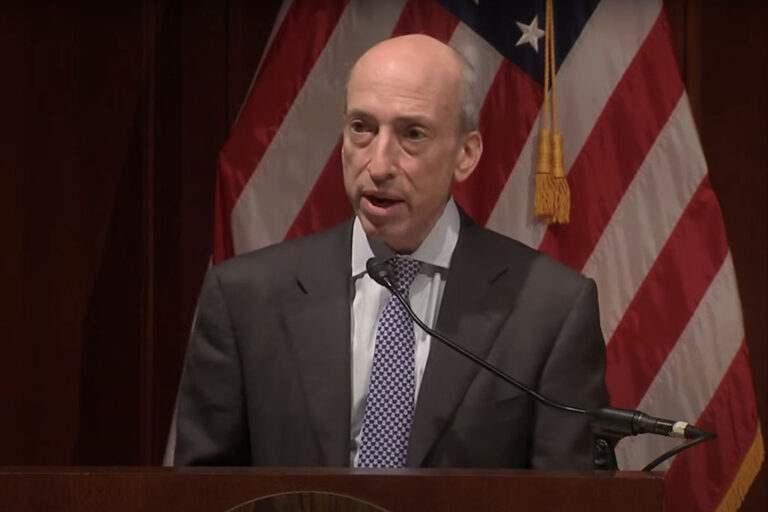

SEC Chair Gary Gensler said that the SEC is forced to hold the SAB 121 accounting rules in place citing multiple bankruptcies like FTX, Terraform, Celsius, etc.

During his testimony on Tuesday, SEC chief Gary Gensler said that he won’t be repealing the controversial SAB 121 accounting rules. Congressman Wiley Nickel Gensler on the SAB 121 accounting rules stating that the SEC has overstepped its authority and harmed investors.

Congressman Nickel stated that despite reaching out to the SEC office several times over this matter, they have completely ignored all of their requests. He asked the SEC chair whether he holds any regrets in upholding the controversial SAB 121 accounting rules.

Gensler said that the SEC is forced to hold the rules in place citing multiple bankruptcies like FTX, Terraform, Celsius, etc. He added that crypto is a liability for companies and thus the Staff Accounting Bulletin (SAB) is necessary in its place. “It’s a good accounting Bulletin out there,” added Gensler.

JUST IN: 🇺🇸 Gary Gensler says he will NOT commit to overturning SEC rule that prevents highly regulated financial firms from holding #Bitcoin and crypto. pic.twitter.com/gNDzOnVnGP

— Bitcoin Magazine (@BitcoinMagazine) September 24, 2024

The SAB 121 accounting has done more damage to the crypto industry, especially the crypto custodians. US securities regulator has been leveraging this rule asking regulated financial institutions to forcefully disclose their custodial assets.

This rule has also made it difficult for crypto-friendly banking institutions like Custodia Bank, Silvergate Bank, etc. to do business. Interestingly, the regulator recently exempted banking giant BNY Mellon from the SAB 121 rule and granted it a license to provide crypto custody services to ETF issuers in the market. The broader crypto industry has largely criticized this development calling it unethical.

Gary Gensler Invented the ‘Crypto Asset Security’ Term

During Tuesday’s Congressional hearing, Congressman Tom Emmer said that the SEC Chair has made up the term “crypto asset security” to stifle innovation in that space. He said that Gary Gensler has been using this term to push his agenda of regulation by enforcement against crypto over the past three years.

“You’ve made up the term crypto asset security. This term is nowhere to be found in statute, you made it up [and] you never provided any interpretive guidance on how crypto asset security might be defined within the walls of your SEC,” said Emmer.

Additionally, Tommer also said that Gensler is inconsistent on the application of crypto rules which makes him “a more historically destructive or lawless chairman of the SEC”.

Emmer also questioned Gensler about the SEC’s handling of the Debt Box case, in which the agency sued a crypto startup for an alleged $50 million fraud scheme. The case against Debt Box was dismissed on May 28, resulting in the SEC being ordered to pay $1.8 million in fees.

The SEC Chair acknowledged that his office handled the situation badly.

next