Gemini Refuses to Hire MIT Graduates Due to Gary Gensler’s Role

Gemini halts hiring MIT graduates until Gary Gensler is removed as an instructor, citing his controversial SEC leadership.

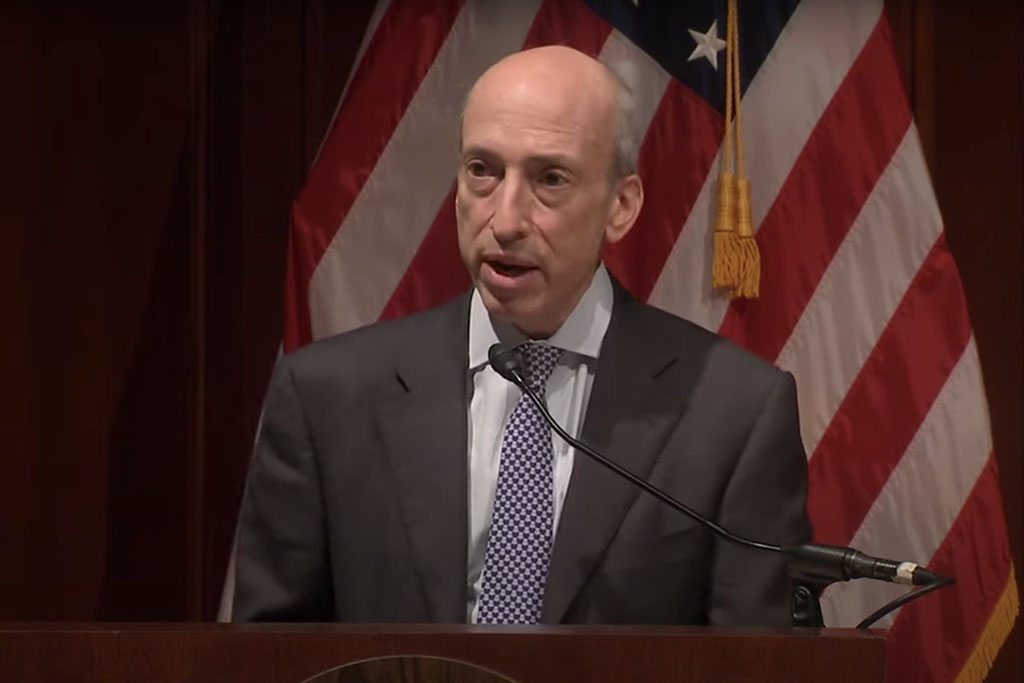

Chairperson, US Securities and Exchange Commission

Gary S. Gensler is an American government official and former investment banker who served as the chair of the US Securities and Exchange Commission (SEC) from 2021 to 2025. Gensler previously worked for Goldman Sachs and has led the Biden–Harris transition’s Federal Reserve, Banking, and Securities Regulators agency review team. Prior to his appointment, he was professor of Practice of Global Economics and Management at the MIT Sloan School of Management.

Gensler served as the 11th chairman of the Commodity Futures Trading Commission, under President Barack Obama, from May 26, 2009, to January 3, 2014. He was the Under Secretary of the Treasury for Domestic Finance (1999–2001), and the Assistant Secretary of the Treasury for Financial Markets (1997–1999). Prior to his career in the federal government, Gensler worked at Goldman Sachs, where he was a partner and co-head of finance. Gensler also served as the CFO for the Hillary Clinton 2016 presidential campaign. President Joe Biden nominated Gensler to serve as 33rd chair of the US Securities and Exchange Commission. He succeeded SEC Acting Chair Allison Lee.

US SEC

Oct 18th, 1957

American

The Wharton School, University of Pennsylvania, MBA, 1979

The Wharton School, University of Pennsylvania, Undergraduate Degree in Economics, 1978

Maryland Financial Consumer Protection Commission, Chair, 2017-2019

MIT Sloan School of Management, Professor of the Practice of Global Economics and Management

MIT’s Fintech@CSAIL, Co-Director

MIT Media Lab Digital Currency Initiative, Senior Advisor

Commodity Futures Trading Commission, 11th Chairman, 2009-2014

Treasury for Domestic Finance, Under Secretary, 1999-2001

Treasury for Financial Markets, Assistant Secretary, 1997-1999

Gemini halts hiring MIT graduates until Gary Gensler is removed as an instructor, citing his controversial SEC leadership.

While crypto advocates cheer the SEC’s decision, skeptics like Jacob King warn that the industry’s shift toward bank custody contradicts Bitcoin’s original vision of decentralization.

Gensler’s SEC tenure saw 18% of complaints tied to crypto violations, impacting Binance, Coinbase, and others.

Emmer is a pro-crypto Congressman who now joins Bryan Steil as part of the subcommittee’s leadership to oversee crypto regulation in the US.

“Bitcoin is a highly speculative, volatile asset. But with 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years,” said Gensler.