In this article, you’ll get a comprehensive look at what XRP is, why it’s gaining renewed attention, and whether it deserves a pla...

Best Decentralized Crypto Wallets Reviewed for 2025

UTC by Tony Frank · 27 mins read

We’ve found eight decentralized wallets that stand above the rest. Keep reading to find the best decentralized crypto wallet to use today.

Disclaimer: Cryptocurrencies are considered high-risk investments. This article serves for informational purposes only. It should not be perceived as financial advice. By reading our website, you acknowledge and accept our terms and conditions. Our content may include affiliate links, through which we may earn a commission.

Choosing the best decentralized crypto wallet is one of the most important decisions you’ll make in your crypto journey. Your wallet is key to safely buying and selling crypto, storing your tokens, interacting with Web3, and so much more.

To help, we’ve evaluated dozens of popular wallets and found eight that stand above the rest. Keep reading to find the best decentralized crypto wallet to use today.

Key Takeaways on Decentralized Crypto Wallets

- Decentralized crypto wallets enable you to do more than just store crypto. They also allow you to buy, sell, stake, and connect to dApps.

- Unlike centralized or custodial crypto wallets, decentralized wallets put you in full control of your wallet’s private keys. You have total control over your tokens and access the entire world of Web3.

- Decentralized wallets can be safe, but it’s up to you to be responsible with your wallet. Activate multi-factor authentication and store your wallet’s seed phrase somewhere safe.

- There are two main types of decentralized wallets: software wallets (also called hot wallets) and hardware wallets (also called cold storage wallets)

- When choosing a wallet, be sure to consider what security features it offers, what cryptocurrencies it supports, the quality of the user experience, what Web3 features it offers, and what swap fees it charges.

Best Decentralized Wallets to Use in 2025

We tried out dozens of popular crypto wallets of all types, including software wallets, hardware wallets, Bitcoin wallets, and everything in between. Based on our testing, we think these are the eight best decentralized wallets to use today:

- Best Wallet – Overall best decentralized wallet with tons of Web3 features

- Ledger Nano X – Best cold storage wallet for maximum token security

- Zengo Wallet – Secure MPC cryptography wallet with no seed phrases

- Trust Wallet – Convenient hot wallet compatible with 100+ blockchains

- Trezor Model One – Affordable hardware wallet for BTC and popular altcoins

- MetaMask – Widely used Web3 wallet compatible with nearly all dApps

- Atomic Wallet – No KYC wallet for buying, swapping, and selling crypto

- Coinbase Wallet – Self-custody wallet with seamless Coinbase integration

Reviewing the Best Decentralized Crypto Wallets

Want to find out more about the top platforms in our list of decentralized wallets? We’ll explain what stood out about each of these wallets and why we think they’re great choices for you.

1. Best Wallet – Top Decentralized Wallet with Range of Web3 Features

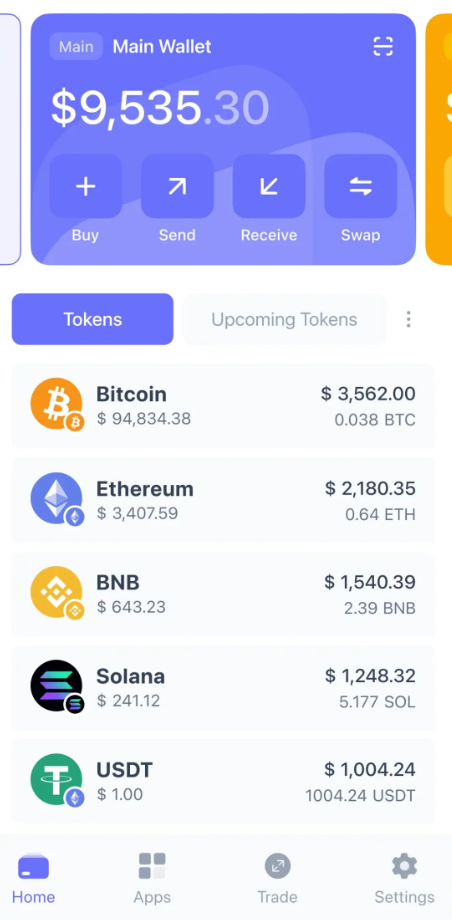

Best Wallet is our overall favorite decentralized crypto wallet in 2025 thanks to its outstanding combination of security, privacy, and Web3 features. To start, this software wallet uses multiple layers of security—like biometric and two-factor authentication and secure PIN codes—and no seed phrases to keep your wallet secure. Best Wallet has never suffered a hack.

