In this article, you’ll get a comprehensive look at what XRP is, why it’s gaining renewed attention, and whether it deserves a pla...

Spell Token (SPELL) Price Prediction for 2025–2030: Is It a Smart Investment?

| Updatedby Tony Frank · 10 mins read

In this article, you’ll get a comprehensive look at what SPELL is, why it’s trending again, and whether it deserves a spot in your portfolio. We’ll explore price predictions for 2025 through 2030.

Spell Token (SPELL) is back on the radar in 2025 as DeFi protocols rebound and interest in decentralized stablecoins like MIM gains traction. Originally launched as part of Abracadabra.Money ecosystem, SPELL has re-emerged as a “dark horse” asset, capturing attention from DeFi natives and risk-tolerant investors looking for real yield opportunities.

In this article, you’ll get a comprehensive look at what SPELL is, why it’s trending again, and whether it deserves a spot in your portfolio. We’ll explore price predictions for 2025 through 2030, technical analysis, expert opinions from platforms like CoinCodex and Changelly, and discuss the key drivers influencing SPELL’s future—from staking dynamics to regulatory risk.

What Is Spell Token (SPELL)?

Spell Token (SPELL) is the utility and governance token of Abracadabra.Money ecosystem—a decentralized lending protocol that allows users to deposit interest-bearing crypto assets as collateral to mint MIM (Magic Internet Money), a stablecoin soft-pegged to the US dollar. SPELL is central to the platform’s incentive structure, governance, and staking model.

The current USD price of SPELL is SPELL $0.00059 24h volatility: 1.4% Market cap: $94.35 M Vol. 24h: $18.20 M , and its market cap is $95.4 million.

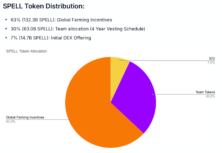

SPELL has a total supply of 210 billion tokens. As of early 2025, the circulating supply hovers around 120 billion. Token distribution was initially weighted toward community incentives, team allocations, and protocol development, with emissions tapering over time.

Stakers can lock SPELL in the sSPELL contract, earning a share of protocol revenue generated through loan interest and liquidation fees. SPELL holders also vote on key governance proposals like fee structures and collateral onboarding.

Current Spell Token Sentiment

Since its launch, SPELL has experienced dramatic price swings that reflect the volatile nature of the DeFi landscape. From its initial surge during the 2021 bull market to its current subdued levels, the token’s journey highlights both the rapid growth and sharp corrections typical in crypto. The following section explores SPELL’s historical price performance, key milestones, and where the token stands today regarding supply, trading volume, and crypto market capitalization.

Historical Price Movements and Past Performance of Spell Token

SPELL was listed on Binance in late 2021, marking a significant milestone for the token’s visibility and liquidity. Shortly after, in November 2021, SPELL reached its all-time high of approximately $0.035, fueled by the broader DeFi bull market and rising interest in algorithmic stablecoins.

SPELL Historical Data Price Chart. Photo: TradingView.

SPELL Circulating supply, Market Cap

As of March 2025, Spell Token (SPELL) has a circulating supply of 196,008,739,620 SPELL out of a maximum supply of 210,000,000,000.

Photo: Official Spell Website.

The trading price is around $0.0006, with a 24-hour trading volume of approximately $12.3 million and a market cap near $95.4 million.

What Affects Spell Token Price Chart?

The Spell Token network operates in a highly fluid environment where crypto market dynamics are influenced by protocol-specific developments and broader DeFi sentiment. According to the latest data gathered, SPELL’s current value reflects a complex interplay of internal mechanisms and external market forces.

One of the key drivers behind Spell Token’s performance is the continued expansion of Abracadabra.Money. As more users mint MIM and lock interest-bearing tokens as collateral, demand for SPELL increases—particularly when staking rewards are strong. This demand and the protocol’s buyback and burn mechanisms introduce deflationary pressure that can counterbalance price declines during a bearish trend.

However, several factors beyond protocol fundamentals also impact the Spell Token price. Network costs such as Ethereum gas fees influence user activity, while crypto market sentiment, including Fear and Greed Index fluctuations, shape investor behavior and short-term volatility.

SPELL has carved out a reputation as a DeFi “dark horse” with a niche but loyal community. Insights from SPELL’s snapshot page and token statistics show that social media narratives and influencer engagement continue to amplify short-term price movements, reinforcing its position as a sentiment-driven asset within the crypto space.

