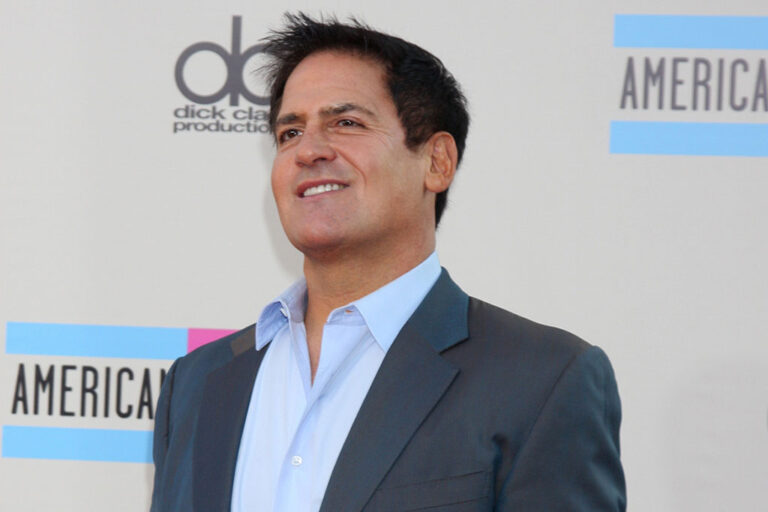

Mark Cuban has voiced his interest in leading the US SEC under Kamala Harris’ administration.

The seat of the United States Securities Securities Exchange Commission (SEC) Chairman is becoming more enticing to many high-profile individuals, including Mark Cuban. In a recent interview with FOX News, the American businessman voiced his interest in leading the Commission under Kamala Harris’ administration. Harris is competing alongside Donald Trump in the upcoming US elections.

Deaton Supports Cuban’s Interest for US SEC Chair

The conversation between Cuban and his interviewer took a turn when the journalist asked him whether he would want to take the position of Treasury Secretary or Commerce Secretary in the Harris administration. The billionaire said he would rather be the “Head of the SEC. That’s the job I would take”.

Even if you disagree with @mcuban on specific issues, objectively speaking, Mark would be a breath of fresh air and a welcomed change from the lawlessness of @GaryGensler.

A decade ago, Mark witnessed firsthand the type of gross overreach the @SECGov is capable of. Much like… https://t.co/XT82sFlVN8

— John E Deaton (@JohnEDeaton1) September 26, 2024

Many key players in the crypto industry support Cuban’s proposal. Even John Deaton, the pro-XRP lawyer who disagrees with Cuban on other subjects, stated that he supports the billionaire’s takeover from Gary Gensler, the current US SEC Chair. Furthermore, he described Mark Cuban as a “breath of fresh air” compared to Gensler’s “lawlessness”.

Deaton recalled when the American investor suffered the SEC’s gross overreach but fought back. He believes Cuban would bring the change that the crypto industry needs. Generally, the crypto industry has suffered too many enforcement actions with Gensler at the helm of the affair. It is, therefore, only normal that they will seek his dethronement.

During the recent SEC Chair hearing, Gensler was flooded with several tough questions related to his approach to the US crypto industry. According to US Representative Tom Emmer, the 66-year-old American government official is the most “destructive” and “lawless” chairman in the agency’s 90-year history.

Mark Cuban and Other Potential SEC Chair Prospects

Mark Cuban is an active player in the crypto industry, investing in several digital currencies and even suffering a huge loss to scams at some point. Over the years, he has constantly spoken against the SEC’s inhumane approach to the crypto industry. In June 2023, the regulator sued Coinbase Global Inc (NASDAQ: COIN) and Binance separately for violating federal securities laws.

Cuban immediately criticized the SEC for failing to clarify the official registration process for crypto firms. The billionaire pointed out that this lack of clarity makes it extremely difficult to determine what qualifies as a security in cryptocurrencies. Mark Cuban also criticized the SEC for its differential treatment of the stock and crypto loan industries.

Should Cuban become SEC Chair, he may change the agency’s narrative and provide clarity for digital assets.

Apart from Cuban, the crypto ecosystem has been discussing a few other professionals that may take over from Gensler. There is crypto-friendly Commissioner Hester Peirce, often called “Crypto Mom”.

Robinhood’s Chief Legal Officer (CLO) Dan Gallagher may also be hired to replace Gensler. Other nominees are former CFTC heads J. Christopher Giancarlo, Heath Tarbert, and Paul Atkins.

next