Litecoin (LTC) Halving Approaches, Will the Price Pump? Investors Flock to Collateral Network (COLT) for the Biggest Returns on the Market

Litecoin (LTC), one of the most popular forks in Bitcoin (BTC), has experienced a price decline of 0.61% in the last week as market analysts predict it could crash in May. As a result, investors are flocking to Collateral Network (COLT) to optimize their returns.

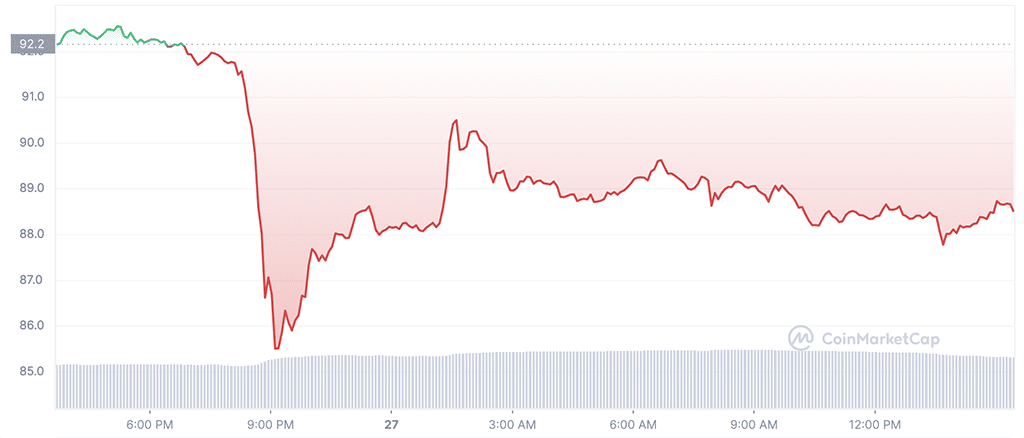

Litecoin (LTC) Price Drops Below $90

After hitting $102.96 earlier in April, Litecoin (LTC) has recently crashed to $88.62, losing 3.82% of its value at the time of writing. Although many cryptocurrencies have dropped due to the recent market correction, analysts anticipate that Litecoin (LTC) could drop further as other investments recover.

The 24-hour price chart for Litecoin (LTC). Photo: CoinMarketCap

With the Litecoin (LTC) halving fast approaching, market analysts believe that additional Litecoin (LTC) price fluctuations are on the way. Though it’s impossible to predict whether or not these will be positive or negative, some analysts are taking a bearish perception, stating that Litecoin (LTC) has already increased too much from its price of $69.95 at the start of 2023.

Collateral Network (COLT): On Track to Become One of the Markets Highest Return Projects

With the crypto market on the brink of a downturn, investors are flocking to Collateral Network (COLT) to capitalize on a potential 3500% ROI in the next six months. Collateral Network (COLT) is the world’s first DeFi crowdlending platform that lets individuals borrow against their real-world assets.

Instead of going down the traditional routes to unlock liquidity from their assets, Collateral Network (COLT) enables individuals to bring their physical assets on-chain as NFTs. Each NFT is fractionalized into smaller segments, and these pieces are sold to multiple investors to help fund the loan with smaller amounts. Holders of the NFTs generate a weekly fixed rate of interest for the duration of the loan. Once the loan is repaid the NFT is burnt and the asset is returned to the borrower.

This solution is a game changer in the lending industry. The market will no longer be controlled by large institutions and select pawnbrokers. Now every lender on the platform can become their own mini bank.

As an innovator in the market, analysts predict that Collateral Network (COLT) could rise from $0.014 to $0.35 before its presale ends, offering huge returns for bullish investors.

Collateral Network (COLT) has already increased by 40% during its presale and is expected to rise to $0.0168 once the next phase sells out.

Collateral Network (COLT) native token, COLT, is currently available to buy via the presale portal.

Conclusion

With the Litecoin (LTC) halving, is creating uncertainty for LTC holders, many are buying Collateral Network (COLT) for greater stability and even higher returns. As the project continues to gain momentum, experts predict price increases to become a norm, with COLT potentially surging an additional 100x once it hits mainstream exchanges.

Find out more about the Collateral Network here: Website, Presale, Telegram, Twitter.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.