The deployment of the 24,000 chips should be completed by February 2024.

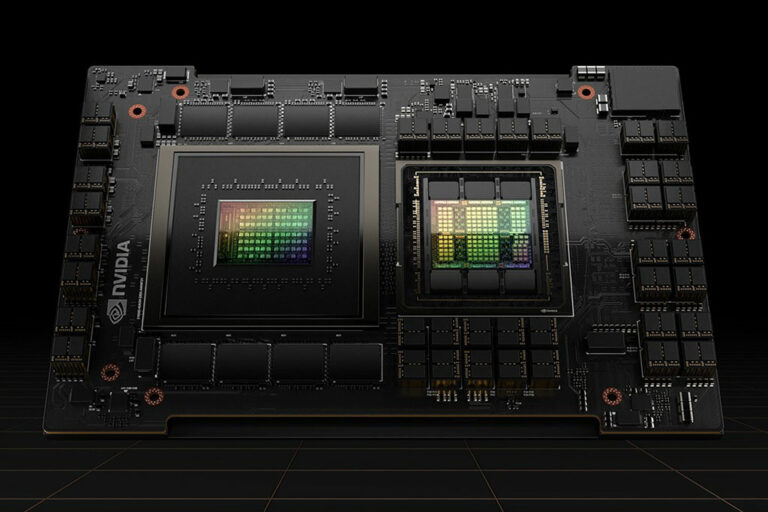

Voltage Park, a nonprofit organization founded by billionaire Jed McCaleb, has acquired approximately 24,000 Nvidia H100 chips for approximately $500 million. According to The Business Time, the organization plans to lease AI computing power at a low cost to address the shortage of these chips.

Eric Park, CEO of Voltage, stated:

“The current ecosystem for machine learning is fundamentally flawed.”

Therefore, the organization aims to install the new chips in its facilities in Texas, Virginia, and Washington. The deployment of the 24,000 chips should be completed by February 2024 to meet the growing demand for AI chips following the successful launch of OpenAI’s ChatGPT, which has revolutionized the field of AI.

NVIDIA’s Shares Surge Over 200% amid AI Boom

Nvidia Corporation (NASDAQ: NVDA) is a company dedicated to designing and manufacturing graphics processors (GPUs) for computers, chipsets, and software aimed at specialized markets such as gaming and artificial intelligence.

In 2023, Nvidia has been one of the top-performing companies of the year, thanks to its substantial investment in AI-focused chip development. This has propelled it to become one of the leading companies in the AI market.

Over the past year, NVIDIA (NVDA) shares have surged by an impressive 212%, climbing from $135 to the current price of $406.31. This surge followed its peak on August 30th, when it reached a high of $493.55, driven by the increasing demand for its AI chips, thanks to the popularity of AI models like ChatGPT and Claude.

NVDA price. Photo: TradingView

According to Business Insider, sources close to Nvidia have reported that the company expects to triple its production of H100 chips by 2024, manufacturing between 1.5 to 2 million units compared to the 500,000 produced in 2023.

Tech Giants Betting Big on the AI Race

Microsoft, Amazon, and Google are among the tech giants making massive investments in AI development. On October 24th, Microsoft Corp (NASDAQ: MSFT) announced a $5 billion Australian dollar (3.2 billion US dollar) investment to strengthen the artificial intelligence sector in Australia. Previously, Google had announced a $1 billion investment in partnership with the Australian government.

These investments come in a context where the regulatory landscape for AI, similar to that of cryptocurrencies in the United States, is generating uncertainty among investors. Some experts suggest that unclear or overly strict rules in the US are driving AI developers to seek opportunities in more technologically and regulatory-friendly countries.

Likewise, Amazon, the retail giant, recently introduced a new generative AI feature called “Explore with Alexa”, designed to provide “reliable” and personalized answers to children’s questions, increasing confidence among adults in the face of AI risks.

Although AI is in its infancy, its associated risks have ignited numerous discussions concerning user safety and privacy. Nevertheless, as this narrative unfolds, it’s highly probable that we’ll witness tech giants channel their fervor – and considerable financial resources – to satisfy the hunger for this groundbreaking technology.

next