Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.

As Mattel’s net sales increased in Q1, the company has expanded its outlook for the rest of the year.

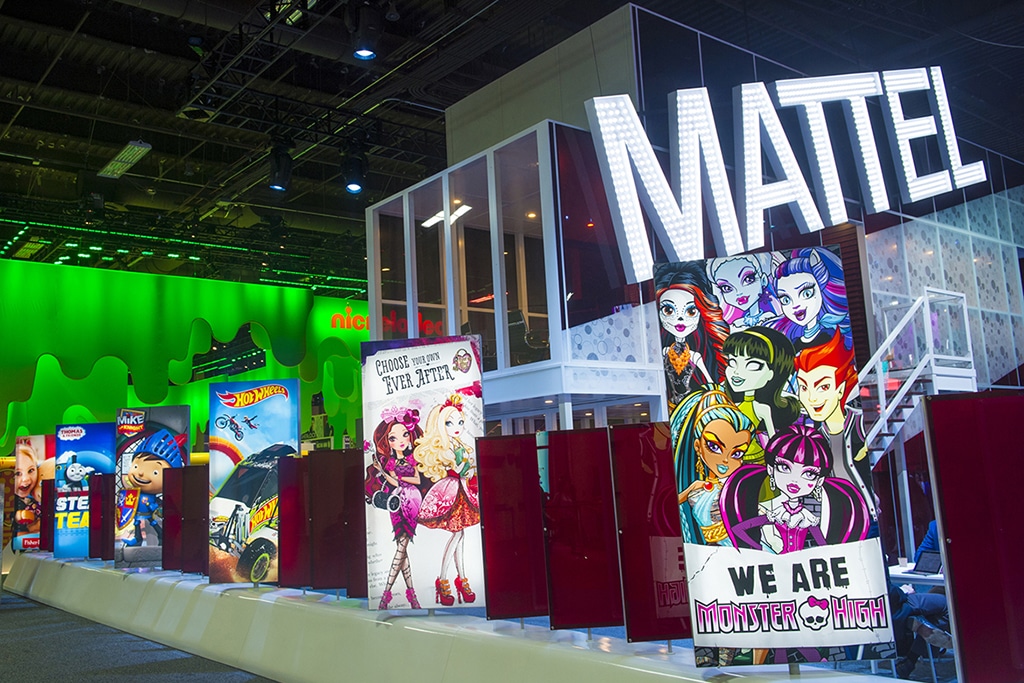

Toy company Mattel Inc (NASDAQ: MAT) reported a 47% increase in net sales in its 2021 first quarter (Q1) earnings result. According to the company, net sales jumped to $874 million. Mattel revealed details of its financial result on the 22nd of April. Following the earnings report, the company jumped 7.28% in after-hours trading.

At press time, Mattel is up 7.76% to $22.50 in premarket trading after its previous close of $20.88. Over the past year, the toymaker has seen a constant increase in its performance. In the last year, it has advanced 149.76% and increased 19.66% in its year-to-date record. Furthermore, MarketWatch data highlighted that the company rose 13.66% in the last three months and added 3.42% over the past month. In the last five days, Mattel has gained 1.85%.

Mattel crushed earlier predictions by recording a lower-than-expected loss against Wall Street forecasts. Earlier predictions stated that Mattel was poised to see a 35% loss per share. The company, however, reported a 10 cents loss per share. Additionally, Mattel’s net loss reduced from $210.7 million seen a year ago to $115.2 million.

In its Q1 report, Mattel attributed the rise in sales to parents who buy more toys for their kids with the government-issued stimulus checks. During the period, sales of Mattel’s American Girl brand rose 22%. The company’s brand, Barbie, also became more popular at the same time.

During the quarter, the gross margin was 46.8%, an improvement of 380 points. Adjusted gross margin also moved by 350 points to 47%. Mattel’s revenue climbed about 190 million to $874.2 compared to analysts’ forecast of $684.2.

Mattel chairman and CEO Ynon Kreiz expressed his satisfaction with the company’s performance. He noted that the toymaker had grown its market share for three consecutive quarters. Speaking further, the CEO said:

“While growth this quarter was partially driven by year-over-year COVID-related comparisons, we believe our outstanding results overall, are attributed to the strength of our brands, quality and breadth of our product, world-class supply chain, global commercial capabilities, and very effective demand creation in close collaboration with our retail partners.”

As Mattel’s net sales increased in Q1, the company has expanded its outlook for the rest of the year. During a conference call with analysts, Mattel said that the company now expects 6%to 8% increase in revenue in 2021.

On the 24th of February, Mattel announced its outlook for 2021 through 2023. For this year, Mattel said adjusted EBITDA is expected to be between $775 and $800 million.

Mattel said the raised outlook signifies that the company will continue at a strong pace in the second quarter. Mattel chief financial officer Anthony DiSilvestro said that the toymaker is “well-positioned to gain momentum for the full year.”

Read other stock market news here.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.