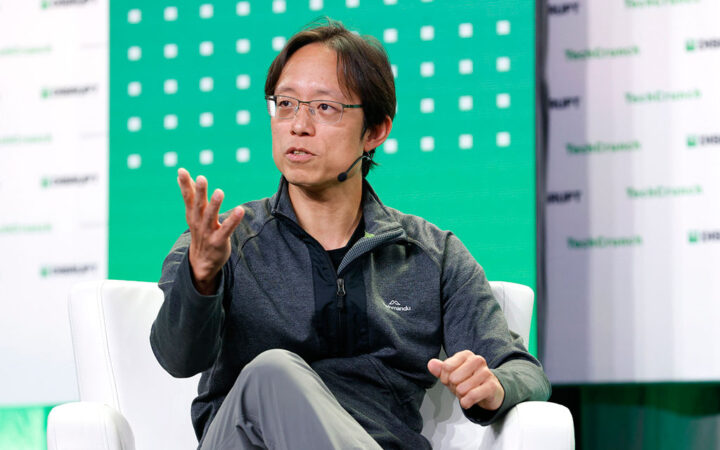

Animoca Brands Chairman Says Timeline for IPO Depends on Market’s Status

Animoca plans for a public listing but has not decided on a location or a timeline, with Siu citing market status as a deciding factor.

Animoca plans for a public listing but has not decided on a location or a timeline, with Siu citing market status as a deciding factor.

World Liberty Financial will sell non-transferrable WLFI tokens, which “are pure governance tokens, only providing the right to make proposals and vote on matters related to the platform.”

Hong Kong aims to stay ahead in fintech by issuing AI guidelines, seeking both innovation and stability.

Since this year began, ARK Invest has initiated multiple offloads of COIN shares. Right before it presented ìs Q2 earnings reports, the company offloaded 12,077 Coinbase shares worth $2.7 million.

Samsung Next will be part of the Soneium Spark Incubation Program by Startale Labs and support a community of creators and builders poised to shape the future of Web3.

Despite its massive user base, Telegram has yet to break even, raising concerns about its long-term viability.

Creditors of Ionic Digital, a crypto mining firm linked to Celsius, are considering liquidating the company due to delays in its public listing plans.

VCs believe that there’s a growing fatigue in infrastructure investment and thus they are putting greater focus on opportunities in crypto applications.

CoinShares has expanded its crypto operations from the European market to the United States through the recent acquisition of Valkyrie’s spot Bitcoin ETF.

Meanwhile, Coinbase recently released its Q2 2024 earnings report, surprising many market observers with its performance.

In the past, Galaxy Ventures invested between $30 million and $50 million of the firm’s money into various crypto startups.

Proton has partnered with third-party on-ramp companies so that users can easily buy Bitcoins using credit cards or bank transfers globally.

The company’s merger is part of the wider trend of cryptocurrency firms gearing towards public offerings.

With the Bitcoin mining landscape becoming increasingly competitive, Riot Platforms’ strategic acquisitions position it as an industry leader.

SRM was originally scheduled to have a maximum supply of nearly 10.1 billion tokens, but the DEX’s collapse ruined the plans.