Solana Price Prediction: SOL Could Dump to 80$ with Big Unlocks as Whales Are Looking at New BTC L2 StratoVM

/StratoVM/ – Solana SOL $122.7 24h volatility: 3.1% Market cap: $62.84 B Vol. 24h: $5.44 B has seen a huge drop, following the recent downturn – dipping nearly 40% over the past month. Analysts now seem worried about its future, with some of them even predicting it could plummet to $80.

At the same time, StratoVM (SVM) could gain attention in the BTCFi field with its innovative Layer-2 solution. According to CoinGecko, its price has exploded by 1236% in the past week, defying the red trend.

Let’s check out the details!

Solana Price Prediction: Will SOL Price Dump to $80?

The crypto market has taken another hit, with its total market cap dropping to $3.13 trillion, reflecting a 0.84% decline. As a result, leading assets are facing big losses, and Solana is leading the way. Over the last 30 days, SOL has shed nearly 40% of its value.

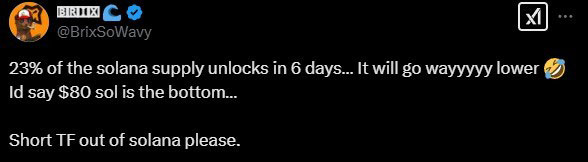

The latest selloff is mostly fueled by Binance offloading massive amounts of SOL. But that’s not all – crypto analyst Brix warns that things could get worse. With 23% of Solana’s supply set to unlock in six days, he predicts the price will tank further, possibly bottoming out at $80.

At the moment, Solana is trading around $143 after a 15% weekly drop. If the downtrend continues, key support levels around $100 could come under threat, making an $80 price target more possible. Increased selling pressure and market uncertainty could push further declines, making short-term recovery difficult.

StratoVM (SVM) Could Become an Important Player in BTCFi Field with Its New Layer-2 Blockchain

StratoVM (SVM) offers a Layer 2 blockchain on Bitcoin that enables smart contracts, meme coins, AI, and DeFi applications directly on the Bitcoin network.

Currently trading around $0.0363, it has seen remarkable growth of over 1230% from previous weeks according to market data. This surge could indicate resilience amid market fluctuations, potentially pushed by its solution to Bitcoin’s scalability limitations.

With its mainnet launch on the horizon, StratoVM is currently at an important development stage. Compared to other Bitcoin Layer 2 solutions such as CoreDAO (~$990M fully diluted valuation), StratoVM could be undervalued at roughly $3M.

A successful mainnet debut could bring bullish momentum for the project. However, according to DefiLlama, the BTCFi sector has expanded significantly, with total value locked growing from around $307 million in early 2024 to around $6.6 billion in 2025 – a market StratoVM might tap into with its innovative approach.

SVM listing on UniSwap improves its credibility, while its ecosystem appears to be growing with numerous strategic partnerships. There are indications of a possible centralized exchange listing in the future.

With a community of nearly 100,000 followers across X, Telegram, and Discord, StratoVM could position itself as a BTCFi leader as Bitcoin’s use expands beyond digital gold. The upcoming mainnet launch, combined with its features, might create opportunities for potential CEX listings and broader adoption.

The Takeaway

Solana’s recent drop has concerned investors, with many in the market now believing it could dip even further. If the downturn continues and key resistance levels drop to $100, SOL might be in danger of plummeting all the way to $80.

Meanwhile, StratoVM (SVM) could become an important player in the BTCFi field. Its Layer-2 solution, which is planning to improve Bitcoin’s scalability and DeFi potential, could attract liquidity and developer interest.

Disclaimer: This article does not offer financial advice. Cryptocurrencies can be unpredictable and carry risks. It is important to conduct thorough research before acquiring any crypto asset. Forward-looking statements carry risks and are not guaranteed to be updated.