Bitcoin (BTC) Price Strikes New ATH while Gold Declines as Stimulus Calls Increase

The increase of US stimulus package talks serves as a booming situation for Bitcoin and Gold. However, Bitcoin price strikes a new record while Gold declines.

The increase of US stimulus package talks serves as a booming situation for Bitcoin and Gold. However, Bitcoin price strikes a new record while Gold declines.

The Reddit community of investors who fueled the GameStop rally has shifted its focus to precious metal silver taking its price 7% higher to $29 per ounce.

Before silver’s buying stampede, the Reddit frenzy also fueled the rise in GameStop, Dogecoin, and others.

While Bitcoin has enjoyed a high level of acceptance both from investors as well as recognition from the mainstream media, many gold proponents believe its meteoric rise is a bubble.

The announcement reveals that the regulations are created to be “technology-neutral” in case of future technological developments.

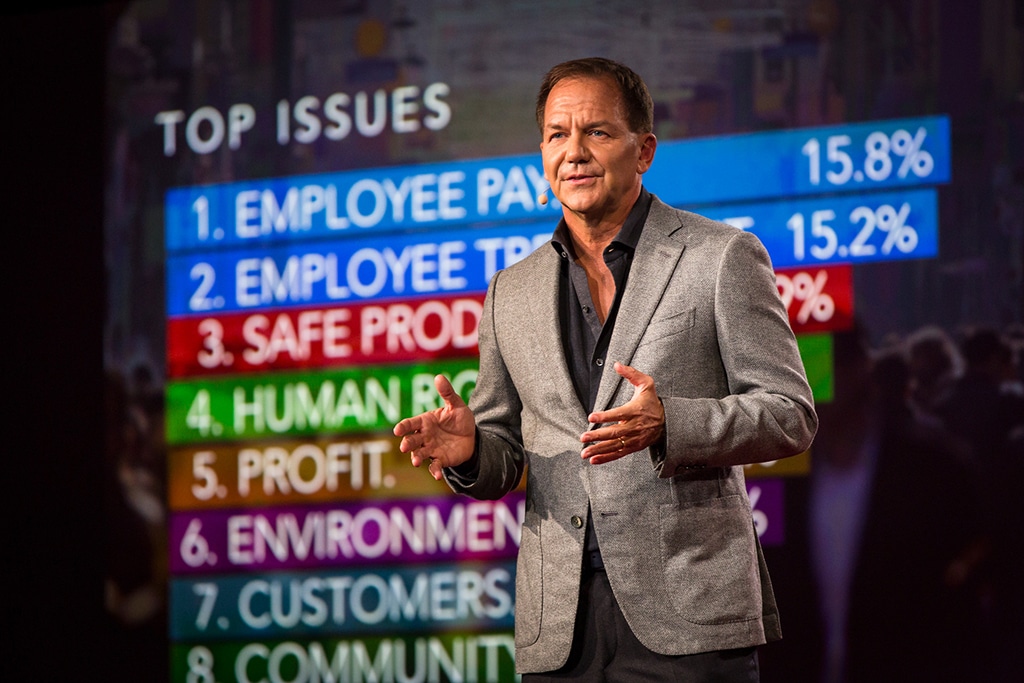

Paul Tudor said that in the next 20 years, digital currencies will be similar to the “complex metals” of today. Here Bitcoin will be the “precious crypto” assuming the role of Gold and other transactional cryptocurrencies will be industrial metals like aluminum and copper.

Both Bitcoin and Gold market value has significantly increased during the pandemic.

According to reports, 98% of Raoul Pal’s liquidated net worth would be invested in Bitcoin and Ethereum in the ratio 80:20.

Citibank executive noted that Bitcoin is going through a similar period to that of Gold in the 1970s and expects a potential breakout next year.

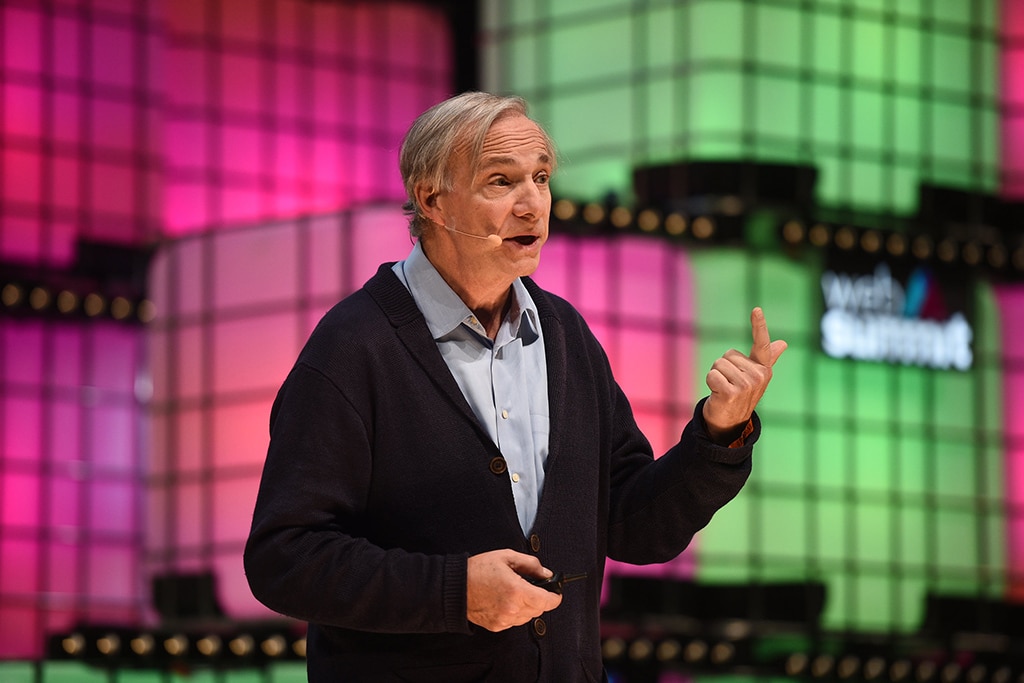

Dalio says that Bitcoin’s volatile nature leaves it with fewer use cases as a medium of exchange. He added that he would prefer Gold over Bitcoin.

Stanley Druckenmiller is betting on Bitcoin against the dollar that has been depreciating in value ever since the coronavirus outbreak.

The banking giant said that Bitcoin is smartly consolidating its strength against the yellow metal and emerging as a potential alternative.

Most traders hope that Biden will reduce international conflicts and push for peace. Therefore, their reaction to the election results was positive.

As the oil price continues to dip following the effect of the coronavirus and the U.S. elections this week, many experts expect OPEC and its allied bodies to make policy moves to help prevent the complete market collapse.

Bitcoin Futures contract has at this time revealed a differing behavior between hedge funds and institutional investors in a scenario that seems to stir market analysts amusements.