Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

OptionRoom’s fixed protocol rewards are distributed on the basis of users’ levels of activity across the protocol.

At OptionRoom, the team always believed in rewarding the users who participate in the project’s ecosystem; not only does this encourage and incentivize interaction with the protocol, but it makes a tangible and positive contribution towards the agenda of fostering adoption for prediction markets and decentralized finance as a whole.

Because of this, OptionRoom was founded with the vision of offering a rewards structure that is unrivaled throughout the DeFi forecast protocol space. This article provides an overview of those rewards and gives you all the info you need to start benefiting from our ethos of incentivization.

OptionRoom’s fixed protocol rewards are distributed on the basis of users’ levels of activity across the protocol; these are daily distributions, for which we’ve set aside substantial amounts of $ROOM tokens. The breakdown of these distributions follows below, along with info around how you can start earning:

To benefit from these significant rewards, users can head over to the OptionRoom dApp and start Trading, Validating, and Resolving the innovative forecast markets.

N.B: There’s a floor price for these reward calculations which is set at $0.25; if the price of $ROOM falls below this, rewards will decrease slightly

Our volume-based rewards are distributed to users who create markets on the OptionRoom platform, and to users to provide liquidity for those markets. A breakdown of the significant rewards available to market creators and LPs is provided below:

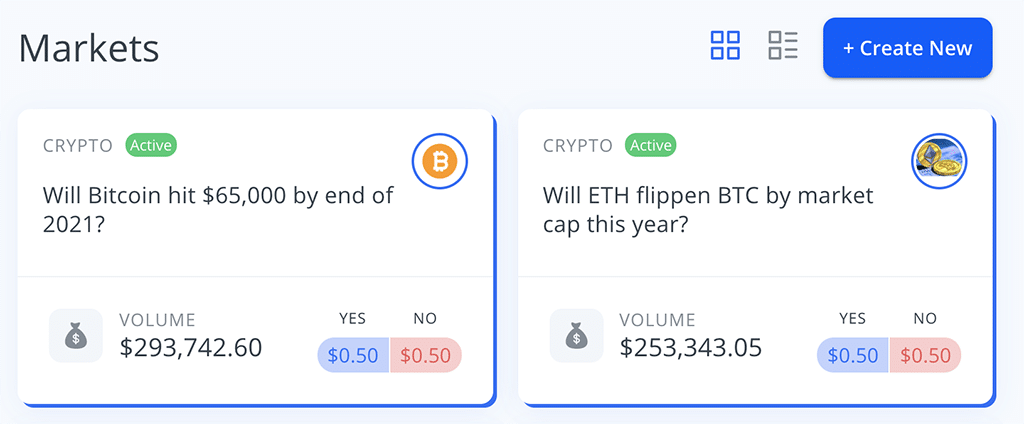

To create markets on the OptionRoom platform, and to start reaping the lucrative benefits of being a market creator, head over to the Markets section of the OptionRoom platform, you can click on the “Create New” tab and then follow the instructions on the next page.

