Euroclear to Launch DLT-based Bond Settlement Platform This Year

Euroclear conducted a recent trial with the French central bank for using blockchain technology for bond transactions using CBDC as a payment.

Euroclear conducted a recent trial with the French central bank for using blockchain technology for bond transactions using CBDC as a payment.

Called “Tickets 3.0”, NFT tickets sold by Flybondi can be renamed, transferred and sold. The whole technology runs on the Algorand blockchain that offers a wide range of secure, efficient and scalable applications.

Ranking as the sixth largest stock exchange in the European Union and second in Germany, Boerse Stuttgart is committed to doubling down on its track record concerning its new crypto service offerings.

While there is a plan to set up a panel in April, the Japanese government is also launching a pilot program for the digital yen in the same month.

The Radiant Capital-Binance Launchpool development reflects the growing dynamism in the exchange’s staking platform.

It is said that the exchange exposed its users to a very significant risk by combining several aspects of its operations that should have been registered and operated separately.

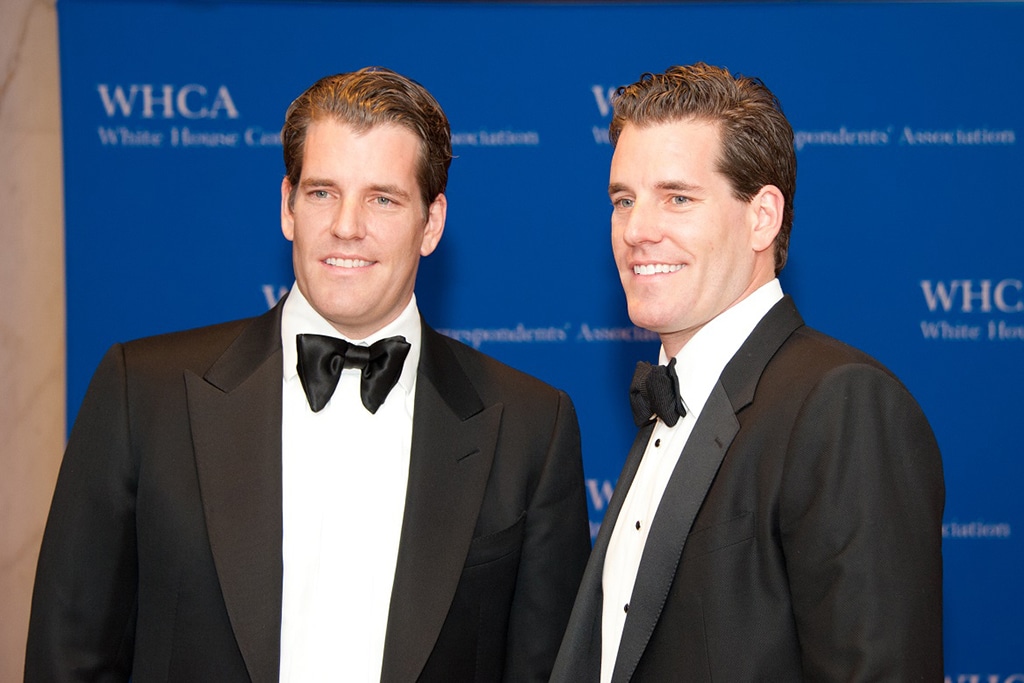

The collapse of FTX in November might have played a major role in the decision of Gemini to foray into derivatives trading.

Amid the tightening of regulatory rules in Canada, crypto exchanges are contemplating whether to continue their operations or exit from the country.

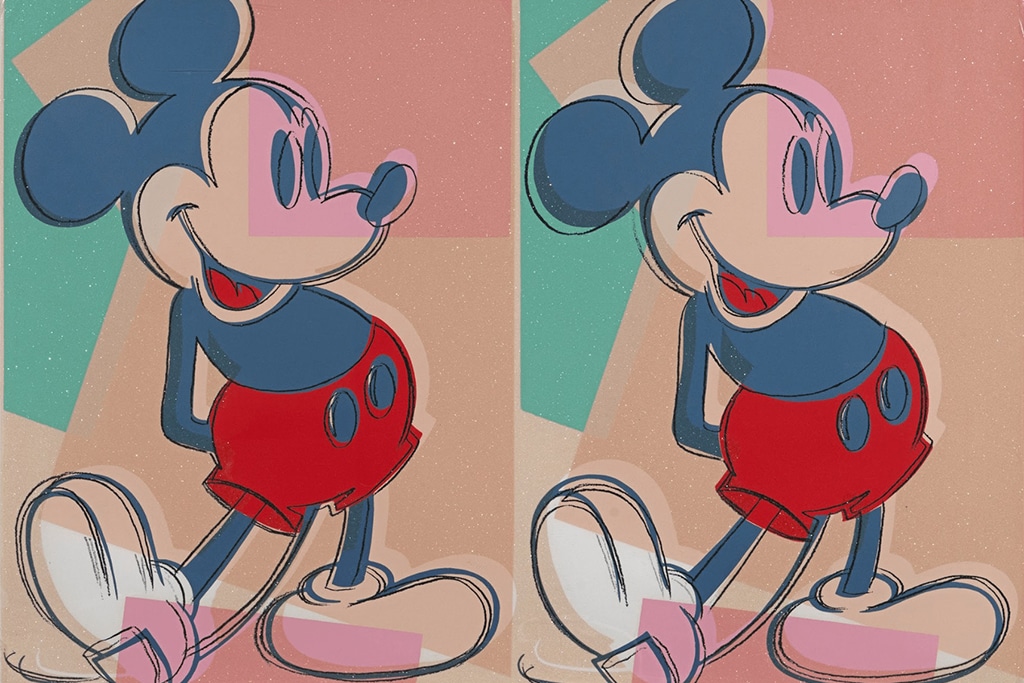

Each of four Warhol’s prints will be accessible as shares in the form of security tokens.

Despite the lack of clarity in the rules, the SEC chairman has reiterated that any attempt to create new laws will unsettle the status quo.

The minimum amount to start trading BTC and ETH in Chile is 50 Chilean pesos (equivalent to about 6 cents). The service is provided by Mercado Libre in partnership with Latin American crypto company Ripio.

Starting next week on April 5, Signature Bank will return $4 billion in deposits linked to crypto businesses since they aren’t a part of the NYCB deal.

Fetch.ai will use the investment to deploy decentralized machine learning, autonomous agents, and network infrastructure on its platform.

Amid the fallout of the Silicon Valley Bank this month, Circle’s USDC stablecoin saw massive outflows which continue to date. The USDC stablecoin has lost 23% market share in less than a month’s time.

Besides its basic offerings, Wakweli is also bound to offer other advanced utilities or use cases that can add extra value to all Polygon users who adopt its solution.