BlackRock’s iShares Ethereum Trust Hits $1B in Net Inflows to Set New Benchmark

BlackRock’s iShares Ethereum Trust (ETHA) has just become the first US spot Ethereum ETF to see $1 billion in net inflows.

BlackRock’s iShares Ethereum Trust (ETHA) has just become the first US spot Ethereum ETF to see $1 billion in net inflows.

The Hashdex Solana ETF will trade on the B3 Brazilian stock exchange as per the CVM database. On the other hand, US investors lose hope of the Solana investment product.

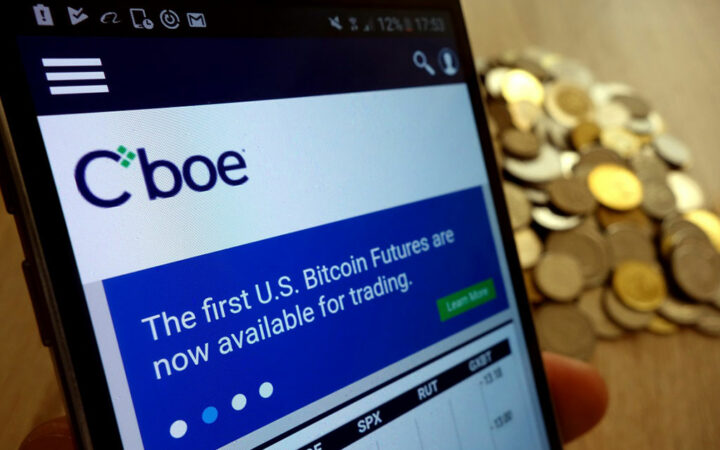

Forms for Solana spot exchange-traded funds (ETFs) filed by VanEck and 21Shares have been unexpectedly removed from the Chicago Board Options Exchange (Cboe) website, leading to speculation that these applications might face delays or even denial.

NYSE has retracted its application to list and trade options on the Bitwise Bitcoin ETF (BITB) and the Grayscale Bitcoin Trust (GBTC).

Amid the broader crypto market’s slowness, US spot Ether ETFs recorded an outflow of $39.21 million on Thursday.

The State of Winconsin increased its stake in BlackRock bitcoin ETF while liquidating all of its GBTC share holdings during the last quarter.

U.S. spot Bitcoin exchange-traded funds (ETFs) recorded an $81.36 million outflow on Wednesday, breaking a two-day streak of positive inflows. Of all spot Bitcoin ETFs, only two funds managed to secure relatively modest positive inflows on the day.

Banking giant Morgan Stanley announced a near-selloff of its Grayscale holdings while liquidating a total of $269.9 million worth of GBTC shares which it held in Q1 2024.

Grayscale ETHE saw a net outflow of $31 million, reversing the previous day’s breakeven flow, likely due to concerns over Grayscale’s ability to convert ETHE shares into real Ethereum.

According to the filing, Goldman Sachs holds substantial positions across seven different Bitcoin ETFs available in the U.S. market.

Ethereum (ETH) is a huge beneficiary of the recent price correction. Beyond the $155 million in inflows last week, its year-to-date inflows have reached $862 million.

Presently, ETHA stands as one of the top six ETF launches of the year.

It is now a possibility that there is a postponement of the final deadline for a SEC decision.

While five of the eleven approved Bitcoin ETFs saw positive inflows running into the millions, the remaining products experienced mixed results.

NYSE American’s request follows Nasdaq’s proposal to the SEC, seeking approval for options trading on the BlackRock iShares Ethereum Trust (ETHA).