The Ethereum Pectra Upgrade marks a major evolution for the network, combining proposals like EIP-7251 and EIP-7702 to streamline ...

How You Can Earn Interest from DeFi

| Updatedby staff writer · 6 mins read

Check out our step-by-step guide on earning interest from DeFi to learn more about commonly used DeFi Apps, notable stablecoins, and the ways of earning interest.

In recent years, DeFi has been in the spotlight for the many promising blockchain-based applications it has spurred. Although blockchain itself is completely decentralized, there are a few aspects of DeFi which are not fully decentralized. We see Smart Contracts that employ different features of DeFi, however, it still has a few centralized sides to it.

As we see more innovative methods propping up every day, decentralization is going to become more prominent. For now, it’s appropriate to consider DeFi dApp as a non-custodial service. Here are some of the most commonly used DeFi Apps:

When you dive into the ocean of decentralized finance, you’re bound to eventually come across stablecoins. A stablecoin is a cryptocurrency that is pegged to a fixed value, such as a fiat currency.

Since their value relies on reserve assets, they are more centralized than most cryptocurrencies. A central party holds the fiat currency in reserves, and in turn, issues a token that represents the value of the reserve currency.

Stablecoins also give you the opportunity to earn passive income by gaining interest rates through lending. The notable stablecoins used in DeFi are:

- Dai (DAI): It is created on MakerDAO through locking up Ether as collateral and opening a Collateralized Debt Position (CDP).

- USD Coin (USDC): This is used by California-based crypto exchange Coinbase when you deposit U.S. dollars into your Coinbase wallet. The exchange automatically converts your U.S. dollars into USDC.

- TrueUSD (TUSD): A stablecoin issued by TrustToken. The U.S. dollars sent to TrustToken are converted into TUSD.

There are also many other stablecoins that can be purchased on various exchanges.

How Do I Earn Interest Through Lending?

Once you’re sure which stablecoin you want to go with, you just have to follow these simple steps to get started.

- You will require a Wallet to store your crypto assets and connect with the DeFi dApp. For a seamless experience, it’s better to go with a commonly used and trusted wallet. Install the web extension of MetaMask on your Chrome web browser. It helps you interact with Ethereum Blockchain and manages your private keys to your Ethereum wallet within the browser.

- Once you’ve installed Metamask, you will receive a public Ethereum address. You can access a public address only if you own the private key. A public address is like username and the private key is like a password. You can share your username, but never your password. Transfer your holdings to this address.

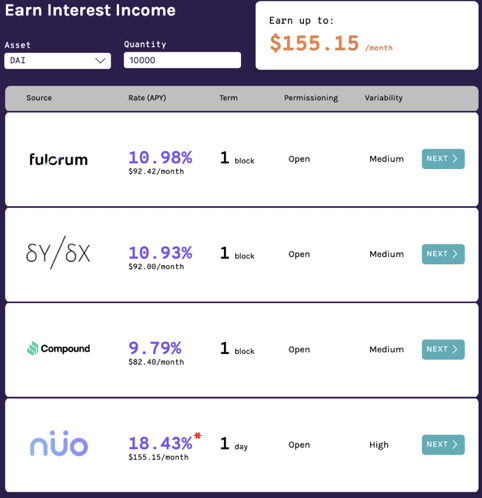

- Now select a DeFi platform, it’s best to go with the ones that give and sustain a high-interest rate.

Source: DeFi Pulse

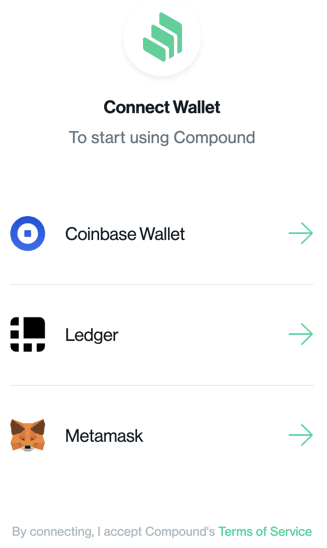

- Once you’ve selected a DeFi platform, you’ll have to connect Metamask to the dApp.

