Pi Coin Drops 20% after Justin Bons Criticizes It as a Ponzi Scheme – Will It Hit Zero?

Pi Coin is facing heavy downward pressure following criticism from Cyber Capital Founder Justin Bons, which has stirred fresh uncertainty around the project.

Once seen as a high-flying newcomer, its current price action suggests a possible retest of its all-time low.

Market sentiment has soured, with many investors now questioning the project’s long-term viability.

1/9) WARNING: PI is a straight-up scam! ⚠️

Offering an “MLM” based “mining” scheme on mobile is a gimmick, as it does not contribute to consensus!

PI is fully permissioned (centralized) & everything requires KYC, even simple TX’s!

PI is an investment scam; it is that bad: 🧵

— Justin Bons (@Justin_Bons) March 19, 2025

Pi Coin and Justin Bons’ Ponzi Scheme Allegations

At the time of writing, data from CoinMarketCap shows Pi Coin trading at $0.8689, down 26.07% in the past 24 hours.

The token previously hit an all-time high of $2.981 as years of anticipation fueled a wave of adoption.

However, sentiment shifted sharply earlier this week when Cyber Capital Founder Justin Bons, known for his in-depth critiques of blockchain projects, voiced strong criticism of Pi Coin.

Bons labeled Pi a scam, accusing it of using an MLM-style mobile mining model that contributes nothing to the network’s consensus.

He also flagged several red flags, including claims of decentralization despite central control, and the protocol’s mainnet being five years overdue – with no meaningful innovation to show for it.

2/9) Claiming decentralization while remaining extremely centralized is a massive red flag 🚩

Delivering a mainnet five years behind schedule with ZERO innovation is another 🚩

PI claims to be a revolutionary new decentralized crypto, nothing could be further from the truth…

— Justin Bons (@Justin_Bons) March 19, 2025

The current outlook of Pi Coin is proof that investors are pricing in these claims.

Pi Coin has dropped 45% in the past week and 49.3% over the past month, reflecting strong selling pressure in the market.

The PI/USDT 4-hour chart shows an RSI of 40.74, indicating a slight recovery from oversold conditions, but still at risk of further downside.

Source: TradingView

If Pi holds its current support along the descending wedge’s lower trend line, a breakout above $1.33 could trigger a strong move toward $2 and beyond, with a potential retest of the $3 all-time high.

However, if Pi fails to break resistance, another drop could send it below $0.80, with the risk of deeper losses if selling pressure intensifies. Market sentiment remains fragile, and traders should watch for confirmation before positioning for a major move.

Pi Network Confronts Strong Competition from Meme Index

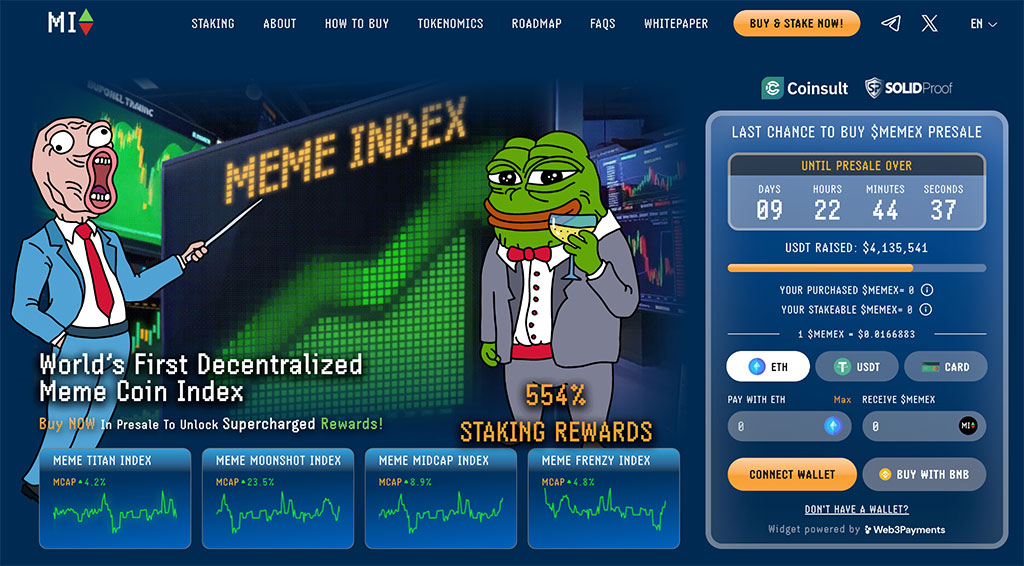

The Pi Network built immense anticipation due to its extended development timeline. However, another innovative project with a well-defined roadmap is gaining traction – Meme Index (MEMEX).

Meme Index is transforming meme coin investing by offering diversified exposure through a single token.

Instead of betting on individual assets, MEMEX holders gain access to a curated selection of top-performing meme coins while influencing the portfolio’s structure.

Built on Ethereum, Meme Index organizes assets into four indexes – Titan, Moonshot, MidCap, and Frenzy – each designed for different risk levels.

The platform dynamically updates its selections, ensuring investors stay ahead of market trends.

Currently in its presale phase, MEMEX offers staking rewards up to 554% APY and governance participation, allowing holders to vote on index composition. Priced at $0.166883, MEMEX has strong growth potential once listed.

It’s time to clean up with $MEMEX

Are you ready for the Frenzy? 🔥📈 pic.twitter.com/N9kYz8rIAH

— Meme Index (@memecoin_index) March 20, 2025

MEMEX serves multiple functions, including governance participation and staking rewards, with investors earning up to 554% APY.

MEMEX is currently priced at $0.166883, with the potential for significant gains once it lists on exchanges.

To buy MEMEX, investors can visit the Meme Index website, connect their wallets (such as Best Wallet), and purchase using ETH, USDT, BNB or a bank card before the presale ends.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.