Fintech Firm Plaid Acquires Its Rival Quovo to Build the New Full-Service API Platform

San Francisco-based fintech app provider Plaid has announced its first major acquisition. The startup allegedly spends $200M to acquire its rival company Quovo.

San Francisco-based fintech app provider Plaid has announced its first major acquisition. The startup allegedly spends $200M to acquire its rival company Quovo.

FinTech is increasingly collaborating with traditional banking institutions, combining the innovative mindset of FinTech startups with the scale, strong brand recognition of traditional banking institutions. However, a new disruptive force is on the horizon: TechFin.

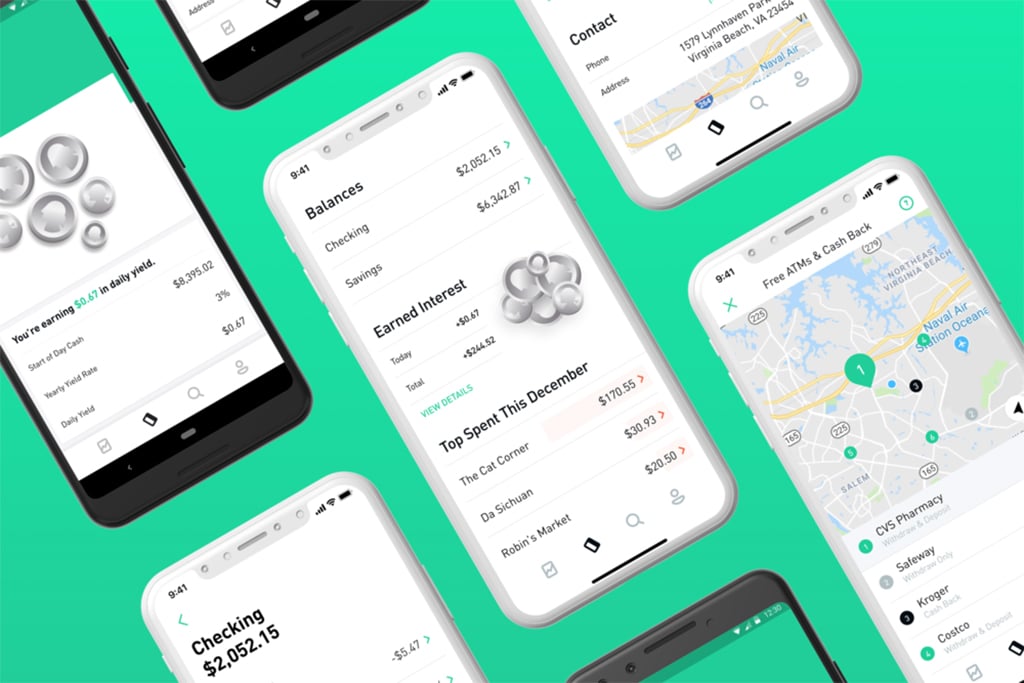

The traditional banking system has ‘fleeced’ their unsuspecting customers through hidden charges on most services. Robinhood has intervened to salvage the deteriorating situation.

The lack of information equality for borrowers in lending marketplace is something this article will address by providing an overview of the lending landscape, and in doing so, offer some viable solutions.

The latest Series C funding round worth $250 million was led by popular venture capitalist Mary Meeker through her Kleiner Perkins’ growth fund.

The service is expected to enable speedy and seamless transactions, reduce delays and costs, and increase efficiencies in the payments process.

Alternative banking provider Revolut is ready to serve numerous Asian customers with a compliant financial assistance, as the company expands to Japan and Singapore.

Amazon Pay surges in popularity on merchant websites. Financials host Jason Moser believes PayPal and Apple Pay have clear tech advantages and Fool.com contributor Matt Frankel, CFP, thinks that Amazon’s familiarity gives it an advantage as more consumers adopt digital wallets.

Shift Money, a conference floor jampacked with content and amazing after-parties, has become famous for its atmosphere. Holding purpose to explore new ways to disrupt the world of Payments, Insurance, Lending, and Blockchain, it gathers industry’s representatives to find new partners and new opportunities.

Abu Dhabi-based Al Hilal Bank has conducted the first-ever blockchain-based transaction for an Islamic bond called Sukuk worth $500 million.

To dominate the retail world, e-commerce giant Amazon is persuading brick-and-mortar merchants to accept its mobile payments system Amazon Pay.

While blockchain has considerable, yet partly unsused potential in the wider financial markets, PumaPay has come to reform credit transactions and introduce cryptocurrencies into the consumer mainstream.

A new project Aerum will challenge the current issues of blockchain technology with its “number one” Ethereum-based platfrom.

Since we can’t always predict what our life has in store for us, and circumstances may change in a blink of an eye, which comes especially important when you’re paying a personal loan, it’s wise to consider several possibilities for its refinancing.

Cryptocurrency startup Veem just completed a new funding round that includes investors such as Goldman Sachs and Google Ventures. This is not surprising, given the exponential growth of the company, as it seeks to disrupt the global payments sector.