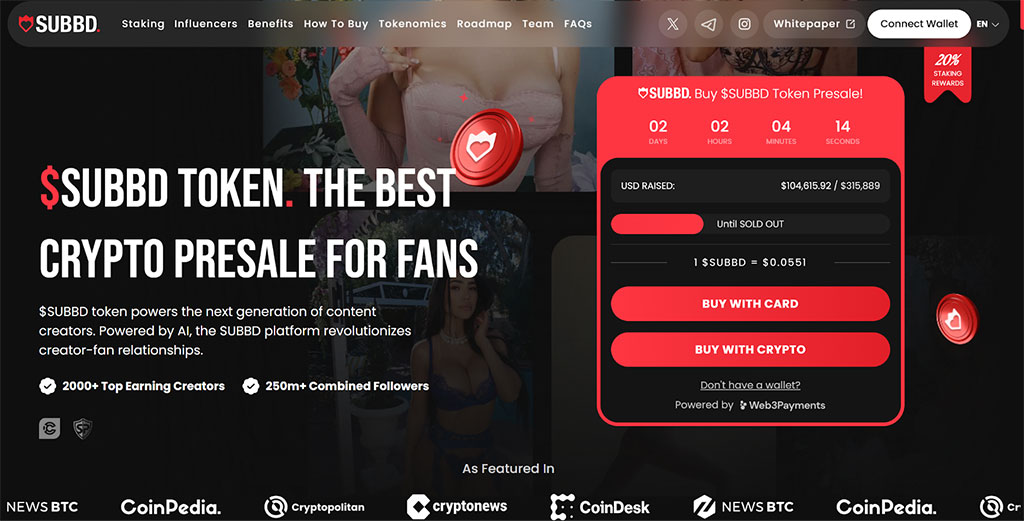

This Booming Project Raises $104K in Presale amid XLM Crash

As the broader crypto market reels from a steep downturn – sparked by President Donald Trump’s tariffs and worsening macroeconomic sentiment – one project is defying the trend.

SUBBD, an AI-powered content creation platform, is gaining traction by offering real utility through its native $SUBBD token.

Holders can participate in governance, earn rewards, and unlock exclusive perks within the platform.

Source: SUBBD

SUBBD’s presale has already attracted $104,000 in early funding and just two days left before the next price increase.

In order to purchase $SUBBD, simply visit the SUBBD official website and connect your wallet (such as the Best Wallet).

You can swap ETH or USDT in your wallet or even use a bank card to perform a transaction.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.