Short-Term Spell Token Price Prediction (2025)

The Spell Token price prediction for the short term in 2025 reflects cautious optimism as the current price consolidates within a narrow band. This Spell Token price action pattern signals broader cryptocurrency market uncertainty, typical of a sector still recovering from volatility.

Key Spell Token price prediction indicators, such as the RSI and moving averages, show mixed signals. The RSI hovering near 50 indicates indecision, while the 50-day moving average sitting just above the current price serves as resistance. A move beyond that level—especially if supported by volume—could point to a bullish scenario with a potential upside.

Analysts are closely watching for a SPELL’s price change driven by protocol developments or broader shifts in sentiment. If the greed index begins to climb, reflecting growing risk appetite in the DeFi market, Spell Token could break out of its current consolidation range and resume upward movement. However, until then, the cryptocurrency market sentiment remains in wait-and-see mode.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

| Mar 2025 | $ 0.000605 | $ 0.001217 | $ 0.002041 | 239.45% |

| Apr 2025 | $ 0.001858 | $ 0.00239 | $ 0.002835 | 371.66% |

| May 2025 | $ 0.001493 | $ 0.001812 | $ 0.002225 | 270.18% |

| Jun 2025 | $ 0.002042 | $ 0.002165 | $ 0.002415 | 301.68% |

| Jul 2025 | $ 0.001579 | $ 0.001933 | $ 0.002183 | 263.12% |

| Aug 2025 | $ 0.00132 | $ 0.001526 | $ 0.001696 | 182.11% |

| Sep 2025 | $ 0.001336 | $ 0.001529 | $ 0.001613 | 168.41% |

| Oct 2025 | $ 0.001027 | $ 0.001159 | $ 0.001297 | 115.81% |

| Nov 2025 | $ 0.001091 | $ 0.00117 | $ 0.00127 | 111.20% |

| Dec 2025 | $ 0.001118 | $ 0.001121 | $ 0.001124 | 87.04% |

The average Spell’s price in 2025 will remain at $0.001602, according to CoinCodex and Changelly.

Mid-Term Spell Token Price Forecast (2026)

Regarding the token SPELL price prediction for 2026, much will depend on how quickly the DeFi space embraces institutional adoption. If Abracadabra.Money successfully integrates with compliance-ready platforms and attracts larger capital inflows, it could trigger increased demand within the Spell Token market, leading to a shift in momentum.

The growing appeal of decentralized stablecoins like MIM—especially under rising regulatory pressure on centralized assets—adds another layer to SPELL’s long-term forecast. In such a scenario, Abracadabra and SPELL could be an essential infrastructure for permissionless finance, driving utility and sustained growth.

However, SPELL’s future won’t be immune to market volatility, which remains a defining feature of the DeFi landscape. External factors like ETH gas fees, macroeconomic shifts, and evolving global policy could accelerate or delay its growth trajectory. Overall, while uncertainty remains, the fundamentals suggest that SPELL has the potential to grow if market conditions align.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

| Jan 2026 | $ 0.001114 | $ 0.001252 | $ 0.001483 | 146.73% |

| Feb 2026 | $ 0.001442 | $ 0.001591 | $ 0.001664 | 176.88% |

| Mar 2026 | $ 0.001453 | $ 0.001549 | $ 0.001641 | 173.04% |

| Apr 2026 | $ 0.00148 | $ 0.001561 | $ 0.001596 | 165.45% |

| May 2026 | $ 0.001195 | $ 0.001428 | $ 0.001501 | 149.76% |

| Jun 2026 | $ 0.001197 | $ 0.001256 | $ 0.00131 | 117.93% |

| Jul 2026 | $ 0.001 | $ 0.001121 | $ 0.001217 | 102.39% |

| Aug 2026 | $ 0.00081 | $ 0.000933 | $ 0.001011 | 68.14% |

| Sep 2026 | $ 0.000828 | $ 0.000894 | $ 0.000988 | 64.40% |

| Oct 2026 | $ 0.000879 | $ 0.000955 | $ 0.001083 | 80.16% |

| Nov 2026 | $ 0.000795 | $ 0.00091 | $ 0.000965 | 60.56% |

| Dec 2026 | $ 0.000695 | $ 0.000789 | $ 0.000845 | 40.56% |

The average Spell’s price in 2025 will remain at $0.001187, according to CoinCodex and Changelly.

Long-Term Spell Token Price Prediction (2030)

By 2030, SPELL’s valuation will likely hinge on the sustained growth of MIM adoption, Abracadabra.Money’s protocol evolution and its ability to operate seamlessly across multiple blockchains. As DeFi infrastructure matures and interoperability becomes standard, platforms like Abracadabra—offering composable, yield-generating tools—could become critical components of mainstream financial architecture.

