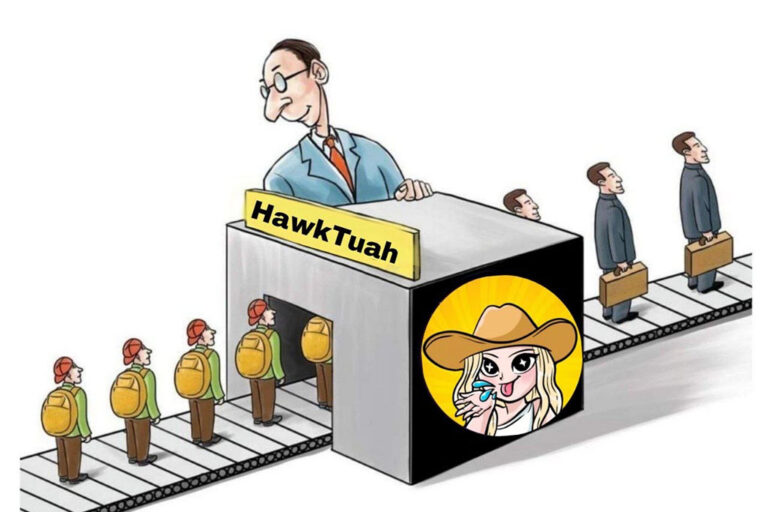

Hailey Welch’s Hawk Tuah meme coin (HAWK) sparked controversy after a massive pump-and-dump, with its market cap briefly reaching $490 million before plummeting 90% to $36.6 million within hours.

Hailey Welch’s Hawk Tuah meme coin has sparked a major controversy across social media platforms after it experienced a huge pump-and-dump collapsing more than 90% from the top, soon after the debut. Investors have been complaining about insider wallets and sniper activity in this meme coin.

Hawk Tuah (HAWK) was launched at 10:00 PM UTC on December 4, briefly reaching a peak market capitalization of $490 million before its sharp decline. However, Welch has denied any sort of involvement in insider sales or insider sales by her team or other affiliated entities.

As per the DexScreener data, the HAWK meme coin’s valuation has dropped to $36.6 million, marking a strong 90% downturn in less than three hours. Aggregated data from Bubblemaps and Dexscreener reveals that between 80% and 90% of HAWK’s supply at launch was controlled by a combination of insider wallets and snipers – entities that quickly acquire large portions of a token’s supply during its initial release.

Hailey Welch was quick to convey her message following the HAWK pump and dump, through an official post on the X platform. She stated that her team hasn’t sold any tokens and no opinion leaders got any sort of free HAWK coins. Welch also noted that the launched the meme coin on Meteora, the decentralized liquidity protocol, in order to reduce any sniping risk. She wrote:

“Team hasn’t sold one token and not 1 KOL was given 1 free token. We tried to stop snipers as best we could through high fee’s in the start of launch on Meteora.”

Investors Lose Major Money Hawk Tuah Meme Coin Dump

Data from the Solana block explorer Solscanner shows that one wallet managed to snatch 17.5% of the HAWK supply just seconds after its launch, purchasing the tokens for 4,195 Wrapped Solana (WSOL), valued at $993,000. In the following 90 minutes, the wallet sold 135.8 million HAWK tokens, netting a profit of $1.3 million. One user on the X platform noted:

“I really lost $43k apeing in ‘hawk tuah’ coin.”

Despite claiming no wrongdoing by the team, some market observers believe that such HAWK pump-and-dump could land Welch and her team in major regulatory trouble. On the X platform, several users claimed that they have registered an official complaint with the US SEC against the HAWK meme coin, Additionally, several law firms have also begun advertising their services to those who lost money in the meme coin.

In a December 5 post on X, Burwick Law urged anyone who incurred losses from the meme coin to reach out to their firm and learn about their legal rights. “If you lost money on $HAWK, contact our firm to learn about your legal rights,” they wrote.

next