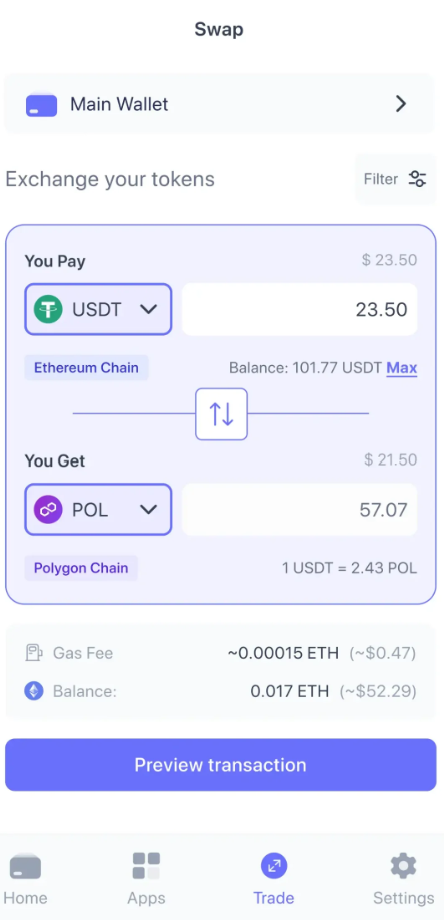

You can use Best Wallet to buy crypto anonymously across more than 60 blockchains with no KYC checks. All you need is an email address to sign up and start using the wallet. Plus, Best Wallet supports cross-chain swaps at a built-in exchange, so you can easily trade from Bitcoin to your favorite altcoin in a single transaction.

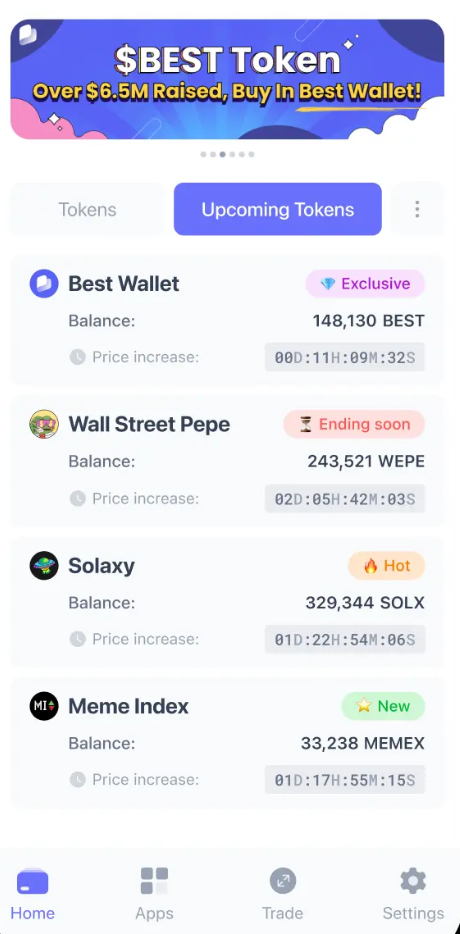

Best Wallet’s mobile apps for iOS and Android are easy to use, and the app comes with tons of innovative features to help you get the most out of Web3. For example, you can stake your tokens directly within Best Wallet, quickly connect to crypto gambling sites through a built-in iGaming hub, or find the hottest emerging crypto projects in the Upcoming Tokens launchpad.

We found a lot to love about Best Wallet, and we think you will, too.

Pros

- No KYC required – sign up with an email address

- Buy, sell, and swap tokens directly in the Best Wallet app

- Airtight security including biometric and two-factor authentication

- Invest in the best new crypto projects with Upcoming Tokens launchpad

- Active development roadmap with many new features planned

Cons

- No desktop software or browser extensions available at this time

Wallet type: Software

Supported blockchains: 60+

Price: Free

2. Ledger Nano X – Our Favorite Cold Storage Wallet

Ledger is a renowned hardware wallet maker, and the Nano X is our favorite model from the company because of its affordability and security. You won’t get a fancy touchscreen with the Nano X (although that’s available with more expensive Ledger models like the Flex and Stax), but you will get 100% peace of mind from the wallet’s impenetrable security features and straightforward Bluetooth connectivity for interacting with your crypto tokens.

