As Ethereum and Bitcoin hit new all-time highs this week, the pundits are out in force with proclamations of “digital currencies are in a bubble”:

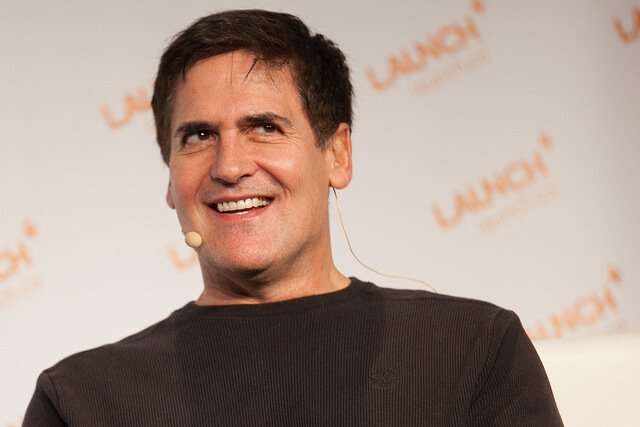

Mark Cuban, whose most notable quality is being smart enough to make a pile of cash for himself, but not quite bright enough to ever make anyone else any money, was the most recent notable talking head to mention the b-word:

Mark Cuban, whose most notable quality is being smart enough to make a pile of cash for himself, but not quite bright enough to ever make anyone else any money, was the most recent notable talking head to mention the b-word:

“I think it’s in a bubble. I just don’t know when or how much it corrects. When everyone is bragging about how easy they are making $=bubble

The problem for Cuban and all the rest of the Wall Street guys is – well, they are wrong. Bitcoin, Ethereum and other digital assets are not in a bubble. Nor will they ever be in a bubble.

Yes, you heard that correctly. I am saying a bubble in digital asset valuations is completely practically impossible from any reasonable conceptual and logical – and especially, financial – standpoint. The reason? Market Bipolarity.

Market Bipolarity is something no one understands, but if you hold digital assets right now (and even if you don’t) you may as well get the hang of it, because its core tenants are vital to understanding how valuations in these assets are formed.

The concept of Bipolar, Cyclothymic and Cluster B Markets is in fact an especially essential one to understanding digital assets such as Ethereum, where smart contracts etc. are in use. It’s complicated but I’ll try to distil it easily here as I believe it is the essence of interpreting value in this market.

First of all, I want to make it very clear. Bipolar Markets is my own observation and theory based on:

1) the Theory of Reflexivity which belongs to George Soros;

2) my own observations of how different thinking participants act in capital market cycles;

3) annexing my understanding of the latter with my understanding of the function and affect of the Blockchain economically speaking.

Furthermore, I have personally used this theory to amass a colossal amount of wealth in a very, very short space of time over the past few years. I guarantee that before now you will never have heard the following before. I can only suggest that it may be worth trying to understand at least the jist of what follows (I am sympathetic to the fact it’s not easy stuff, however. You can just drop me an e-mail if you have further questions. I will try and answer within reasonable time,)

Introducing Reflexivity

Some time ago George Soros noted that market conditions are not really “equilibrium” (i.e. they don’t usually “revert to the mean”) but rather they are “reflexive” (i.e. they reflect the views of their participants). This is because of two thinking functions being in synch: the cognitive function and the manipulative function.

The cognitive function is supposed to be a neutral thinking function, assessing facts for what they are; the manipulative one however seeks to turn the fact into an advantage. If the cognitive thinking function of the mind is influenced by the manipulative function of the mind then the mind assesses neutrally what is in fact manipulated fact. Thus markets often reflect the views of the participants, not of the reality of the underlying economics.

Bipolar Markets

Now, onto my own observations. We can express the thinking of George Soros’s Theory of Reflexivity thus:

Either:

(Manipulative – Cognitive) = Reflexive (Positive Feedback Loop)

Or:

(Manipulative + Cognitive) = Equilibrium (Negative Feedback Loop)

Some of you are probably wondering why we start with the manipulative thinking function in the equation. After all, are we not cognitive thinkers first?

There are two reasons I have presented the equation this way round. First, as Soros points out, most of the time markets reflect the opinions of the players, not the fundamentals. Second, if we started with the cognitive thinking process then how would we establish the reflexive market condition? By adding in the manipulative function to the already cognitive function? Maybe – but the cognitive process is influenced by the manipulative process, remember. Further, it would make no sense to subtract out a meta-state of thinking that wasn’t already present in the equation; so if cognitive thinking was the only thinking present, we could not accurately represent it using the line (Cognitive – Manipulative) = Equilibrium; rather we would have to use the caption (Cognitive) = Equilibrium. But that is not at all what Equilibrium Value is. Equilibrium Value is a negative feedback loop; a feedback loop implies there are multiple variables.

Clearly, Soros is logically correct here in his assumption that despite the cognitive thinking function being the “neutral/natural” one, in reality our perceptions are mostly vastly distorted all the time by our state of mind and ambitions. (That’s especially true when it comes to making money, too.)

Specifically, what I realised some time ago is that in Ethereum or Blockchain markets in general, what is unusual is there is an artificial thinker involved as well as a natural thinker (human being).

In other words, the Blockchain is a basic form of AI since via performing its own calculation of equations (to make units such as Bitcoins for example) or enacting smart contracts, technology is suddenly thinking in an economic way (indeed this is the whole revolutionary aspect of the Blockchain).

Now, seeing as the Blockchain is created out of the natural thinker’s manipulative thinking process (i.e. there was a goal/purpose/reason for its invention) the Blockchain is always manipulative in mindset, and never cognitive.

So what happens when we annex markets wherein natural thinkers and artificial thinkers co-exist? Simply, we always get reflexivity (what Soros also terms “positive feedback loops” since the manipulative function is influencing the cognitive process of analysis in a positive way). We can express this thinking thus:

Either:

(Manipulative – Cognitive) + Manipulative = Ultra Reflexive / Double Positive Feedback Loop

Or:

(Manipulative + Cognitive) + Manipulative = Superficially Reflexive / False Positive Feedback Loop

These two are the natural states of bipolar markets. That is to say that either markets in digital currencies are bound in terms of self-perpetuating self-reinforcing states of reflexivity, or they are simply self-perpetually reflexive. Bipolar markets reflect the psychiatric term from which their namesake derives and can be compared to the two psychiatric states of bipolar thinking in the following ways:

Double Positive Feedback Loop = Bipolar I which is defined by manic episodes that last at least 7 days, or by manic symptoms that are so severe that the person needs immediate hospital care.

False Positive Feedback Loop = Bipolar II which is defined by a pattern of depressive episodes and hypomanic episodes, but not the full-blown manic episodes described above

Cyclothymic and Cluster B Markets

Mark Cuban, whose most notable quality is being smart enough to make a pile of cash for himself, but not quite bright enough to ever make anyone else any money, was the most recent notable talking head

Mark Cuban, whose most notable quality is being smart enough to make a pile of cash for himself, but not quite bright enough to ever make anyone else any money, was the most recent notable talking head