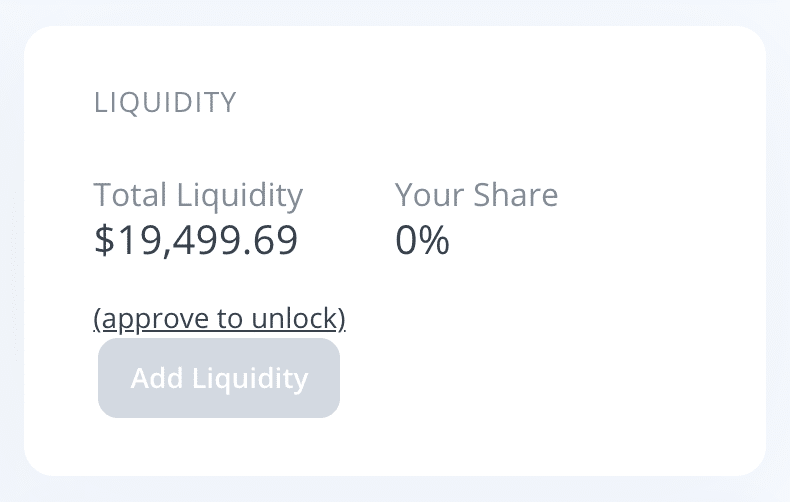

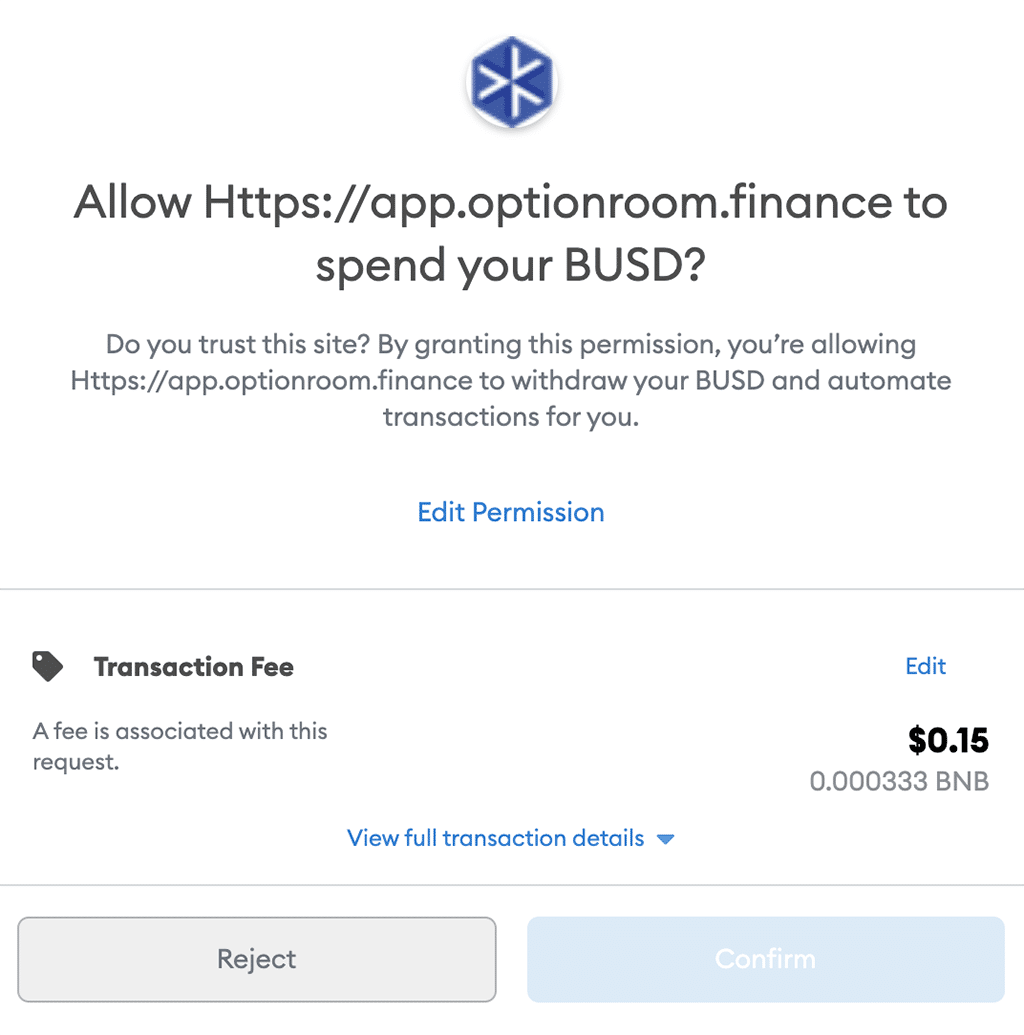

To provide liquidity to the markets on the OptionRoom platform, click on any given market on the Markets page, then look to the “Liquidity” tab on the right hand side of the page and approve the ability to provide liquidity by clicking the link, which will trigger MetaMask to open:

After this, you can simply click “Add Liquidity” in the Liquidity tab and enter how much you would like to provide to the market. Then it is possible to begin earning the Liquidity Provision reward.

N.B: There is a Protocol Fee of 0.4% which is applied to the volume of markets, and which is sent to the reward pool to facilitate the distribution of the rewards.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.