Nano X supports thousands of tokens through the Ledger Live app, which also lets you manage your portfolio, swap your coins, and stake your crypto. All transactions in the app must be validated on your Nano X device, ensuring that it’s incredibly hard for anyone else to get access to your crypto.

Ledger Live is available for desktop, web, and mobile, which makes it even more convenient to use your Nano X. Plus, for a limited time, Ledger is offering $40 in Bitcoin to new users when you buy the Nano X in the Onyx Black color.

Pros

- Accessible and affordable hardware wallet

- Supports all major blockchains and altcoins

- Connects to your phone or computer with Bluetooth or USB

- Small size makes it easy to carry or hide

Cons

- Security depends on a seed phrase

- Doesn’t have a touchscreen for simple actions

Wallet type: Hardware

Supported blockchains: 100+

Price: $149

3. Zengo Wallet – Secure and User-friendly MPC Cryptography Wallet

Zengo Wallet is a high-security wallet that uses multi-party computation (MPC) cryptography to keep your wallet safe without using a seed phrase. It’s a different approach to locking up your tokens than many other wallets take, and we like it because it feels much less dicey to have access to your digital assets dependent on a seed phrase you wrote down and put…somewhere. That said, Zengo Wallet requires facial recognition to get into your wallet, so it can be a little bit of a pain if your phone isn’t great at recognizing you.

Zengo Wallet lets you buy, sell, swap, and stake tokens with no KYC, and it offers a few additional features to help you fully manage your crypto. For example, a legacy transfer feature acts as an insurance policy in case something happens to you or you lose access to your wallet. If you don’t log into Zengo Wallet for a period of time you specify, your tokens will automatically be transferred to an heir.

Zengo Wallet supports most major blockchains as well as NFTs, and you can set up five completely segregated wallets to better control your portfolio. The only major downside to Zengo Wallet is that it’s limited to storing around 380 tokens, mainly in the Ethereum ecosystem.

Pros

- MPC-based security doesn’t require a seed phrase

- No KYC required to buy and sell crypto

- Inheritance-style features to protect your crypto legacy

- User-friendly interface on web and mobile devices

Cons

- Limited support for non-Ethereum-based tokens

- No desktop app or browser extensions available

Wallet type: Software

Supported blockchains: 7 (does not support Solana or Ripple)

Price: Free

4. Trust Wallet – Convenient Hot Wallet with Wide Compatibility

Trust Wallet is a widely used hot wallet with a good combination of usability and security. The wallet has been around since 2017, is independently audited, and is used by more than 200 million people—all of which builds trust that this wallet is secure. At the same time, Trust Wallet supports more than 100 blockchains and NFTs, so you almost never have to worry about compatibility.

Trust Wallet enables you to buy and sell crypto with no KYC, and it has a built-in decentralized exchange and staking platform. There’s also a dApp library so you can fully explore Web3 using your wallet and an NFT marketplace so you can buy and sell digital collectibles.

However, there’s not much to Trust Wallet beyond that. It’s meant to be a wallet you can use reliably without many bells and whistles, not an innovative leader pushing out new or experimental features. We’d like to see Trust Wallet do a little bit more to stay on the cutting edge of Web3, but many users will find it has all the features they need and more.

Pros

- Strong track record of security since launch in 2017

- Integrated DEX, NFT marketplace, and dApp library

- Browser extensions available for Chrome, Brave, Edge, and more

- Supports 10 million tokens and 600 million NFTs

Cons

- Few innovative or unique features compared to other software wallets

- Moderately expensive fees for token purchases and swaps

Wallet type: Software

Supported blockchains: 100+

Price: Free

5. Trezor Model One – Most Affordable Hardware Wallet

Trezor is another popular hardware wallet maker and its Model One wallet has been a best-seller since it launched in 2014—at the time, it was the world’s first hardware wallet. It offers fully trustworthy security in a small package that’s easy to carry with you or hide in any nook of your home.

The model one is designed to be inexpensive and simple. It connects to your phone or computer via USB only, and it features two buttons to enable you to confirm transactions. Most of the heavy lifting is done by the Trezor Suite app, which lets you manage your portfolio, trade cryptos, and stake your tokens to earn from them.

The downside to the Trezor Model One is that it doesn’t support all blockchains. In particular, it’s not compatible with Ripple, Solana, or Cardano, three of the largest networks. The good news is that it only costs $49, so it’s a great option if you’re looking to buy your first hardware wallet and don’t want to spend a fortune.