Source: Compound

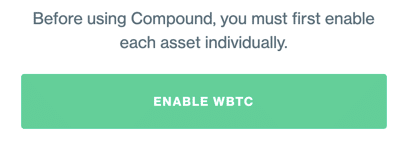

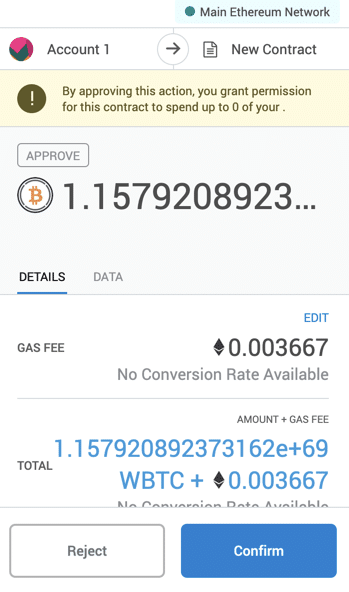

- Before your first use, you will have to approve the DeFi smart contract, allowing it to operate the asset. Once you click enable, Metamask will open up your transaction details.

Also, note that there is a gas fee in Ether (ETH) every time you interact with a smart contract.

Source: Compound

Source: Compound

Costly gas fees can be a major turn off, but it’s only a matter of time before Ethereum 2.0 rolls out, which is likely to bring a significant reduction in gas fees.

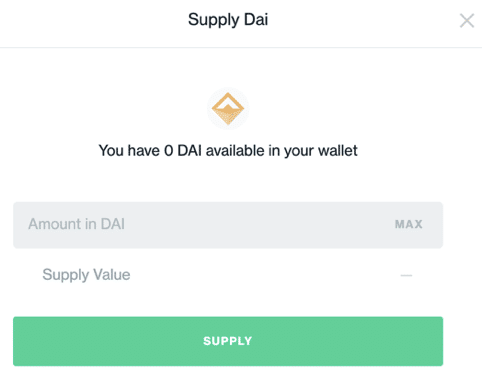

- After pressing enable, you can now supply your stablecoin asset to start making profit. Select the amount you wish to supply to the protocol. Metamask will open up again, and you’ll have to approve the transaction with the respective gas fee.

Source: Compound

Well done! You are now part of an open financial revolution. Now instead of a third party, computer code is managing your funds. You will start earning interest in real-time as your funds are borrowed, it will keep being updated as each blockchain block is mined.

- If at any point you wish to stop lending, you can simply withdraw your funds by using the withdrawal function. Within the DeFi ecosystem, you’re in complete control of your funds.

Risks and Considerations

DeFi may seem like a flawless solution to all the shortcomings of the traditional financial system. However, it’s best to completely understand the technology behind it beforehand, and carefully consider the risks that tag along with it.

1. Bugs and Vulnerabilities

It’s important to understand that codes are always vulnerable to bugs and errors. The good news is that such risks can be dealt with by third-party security firms.

The high-value market of DeFi tends to attract many cyberattacks. However, it’s worth highlighting that as yet none of the DeFi products have been hacked.

In August 2019, OpenZepplin, audited Compound’s code multiple times and found no major bugs, although a few risks were detected in the model of their incentive method.

2. Interest Rate Fluctuations

There is huge variability in the interest rate while interacting with smart contracts. A rate of 20% APR might not be valid for long and can instantly drop to a lower rate such as 5%. Always stay alert and don’t let your high expectations get the better of you.

3. Liquidation risks

Assets with low liquidity that are used as collateral by borrowers have the potential to undergo a rapid decline. The Ethereum network is not the most efficient in conducting a high number of operations simultaneously, which can result in outstanding loans not being covered by the forced sale.

However, these problems have been mostly resolved by taking improved risk management measures.

4. Stablecoin Hiccups

Stablecoins are fiat-backed cryptocurrency that shares the same value as that of fiat currency. However, issues related to the banking partner of stablecoin issuer Tether, have caused the value of 1 USDT to drop as low as $0.90 for a short while.

Although stablecoins come as a good solution to the volatility of the crypto market, it’s best to stay aware of the factors that govern the centralized crypto asset.

DeFi Has a Lot of Ground to Cover

The DeFi ecosystem is still in its early stages. With DeFi, new investment opportunities are on the rise, but there are still many uncertainties. It’s best to stay updated with the latest market trends and conduct thorough research before investing. One can never be too certain when new innovations lead us down the less trodden paths.

This guide was contributed by Anupam Varshney, who has been covering blockchain and crypto space for various publications since 2016. His crypto journey began when he bought Bitcoin from an anonymous Reddit user in 2013. In the pursuit of making more people aware of crypto in India, he started a small blockchain community in Delhi that has now grown to thousands of members. When he’s not involved with crypto, he can be found playing chess.

Solana is one of the most technically advanced Layer 1 blockchains, offering high-speed transactions, low fees, and a fast-growing...

Pi Network is pioneering a mobile-native approach to cryptocurrency mining, offering an accessible alternative to energy-intensiv...