If MIM cements its role as a decentralized alternative to fiat-backed stablecoins, demand for SPELL as a governance and utility token may rise significantly. This would be amplified by increased staking participation and token burn mechanisms, which could create long-term deflationary pressure.

Multi-chain deployment—especially across low-fee ecosystems like Arbitrum, Avalanche, or Base—will be key to onboarding a broader user base and reducing Ethereum gas fee exposure.

If DeFi achieves deeper integration with fintech, institutional capital, and regulatory clarity, SPELL could move beyond its niche status and become a foundational asset in the decentralized financial stack by 2030.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

| Jan 2030 | $ 0.002319 | $ 0.002494 | $ 0.002658 | 343.22% |

| Feb 2030 | $ 0.002007 | $ 0.002185 | $ 0.002318 | 286.52% |

| Mar 2030 | $ 0.001991 | $ 0.002122 | $ 0.002299 | 283.38% |

| Apr 2030 | $ 0.002237 | $ 0.002343 | $ 0.002431 | 305.37% |

| May 2030 | $ 0.002072 | $ 0.002153 | $ 0.002268 | 278.32% |

| Jun 2030 | $ 0.001899 | $ 0.002008 | $ 0.002127 | 254.77% |

| Jul 2030 | $ 0.001883 | $ 0.001943 | $ 0.001993 | 232.40% |

| Aug 2030 | $ 0.001972 | $ 0.002118 | $ 0.002206 | 267.93% |

| Sep 2030 | $ 0.001902 | $ 0.001957 | $ 0.002032 | 238.85% |

| Oct 2030 | $ 0.001933 | $ 0.001992 | $ 0.002074 | 245.85% |

| Nov 2030 | $ 0.001935 | $ 0.001967 | $ 0.00199 | 231.95% |

| Dec 2030 | $ 0.001932 | $ 0.001955 | $ 0.00198 | 230.14% |

The average Spell’s price in 2025 will remain at $0.001187, according to CoinCodex and Changelly.

Spell Token Technical Analysis, Greed Index

As of late March 2025, SPELL is trading at approximately $0.0006, showing signs of consolidation after a period of low volatility.

- RSI (Relative Strength Index): Currently at 48.19, the RSI suggests a neutral market stance. A move above 60 indicates bullish momentum, while a dip below 40 indicates growing sell pressure.

- Moving Averages: SPELL remains below the 50-day SMA ($0.0006062) and the 200-day SMA ($0.0006513), reflecting ongoing bearish bias in the mid-term trend.

- MACD (12,26): The MACD line is flat and hovering around zero, reinforcing the view of market indecision and lack of clear directional strength.

Technical indicators currently point to a sideways trend, with neither strong bullish nor bearish momentum. Traders should monitor breakout levels near the 50-day SMA and watch for any volume or momentum indicators uptick to confirm direction.

Spell Token Price Predictions by Analyst and Experts

A comprehensive analysis of the Spell Token market reveals a cautiously optimistic outlook as analysts weigh technical signals, fundamental factors, and shifting investor sentiment.

Based on recent market analysis, CoinCodex suggests that SPELL may trade between $0.000605 and $0.000827 over the next week. This Spell Token price prediction reflects a modest upside, driven by technical indicators and signs of short-term stability despite broader market volatility.

Looking further ahead, Changelly presents a more bullish Spell Token forecast, estimating that the token could reach a price range of $0.018 to $0.021 by 2028. Their model anticipates increased adoption of MIM, broader use of interest-bearing tokens, and growing demand for decentralized financial infrastructure across multiple blockchains.

Still, due to the inherent volatility of crypto assets, SPELL’s future performance remains uncertain. While the Spell Token benefits from an impressive market capitalization and strong community of token holders, real-world events and macro conditions may significantly impact actual results. Those expecting SPELL to perform long-term should closely monitor technical trends and evolving DeFi narratives.

Where to Buy SPELL in 2025

As of 2025, SPELL is widely accessible across centralized and decentralized platforms, making it relatively easy for users to gain exposure to the token.

On the centralized exchange (CEX) side, major platforms like Binance, Coinbase, and Kraken list SPELL with healthy liquidity. These venues offer intuitive user interfaces, fiat onramps, and lower slippage—ideal for retail and institutional traders.