Pros

- Strong track record of security since launch in 2017

- Integrated DEX, NFT marketplace, and dApp library

- Browser extensions available for Chrome, Brave, Edge, and more

- Supports 10 million tokens and 600 million NFTs

Cons

- Few innovative or unique features compared to other software wallets

- Moderately expensive fees for token purchases and swaps

Wallet type: Hardware

Supported blockchains: 50+ (does not support Ripple, Solana, or Cardano)

Price: $49

6. MetaMask – Widely Used Web3 Wallet Compatible with Most dApps

MetaMask is perhaps the most widely used hot wallet in the world, which brings its own set of advantages. The wallet is fully open-source, so users can feel confident that it’s safe and that any updates receive quick scrutiny from security experts. It’s also compatible with almost all dApps, and many even have a quick-connect option for MetaMask users.

MetaMask can be a great choice because of its wide compatibility and ease of use. It offers mobile apps for iOS and Android, extensions for all major browsers, and a web app. You can set up as many segregated wallets as you want and easily manage your crypto portfolio. MetaMask even offers a crypto debit card so you can use your tokens for real-world purchases.

That said, MetaMask has leveraged its dominant position by charging high fees for buying, selling, and swapping cryptos. So, if you’ll be actively managing your portfolio, trading through MetaMask can get expensive quickly.

Pros

- Highly popular open-source crypto wallet

- Massive dApp library with wide Web3 compatibility

- Offers a crypto debit card for real-world transactions

- Available for web, mobile, and major browsers

Cons

- Expensive token swap fees

- Does not support Bitcoin, Solana, or Ripple

Wallet type: Software

Supported blockchains: 9 (does not support Bitcoin, Ripple, or Solana)

Price: Free

7. Atomic Wallet – No KYC Wallet for Buying, Swapping, and Selling Crypto

Atomic Wallet is a user-friendly decentralized cryptocurrency wallet that does a lot of things well. It offers apps for Android and iOS, most desktop systems (including popular Linux distributions, and a Chrome extension. It also supports more than 1,000 cryptocurrencies across more than 50 popular blockchains.

Atomic Wallet lets you buy, sell, swap, and stake tokens with no KYC and no hassle. It offers relatively modest swap fees, which is nice for active investors and crypto traders. There’s also an integrated dApp library so you can easily extend your wallet’s capabilities and explore everything Web3 has to offer.

Atomic Wallet isn’t as widely used as some of the other wallets we tested and relies on seed phrase cryptography. So while it’s secure, it hasn’t put the same level of innovation into protecting users or developing new features as other wallets. Atomic Wallet is a good choice for crypto users who want something that’s easy to use and not very flashy.

Pros

- Offers desktop apps for all systems, including Linux distributions

- Relatively low swap fees

- Transparent staking rates for a wide range of coins

- Integrated dApp marketplace

Cons

- Security relies on a 12-word seed phrase

- No extra features to help you manage or use your crypto

Wallet type: Software

Supported blockchains: 50+

Price: Free

8. Coinbase Wallet – Self-custody Wallet with Seamless Coinbase Integration

Coinbase Wallet is a decentralized crypto wallet built by Coinbase, the US’s largest crypto exchange. It’s a self-custody wallet that you can link to your Coinbase account, enabling you to easily buy, sell, and swap tokens directly through the centralized exchange. This can be really convenient for Coinbase users, although it’s worth noting you’ll need to complete KYC checks to sign up for a Coinbase account (but not to use Coinbase Wallet on its own).

Coinbase Wallet stands out for its fast-growing dApp marketplace and support for NFTs, which help differentiate it from other platforms. You can easily explore NFTs within the app and display or share your own collectibles with others. It’s also easy to discover trending collections and browse the latest hot NFTs right from within your wallet.

Another benefit to Coinbase Wallet is that it supports a much wider range of payment methods for buying and selling tokens compared to other wallets. There are more than 130 payment options listed in the app, including for e-wallets that are widely used outside the US. Overall, this wallet is a worthwhile option for anyone who uses Coinbase as their primary exchange.

Pros

- Seamless integration with a Coinbase exchange account

- Enormous NFT marketplace and NFT discovery features

- Supports 130+ payment methods for buying and selling crypto

- Available for iOS, Android, Chrome, and web

Cons

- Seed phrase-based security

- Opening a Coinbase exchange account requires KYC

Wallet type: Software

Supported blockchains: 100+

Price: Free

What is a Decentralized Crypto Wallet?

