Is Seesaw Protocol (SSW) a Scam? How to Avoid Cryptocurrency ‘Rug Pulls’

Many new cryptocurrencies launch every month. After the huge successes of 2021, in which almost every coin broke through to reach new all-time highs, it is not a surprise that many people are rushing to create new projects. Unfortunately, not of all these creators have the best intentions. Some developers will take advantage of the lack of knowledge that some potential investors have about crypto and defraud them of their money. Thanks to the mostly decentralized nature of the crypto market there is often nothing that can be done to halt scams and scammers.

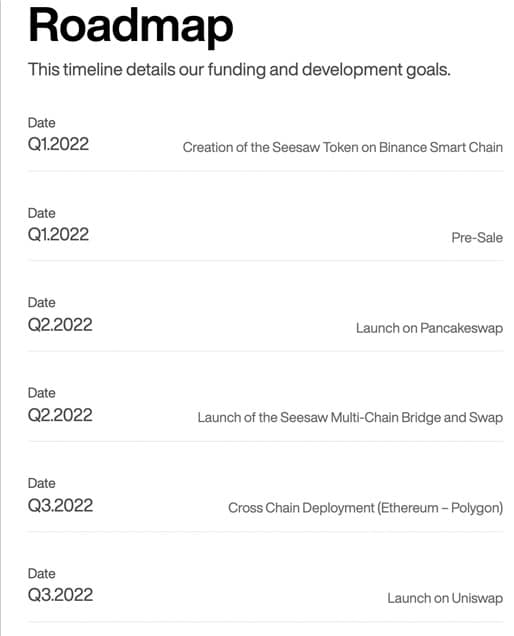

Many new projects are made and backed by anonymous creators, in the style of the pseudonymous Bitcoin (BTC) founder Satoshi Nakamoto. Seesaw Protocol (SSW) is one of these new cryptocurrencies, and its creators are yet to be named. Suffice it to say, after a series of recent high-profile crypto scams, this anonymity has been enough for some to label SSW a scam. There is some FUD (fear, uncertainty, and doubt) concerning Seesaw Protocol, but despite this, it is a far cry from a real crypto scam. Squid Game (SQUID) is possibly the biggest example of a recent scam or ‘rug pull’.

What Is a Rug Pull?

As defined by one of the market-leading listings platforms, CoinMarketCap, a rug pull is a “malicious manoeuvre in the cryptocurrency industry where crypto developers abandon a project and run away with investors’ funds. Rug pulls usually happen in the decentralized finance (DeFi) ecosystem, especially on decentralized exchanges (DEXs), where malicious individuals create a token and list it on a DEX, then pair it with a leading cryptocurrency like Ethereum.” Once a significant enough amount of people have exchanged their ETH for the scam coin, the creators will then withdraw everything which drives the price of the coin to zero. The investors lose out and the creators make off with their money.

Is Seesaw Protocol (SSW) a Scam?

Seesaw Protocol (SSW) is not a scam. Their comprehensive white paper is available to view here.

The presale itself has been underway for just over two weeks and has so far been an astounding success. This could raise eyebrows in itself but all the evidence points towards legitimacy. The price started at $0.005 and has increased by more than 500% to $0.031 at the time of writing.

How to Avoid a Rug Pull

There are several red flags and warning signs to look out for in a potential rug pull. They include:

- Unknown or anonymous developers – On some occasions, it can appear inauthentic if the creators of a cryptocurrency are unknown. Investors may be sceptical of investing in a coin when they do not know who is behind it. However, the huge caveat here is Bitcoin (BTC). The biggest cryptocurrency in the world has a pseudonymous creator behind it. Seesaw Protocol’s (SSW) creators are following this approach and choosing to remain anonymous.

- No liquidity – It is important to ascertain if a new cryptocurrency has liquidity locked. Without it, the creators can take off with investors’ money. Seesaw Protocol (SSW) uses a portion of the transaction fee attached to each purchase and sale to constantly add to its liquidity.

- No independent audit – Most new cryptocurrencies consider it standard practice to be audited by an independent third party. Certik is one of the leading blockchain technology auditors, and precocious backers can check the progress of their chosen cryptocurrency on their site. SSW’s audit is in progress and can be found here.

For More on Seesaw Protocol: Presale, Telegram, Twitter, Instagram.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.