Pioneering Islamic Blockchain Startup Hada DBank Announces successful Presale and Prepares To Release Main token Sale Dates

Islamic blockchain finance startup Hada DBank successfully ended its Pre-ICO exercise last 15th March 2018, after a vote from its community for an additional two-week extension. 11.3 million HADACoins were sold raising approximately USD3 million. Hada DBank has managed to easily achieve its targeted soft-cap and now looks towards its main token sale event.

Hada DBank’s main token sale event will be divided into several stages, to reflect the development stages the Bank is undergoing. Stage 1 – ICO will start 1st May 2018 and will run for the entire month of May, marking the end date to be 31st May 2018.

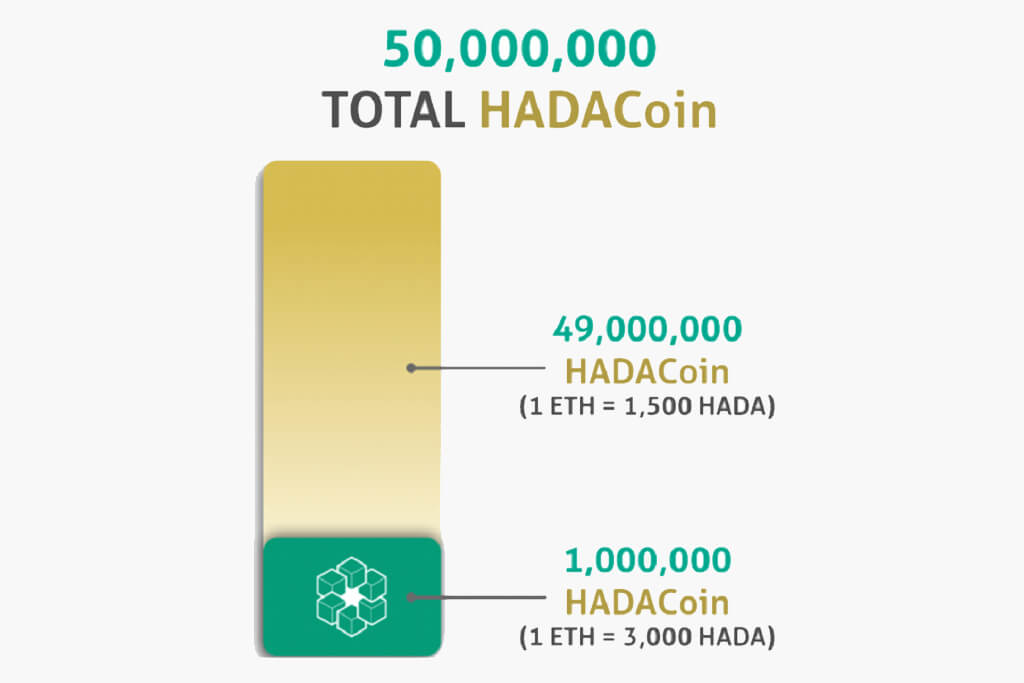

50 Million HADACoins will be up for sale during this stage. Price and tranches will be announced before the commencement date.

Currently, the MVP is being developed and scheduled to be released before ICO starts. Next stages of Coin Offering will be announced periodically as the development progresses. Participant of Hada DBank bounty & airdrop program will receive their HADACoins, one week after Stage 1 – ICO ends.

Hisyam Mokhtar, Chairman & newly appointed Interim CEO of Hada DBank offered the following statement about the performance of the company’s token presale;

“I am delighted with our performance in this Pre-ICO exercise. Despite the volatility in the current cryptocurrency market, we managed to sell almost USD3m worth of HADACoins to both the Public and Institutional Investors during this period. It is an indication that despite the many ICOs and banking related blockchain projects, the market is progressing and accepting the technology. We are looking forward to launch our ICO soon. More advancement will soon be materialized. We thank those who have supported us from day 1 and hope to continue receiving that support.”

In the lead-up to its token presale, Hada DBank secured a number of important targets in terms of funding, advisors, and groundwork for the future security of the platform. In February the company secured an impressive deal to have its native platform’s token listed on F1Cryptos Exchange following the completion of the main token sale event.

Earlier that month Media Maven and Fintech Investor David Drake of LDJ Capital joined HADA DBank as Advisor.

Most recently Hada DBank secured a substantial single $500,000 investment from renowned investment fund DE Asset Management LTD, as the two companies agreed on a long-term partnership.

About Hada DBank

Set to revolutionize the world of banking, Hada DBank determines to fuse blockchain technology with Islamic Banking Module. Having recognized the challenges for customers in the current banking state, blockchain technology will ensure security and transparency, while Islamic Banking module will ensure ethical banking and investment.

Hada DBank believes in benefiting and putting customers’ interest first, rather than profiting without limit and ethics. Thus – Caring & Personal will be the two words that will be embedded in every aspect of Hada DBank’s corporate culture, product, and services.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.