A decentralized crypto wallet is a type of software that enables you to store cryptocurrency on your own devices, without relying on a third party or centralized company for security or other services. They are also known as full self-custody wallets or non-custodial wallets because they give you full control over your crypto.

What defines a decentralized wallet—as opposed to a centralized wallet—is who owns the wallet’s private keys. This is important because private keys are critical to accessing a wallet’s tokens.

With a decentralized wallet, you (the wallet owner) are in control of the wallet’s private keys. With a centralized wallet, on the other hand, you have access to the wallet, but the private keys are managed by a third party such as a crypto exchange or broker.

Centralized wallets are potentially problematic because if the exchange goes bankrupt or suffers a hack, you could potentially lose your cryptocurrency. There’s a common saying in the crypto world: “not your keys, not your tokens.”

In fact, this is what happened to account holders at FTX, the major crypto exchange that went bankrupt in 2022. Token holders had centralized crypto wallets managed by the exchange, and their funds were lost when the exchange went bankrupt.

Decentralized wallets eliminate this risk, but they do come with trade-offs. Taking responsibility for your wallet’s private keys means there’s no one to ask for help if you lose your keys. You can also send and receive crypto without oversight by a third-party, which can allow you to do more in Web3 but also could make you more vulnerable to scams.

Benefits of Decentralized Bitcoin Wallets

Decentralized cryptocurrency wallets offer a number of benefits compared to centralized wallets, which is why they’re the most popular choice for crypto owners. Let’s dive into the benefits and explain how they work.

Total Control over Your Cryptocurrency

The biggest benefit of a decentralized crypto wallet is that you have complete control over your tokens and other digital assets, like NFTs. You can do whatever you like with your tokens—send and receive from any dApp, swap them through an exchange, stake them with a decentralized finance (DeFi) platform, and more. There’s no third-party custodian that can impose limitations on how you use your crypto.

This is especially important for making your tokens resistant to financial censorship. Not only can an exchange or similar crypto-related entity not block your transactions, but neither can governments. Your tokens exist completely outside the traditional financial system.

Access to a Wider Range of Tokens

Most decentralized crypto wallets store a much wider range of tokens—from more blockchains—than most centralized wallets. That’s because centralized wallets typically only work with approved digital assets, such as the specific tokens that a crypto exchange offers for trading.

Decentralized wallets, on the other hand, support as many networks as possible to give you the greatest flexibility to explore Web3. As an example, Best Wallet supports more than 60 blockchains and Trust Wallet supports more than 100 blockchains.

Connectivity to Web3 and dApps

Another major benefit of decentralized wallets is that they enable you to connect to dApps across Web3. There are no limitations—all decentralized apps are compatible with all dApps, although the connection process may vary between wallets. Because of this, decentralized wallets are also called DeFi wallets.

Many decentralized wallets have built-in marketplaces where users can explore dApps to connect to. Some of the most popular dApps include the decentralized crypto exchange Uniswap, the NFT marketplace OpenSea, and the DeFi platform Yearn.finance.

Decentralized apps can also connect to crypto presales, which gives investors the ability to buy emerging tokens before they launch on exchanges.

Full Anonymity

Whereas most centralized crypto wallets require KYC checks—which include ID verification and providing proof of address—most decentralized wallets do not. All you need to sign up is an email address or a username. You can buy and sell crypto completely anonymously, without sharing any sensitive personal details.

No Custodian Risk

As we discussed above, decentralized wallets also eliminate risks that stem from putting someone else in charge of your wallet’s private keys. For example, your tokens aren’t at risk of a custodian going bankrupt or suffering a hack. You must still be mindful to keep your token safe, but the risk doesn’t stem from your wallet’s custodian.

Are Decentralized Crypto Wallets Safe?

Decentralized wallets can be extremely safe. However, it’s important to understand how these wallets work and how to keep your tokens secure.

First, it’s important to choose a trusted wallet provider. If your wallet software has a flaw, it could be vulnerable to hacks even if you do everything right. This is why so many wallets open-source their code—so that security experts can look over it—or undergo third-party security audits.

It’s also important to think about what type of security systems a wallet chooses. Some offer multiple layers of security, like two-factor authentication and PIN codes. Others rely on seed phrases, which are somewhat vulnerable since they must be written down and kept safe. If you lose your wallet’s seed phrase, you won’t be able to get access to your tokens on another device.

