Major Investor Acquires 32K SOL amid Solaxy’s $30M Presale Milestone – What Could Be Driving the Move?

An extremely bullish Solana ($SOL) whale swooped into the depressed waters of crypto, snapping up 32,000 $SOL – worth approximately $3.72 million at the time of purchase.

Meanwhile, Solana’s first Layer-2 chain, Solaxy ($SOLX), has seen its presale funding accelerate – hitting the $30 million mark on Monday.

Could the whale be positioning early for a bigger Solana breakout now that its first L2 infrastructure could be nearing launch?

Or could this whale possibly be one of the early backers helping to drive Solaxy’s presale momentum?

Either way, Solaxy isn’t slowing down – with the current funding stage pricing $SOLX at $0.001694 for the next 30 hours before a scheduled increase kicks in.

Early adopters can also tap into the platform’s staking protocol, earning a 135% annual percentage yield (APY) – maximizing their holdings ahead of Solaxy’s next move.

High-Value Investor Accumulates Nearly $13M in SOL Over the Past Year

The Solana whale’s massive $SOL buy has already paid off – today the 32,000 $SOL is worth roughly $4.25 million, giving the investor a profit of over half a million dollars at the current price of $133.

According to Lookonchain, this move mirrors past plays by the same wallet – including a $9 million Solana purchase six months ago, and another $6.5 million buy at $216 three years ago. Impressively, the whale held through the downturn when $SOL crashed to as low as $10, signaling strong conviction in Solana’s long-term upside.

A whale bought another 32,000 $SOL($3.72M) after 6 months.

This whale seems to be extremely bullish on $SOL.

Three years ago, he bought 30,541 $SOL($6.61M) at $216 and didn’t sell — even when $SOL dropped below $10.https://t.co/ouiQ0QsxeZ pic.twitter.com/qMDeQoks7T

— Lookonchain (@lookonchain) April 10, 2025

While not all of those previous buys are in profit just yet, the whale’s early accumulation suggests strong belief in where Solana could be headed. $SOL’s return above $130 – after dropping to $97 earlier this month – was sparked by the recent 90-day tariff pause from the U.S., which many investors interpreted as a macro relief rally.

Institutional investor VanEck shared its bullish Solana forecast back in February 2025, projecting a $520 price target by year-end.

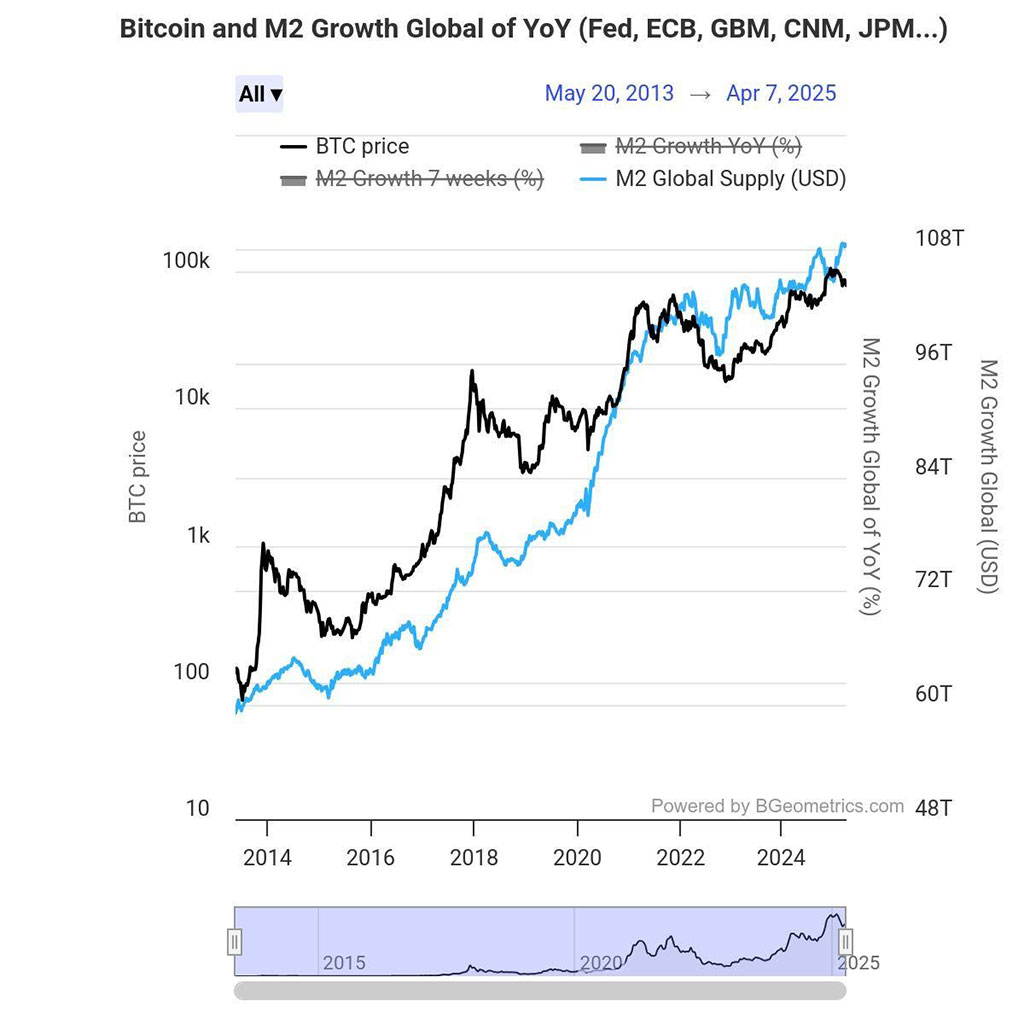

A key part of that thesis rests on the expected expansion of the U.S. M2 money supply – a metric closely tied to Bitcoin’s historical rallies, and by extension, altcoins like Solana. With rising macro pressure on the Fed to resume quantitative easing, the stage could soon be set for another wave of capital to flow into crypto.

