Relite Finance Announces the 2021-22 Roadmap

Relite Finance, a cross-chain DeFi lending platform, has revealed the strategic roadmap for the remainder of 2021 and the entirety of 2022. The roadmap describes the essential product, marketing, and business development implementations that are about to take place within the next 1.5 years.

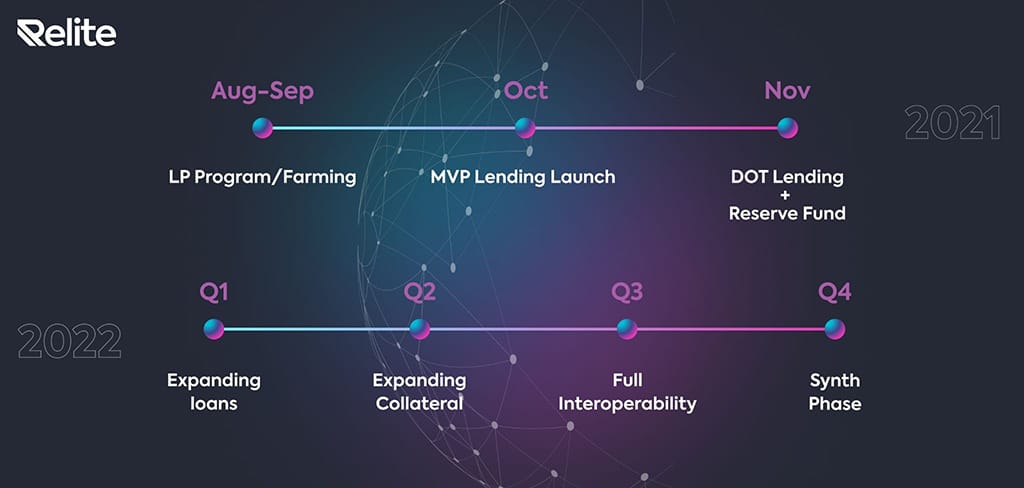

The first product implementations will occur in August and September this year and are related to staking, rewards, and initial liquidity provision. The Relite community will be empowered with the ability to earn double-dip rewards on their liquidity provisions. Additionally, the project will open the first USDC and DAI stablecoins pools to generate yield in addition to $RELI rewards.

October 2021 marks a significant milestone for the Relite Finance project, as the MVP (minimum viable product) will be released. End-users will be able to borrow and lend ETH, DAI, and BNB within the application. The team plans to end 2021 with another vital release – DOT lending.

The Relite team has shared its product development plans for 2022. The first quarter is set to expand loans functionality, including flash and margin loans. During the second quarter of 2022, the team will be expanding the collateral, namely, introducing NFT collateral, whilst opening UNI, ADA, SOL pools. The application will later launch on Polygon, and the mobile app released. During Q3 2022, it is expected that the Relite protocol will become fully interoperable (cross-chain lending between BTC, ETH, DOT, BSC), while Q4, marked as a “Synth Phase”, will bring synthetic and real-world assets and one-click lending.

George Groshkov, CEO at Relite Finance, has highlighted the importance of the upcoming product implementations:

“We can’t be more than excited to present the Relite community with the vision of how our product will develop in a long-time perspective. Since the IDO, we’ve expanded our team and strengthened the development, marketing, and product fronts. Relite is now heading towards full interoperability, and this is an excellent time to focus on building the game-changing product.”

In addition to the upcoming product implementations, the team has stated their plans to deliver marketing and business development activities, including Asian market expansion, community growth, CEX listings, and IR (investors relations).

About Relite Finance

Relite Finance is a cross-chain DeFi money market protocol that enables users to lend, borrow, and stake all crypto assets in one interface by utilizing Polkadot’s Moonbeam Parachain, bridges, and a unique reserve fund module. Relite plans on creating interoperability with Bitcoin, Ethereum, BSC, and other blockchains. In addition, Relite plans to implement collateralization of NFTs with better fees and usability than other protocols can offer. Follow Relite on Twitter and Telegram.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.