Finally, the freedom that decentralized crypto wallets provide can be a double-edged sword if you’re not careful. Scams abound in the crypto world, and if you connect to an untrustworthy dApp you could lose tokens. You’re solely responsible for keeping your crypto wallet secure.

Tips for Improving Security When Using DeFi Wallets

It’s important to take a security-first approach when using a decentralized crypto wallet. Otherwise, you could fall prey to a scam or hack that results in a significant loss of tokens.

To help, we have five tips for how you can maximize your wallet’s security.

-

Activate Multi-factor Authentication

If your crypto wallet offers multi-factor authentication—such as SMS authentication, an authentication code from an app, fingerprint unlock, or facial recognition—be sure to activate those security measures when setting up your wallet. These measures can make it much more difficult for an attacker to get into your wallet even if they are able to steal your password.

-

Store Your Seed Phrase Offline

Many—but not all—DeFi crypto wallets use a seed phrase that represents your private key. You need the seed phrase to restore your wallet to another device if you lose your device or lose your wallet’s password.

When setting up your wallet, write down your seed phrase on a piece of paper and store it somewhere secure. Never store your seed phrase on your computer or in the cloud, where it could potentially be stolen. Don’t tell anyone where your seed phrase is located or show it to anyone.

If your wallet doesn’t use a seed phrase—Best Walle and Zengo Wallet do not—then your wallet’s recovery process typically involves your email address and a recovery file. So, be sure to keep your email secure as well.

-

Keep Your Tokens Offline

If possible, it’s a good idea to store your tokens offline in a hardware or cold storage wallet rather than a software or hot storage wallet. Hardware wallets are designed to keep your tokens disconnected from the internet and they require physical access to your wallet to approve any transactions. This makes it much more difficult for remote attackers to steal your cryptocurrency through a hack, even if they have your wallet’s password.

We’ll dive into more detail about hardware wallets and how they work later in the guide.

-

Spread Your Tokens Across Multiple Wallets

Another good security practice, especially if you have a large amount of cryptocurrency, is to split your tokens up among several different wallets. This can include a mix of software and hardware wallets.

The advantage of this approach is that in the event your wallet is hacked and tokens are stolen, you only stand to lose some of your total cryptocurrency holdings. It’s extremely unlikely that any attacker could steal coins from multiple different wallets with different passwords and different security configurations.

-

Do Your Research Before Connecting to dApps

One of the most common ways that people lose tokens when using decentralized wallets is by connecting to malicious dApps. These could be outright scams in which you send tokens to another wallet for a service that doesn’t exist, while other malicious dApps are designed to take tokens from your wallet.

The solution in either case is to carefully research any dApps before you connect to them. Make sure the dApp is legitimate, and make sure you are connecting to the correct wallet or contract address. It’s also important to only click trusted links and to double-check URLs, since lookalike links are a common technique used by scammers.

How to Pick a Decentralized Bitcoin Wallet

There’s a lot to consider when choosing the best decentralized crypto wallet. We’ll break down the things you need to look for and highlight factors that help the top wallets stand out.

Security Measures

If a decentralized wallet isn’t 100% secure, you should never use it. That said, many wallets achieve security in different ways, so it’s important to know what to look for.

To start, consider whether you want a wallet with a seed phrase or not. Seed phrases can include 12 to 24 randomly generated words and they are commonly used because they’re effective. However, you have to store your seed phrase somewhere safe, or else you could potentially lose access to your wallet forever if you lose your device.

Wallets that don’t use seed phrases are just as secure, and they offer easier ways to restore access to your wallet. For example, with Best Wallet, you just need access to your email and your PIN code to restore your wallet.

We recommend only using wallets that support multi-factor authentication. Biometric authentication is best because it’s considered by experts to be highly secure. If biometric authentication isn’t available, look for wallets that are compatible with an authenticator app rather than those that rely on SMS authentication.

You should also consider additional features like multi-signature support. This requires you to use multiple devices to sign off on transactions, making it more difficult for an attacker to steal your tokens.

Finally, make sure that the code underlying a decentralized Bitcoin wallet is fully secure. We recommend sticking to decentralized wallets that are open-source, like MetaMask, or that have undergone third-party security audits.

Supported Cryptocurrencies and Assets

Another important thing to consider when choosing a crypto wallet is what types of digital assets it can actually store. Some decentralized Bitcoin wallets onl y store Bitcoin, but most support a wide range of altcoins as well.