Source: BGeometrics

VanEck also sees Solana’s market share in the smart contract sector growing from 15% to 22% by the end of 2025. But for that to happen, it must address its biggest weakness – reliability under heavy network load, a flaw that’s long held it back from matching Ethereum’s consistency.

That’s where Solaxy enters the picture. As Solana’s first Layer-2 solution, it’s purpose-built to support the chain’s scalability as it attracts more smart contract projects and developer demand. If Solana is to handle the next wave of growth, it needs the infrastructure to match – and Solaxy is lining up to be that foundation.

It’s all speculation for now – but the whale’s recent $SOL accumulation, with buys all taking place within the past year compared to the three-year gap between buys from 2021 to 2024, could signal renewed conviction not just in Solana but in what’s being built around it. And Solaxy might be a big part of that thesis.

Insights on Solaxy from Major Solana Investors

Early investors are starting to view Solaxy as Solana’s Arbitrum moment. Just like how Arbitrum quietly built under the radar before Ethereum’s gas crisis pushed it into the spotlight – ultimately soaring to a $2 billion market cap – Solaxy is now positioning itself to do the same for Solana.

Solana’s monolithic framework was long thought to be more than adequate to meet the blockchain’s scalability needs However, repeated outages and congestion have exposed its limits. Solaxy steps in as the chain’s first Layer-2 – a purpose-built execution layer that absorbs overflow transactions and posts finalized data back to the mainnet, boosting scalability without compromising performance.

Its advanced tech stack – fraud-proof mechanisms, a trust-minimized message relayer, and an optimistic bridge – gives Solana the Layer-2 edge it’s been missing. And while Solana already supports booming verticals like DeFi, gaming, and token launches, Solaxy is the missing piece that can help it dominate them by delivering stability at scale.

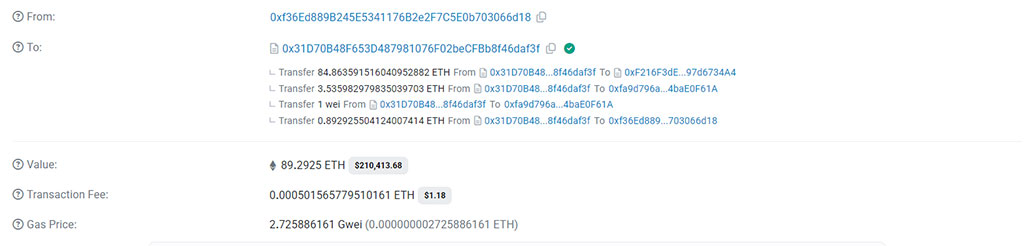

That may explain why whales have been loading up early – not just on Solana, but on Solaxy itself. One whale picked up 1 million $SOLX tokens (worth roughly $242,000 at the time) weeks before the recent $3.7 million Solana buy even happened. The parallel is striking – both bets are placed on Solana’s future, but one focused squarely on the infrastructure that could unlock it.

Ethereum Transaction Hash (Txhash) Details. Source: Etherscan

It’s a signal that smart money isn’t just bullish on $SOL – it sees Solaxy as a core part of Solana’s next chapter. And if Solana is to seriously challenge Ethereum’s dominance, it won’t do it alone – it’ll need a Layer-2 like Solaxy to lead the charge.

$SOLX Price Expectations

Now here’s where things get interesting. With Solaxy’s $30 million raise possibly signaling it’s nearing its funding cap, a listing could be on the horizon. And if it follows Solana’s projected climb from $133 to $520 this year – a roughly 4x move – that alone could push $SOLX from its current presale price of $0.00169 to around $0.0066.

But zoom out, and the upside looks even bigger. If $SOLX echoes Solana’s legendary 2021 run – when $SOL rocketed from $1.50 to $216 – we’re looking at a potential move to $0.243 per token. That’s a 144x gain from today’s levels.

And that’s not far-fetched when you consider $SOLX is a native Solana-based token designed to fix one of the chain’s biggest problems. Even compared to Arbitrum, which launched in March 2023 at $1.38 and later hit $2.39 – that’s a 1.73x return from listing. Modest by degen standards, but for early airdrop recipients, it was game-changing.

If history’s any guide, the biggest winners in crypto are those who move early – before the crowd catches on. $SOLX might not offer a free airdrop like Arbitrum did, but at its current price, it’s about as close to ground floor as it gets.

Are YOU ready to take a trip into Solana’s L2? 🔥

Dive into $SOLX to discover a whole new world to explore 🛸🪐https://t.co/mdaTX9aVVx pic.twitter.com/rZWcJy2YGF

— SOLAXY (@SOLAXYTOKEN) April 9, 2025

Because like Arbitrum before it – $SOLX is built for one direction: up.

How to Buy $SOLX and Participate in the $31M Milestone

To get in early on $SOLX, head to the Solaxy website and join the presale by connecting your wallet – Best Wallet is a solid pick. With multichain support across Ethereum, Bitcoin, and soon Solana, it’s the ideal home for your $SOLX tokens.

Download Best Wallet on Google Play or the Apple App Store to make your purchase and track your holdings with ease.

People familiar with the project also say Solaxy is preparing to launch its own blockchain explorer soon, along with fresh dev updates focused on data processing, performance upgrades, and its cross-chain bridging capabilities.

Join the Solaxy community on X and Telegram to stay up to speed with every update.

Visit the Solaxy website to learn more

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.