For those operating in the DeFi ecosystem, Spell Token is actively traded on Uniswap and SushiSwap, especially within MIM or ETH pairs. These decentralized exchanges offer more composability but require familiarity with self-custody and wallet integration.

Since SPELL is an ERC-20 token, users transacting on Ethereum mainnet should be mindful of gas fees. To reduce costs, consider scheduling trades during periods of low network activity or using Layer-2 alternatives like Arbitrum, where SPELL is also supported.

Conclusion

SPELL offers a unique blend of high upside and equally high risk. On the bright side, it’s tied to an innovative lending platform, features real utility through staking and governance, and benefits from deflationary mechanisms. However, it faces volatility, regulatory uncertainty, and strong competition from blue-chip DeFi tokens.

For long-term holders (HODLers), SPELL could be a speculative bet on the evolution of decentralized stablecoins and cross-chain finance. For short-term traders, price swings and narrative shifts present opportunities—but demand tight risk management. SPELL may appeal most to DeFi degens, high-risk investors, and passive income seekers who understand the game and accept the stakes.

Disclaimer: This article is for informational purposes only and does not provide financial, trading, or investment advice. Cryptocurrency prices can fluctuate wildly, and actual values may differ from SPELL predictions.

Always do your own research (DYOR), assess risks, and consult a professional before making financial decisions. The author and team are not responsible for any losses from using this information.

FAQ

What is SPELL used for?

SPELL is the utility and governance token of the Abracadabra.Money protocol. It’s used for staking, earning a share of protocol fees, and voting on governance decisions.

Is SPELL a good investment in 2025?

SPELL remains a high-risk, high-reward asset tied to the performance of the Abracadabra ecosystem and DeFi adoption. It may appeal to investors bullish on decentralized stablecoins and yield protocols.

What is the price of Spell token prediction for next week?

According to CoinCodex, the Spell Token (SPELL) price is expected to trade between $0.000605 and $0.000827 over the next week. This suggests modest short-term upside potential, driven by neutral technical momentum and broader market stabilization.

Can SPELL reach $0.01 or higher?

SPELL could approach $0.01 in a bullish scenario, especially if the current Spell Token sentiment shifts and protocol adoption accelerates. Its price history shows this level is possible but depends on broader trends like the greed index turning favorable.

Can I buy SPELL on Binance or Coinbase?

Yes, SPELL, among other major exchanges, is listed on Binance and Coinbase, with decent liquidity for spot trading.

What is the ATH of Spell Token?

The all-time high (ATH) of Spell Token (SPELL) is $0.03506, reached on November 2, 2021, according to CoinGecko.

How do I store Spell Token safely?

You can store SPELL in any ERC-20 compatible wallet like MetaMask, Ledger, or Trust Wallet. For maximum safety, consider using a hardware wallet.

Is Spell Token a meme coin?

Enter the answeDespite its whimsical branding, SPELL is not a meme coin—it powers a functioning DeFi protocol (Abracadabra) with real yield mechanics and utility.r in F.A.Q

Why is Spell Token so volatile?

Spell Token is highly volatile due to its relatively low market cap, which makes it more sensitive to sudden price changes. Speculative trading and fluctuating sentiment within the DeFi space heavily influence its price action.

Can I stake or farm Spell Token?

Yes, SPELL can be staked to earn sSPELL, which entitles holders to a share of protocol revenue. Yield farming opportunities are also available through DeFi platforms.

What are the risks of investing in SPELL?

Key risks include smart contract vulnerabilities, regulatory pressure on DeFi and stablecoins, protocol abandonment, and high price volatility.

Will DeFi protocols like Abracadabra survive regulation?

Survival will depend on adaptability. If protocols integrate compliance-friendly features without sacrificing decentralization, they may continue to thrive under regulatory scrutiny.

How does SPELL relate to Magic Internet Money (MIM)?

SPELL is the governance token of the protocol that issues MIM. While MIM acts as a stablecoin, SPELL captures value from its usage through staking and fee distribution.

What affects SPELL token price action the most?

Major price drivers include MIM adoption, protocol revenue, staking participation, DeFi market trends, crypto market sentiment, Ethereum gas costs, and social/influencer sentiment.

Is SPELL better than AAVE or COMP?

SPELL targets a different niche with higher risk and higher potential yield. AAVE and COMP are more established and institution-friendly, while SPELL appeals to more aggressive DeFi users.

We’ve found eight decentralized wallets that stand above the rest. Keep reading to find the best decentralized crypto wallet to us...

This guide is a must-read when exploring the best new crypto in 2025. We reveal the most promising launches to watch.