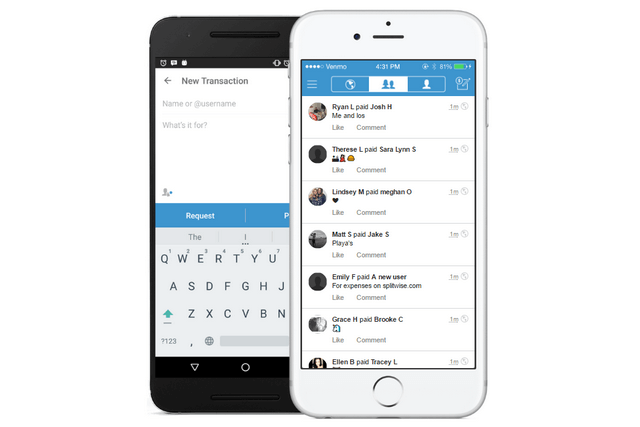

PayPal Integrates Venmo as a Payment Option During Checkout

Online payments giant is adding Venmo as a new payment option and is planning for more partnerships with companies across multiple sectors.

Online payments giant is adding Venmo as a new payment option and is planning for more partnerships with companies across multiple sectors.

The UK’s leading bank has announced the opening of the new innovation site in London, which is set to be the largest financial technology centre in Europe.

Apple users will soon be able to transfer money to other people, as the company is reportedly going to launch a new peer-to-peer payment feature later this year.

Android Pay users in the US will soon be able to make payments with their PayPal balances at thousands of new retailers, including Walgreens, Dunkin’ Donuts and Subway.

Ant Financial is set to bring mobile payments technology to customers in Indonesia via a new partnership with major local media company Emtek.

The UK’s central bank has developed its own Proof of Concept ledger and will make the next version of its interbank payments system compatible with settlement in a distributed ledger.

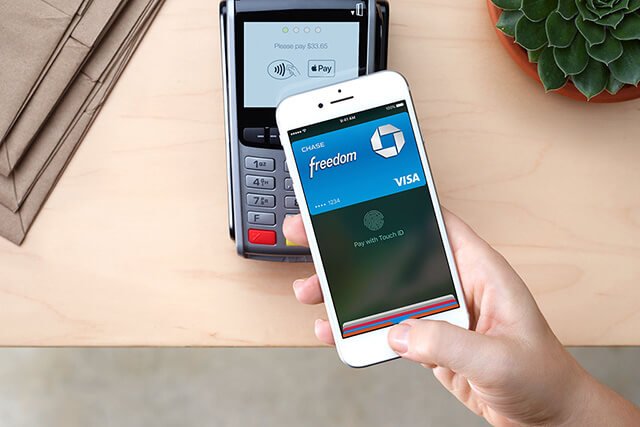

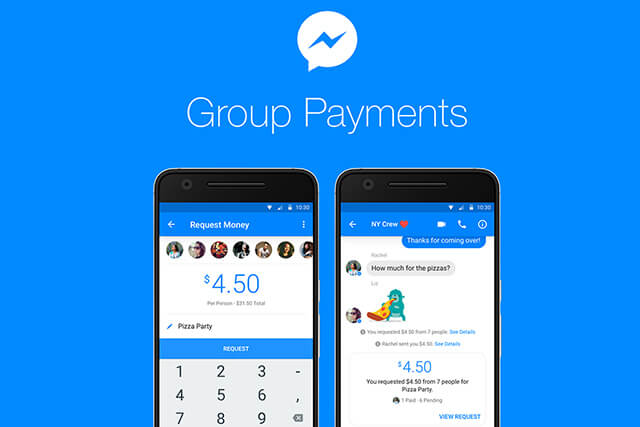

With the new payments functionality, the social media networking giant will enable Messenger users to send funds to several members of the group chat.

Offering Apple Pay as a payment method in the US and later to the UK, Western Union allows customers to conveniently and reliably transfer money whenever they want.

The cooperation will allow the increasing number of Chinese travelers in the UK to purchase goods and services via the WeChat Pay application on their mobile phones.

The company not only described the potential use cases of the blockchain technology for banks, but also identified the main issues impeding its wider adoption in the sector.

Later this year, Samsung Pay will be available at hundreds of thousands of merchants around the world where Visa Checkout is accepted.

LG must have solved the problems it encounted during testing in 2016 and is preparing to launch LG Pay in June.

The new Galaxy S8 may become the first device to use facial-recognition technology for mobile payments verification.

Buyers will no longer need to use their debit cards to pay for purchases as the credit card giant developed a new pair of glasses embedded with a tiny payment chip.

The UCITS fund will be the first-ever fund in Europe with the primary focus on fintech companies.