Generally, we recommend using a wallet that supports at least 50+ blockchains, including all of the largest ones. Some wallets don’t support chains like Ripple, which has a different architecture than most Ethereum Virtual Machine-compatible networks. Think carefully about what tokens you plan to use before choosing a wallet that has limited support.

It’s also worth thinking about whether you plan to buy and sell NFTs, since many decentralized wallets support these digital collectibles. Compatibility for different NFT standards varies widely among wallets.

Apps and User Experience

Nearly all major DeFi wallets offer mobile apps for iOS and Android, making it easy to check your token balances and deploy your cryptoassets on the go. Most also offer a web interface, and some offer browser extensions for Chrome and other major browsers. Desktop apps are less common, but can be a nice feature for crypto users who want to manage their portfolio from a computer.

Be sure to explore the user experience when choosing a wallet. Most wallets are designed to be user-friendly, but some can feel clunky while others overwhelm the user with different options and features. Ideally, it should be extremely easy to monitor your token balances, buy, sell, or swap cryptocurrencies, and connect to popular dApps. More complex security settings should be available, but stored in an out-of-the-way menu for access only when you need.

Web3 Features

Innovative Web3 features can take a crypto wallet from good to great. At a minimum, decentralized wallets should make it easy to stake your tokens to earn interest and offer a dApp library where you can connect to popular DeFi and other platforms. An integrated NFT marketplace is also a plus.

Some wallets are starting to take Web3 integration much further. For example, Best Wallet has a built-in iGaming hub that lets users connect to popular crypto gambling sites with just a tap. It also has an integrated crypto launchpad, Upcoming Tokens, where users can easily invest in emerging crypto projects.

Ideally, wallets should vet the dApps they include in their libraries and offer some form of contract risk analysis. This significantly reduces the chances of connecting to a malicious dApp that could try to steal your tokens.

Swap Fees

A final thing to consider when choosing the best decentralized wallet app is how much the wallet’s built-in exchange charges to swap tokens. Fees can vary widely among different wallets, and they can add up quickly for active investors and crypto traders.

Be sure to also look for gas fee controls. Many wallets let you set maximum gas fees for your transactions, and some offer algorithms and alerts to help you minimize fees when trading cryptocurrencies.

Types of Decentralized Crypto Wallets

There are two main types of decentralized crypto wallets to be aware of: software wallets and hardware wallets.

Software wallets, also known as hot wallets, are solely pieces of software on your device that enable you to manage your cryptocurrencies. They are designed to be secure, but they’re always connected to the internet. This makes them potentially more vulnerable to attack, since someone with access to your wallet’s password could access your tokens at any time. (Multi-factor authentication is critical to ensure they also need physical access to your device.)

Hardware wallets, also known as cold wallets, use a combination of hardware and software to store your cryptocurrencies. Your tokens live on a physical device that is not connected to the internet. When you want to use your tokens for a transaction, the device can be connected (usually via USB or Bluetooth) to a mobile or desktop app, which in turn is connected to the internet.

The advantage of a hardware wallet is that it’s extremely secure. When your device isn’t connected to the internet, there’s no way for anyone to steal your tokens—even if they had everything needed to break into the partner app. In addition, when the device is connected to the partner app, you must press a button or tap a screen on the physical wallet device in order to approve any transactions.

The partner app can be used to buy, sell, and swap cryptocurrencies, as well as to stake tokens to earn interest. However, there may be more limited options for connecting to dApps than with a software wallet.

Not everyone uses hardware wallets because they have some additional drawbacks. First, it can be a hassle to connect your wallet every time you want to complete a transaction. In addition, hardware wallets cost money and may have limited storage capacity, whereas software wallets are free and have unlimited storage.

The solution many crypto investors adopt is to use both a software wallet and a hardware wallet in combination. The security of a hardware wallet is ideal for storing tokens that are long-term investments and don’t need to be swapped or traded frequently. The connectedness of a software wallet is ideal for tokens that might be transferred to a dApp or swapped in the near future. Just remember to keep your positions balanced across your wallets as they change over time.

How to Get a Decentralized Crypto Wallet

Ready to start using a decentralized wallet? We’ll walk through the steps for how you can download a wallet today and get started storing your crypto safely.

Step 1: Download a Wallet App

To get started, head to the website for the wallet you want to use. Download the wallet for your mobile device or browser.

Step 2: Create an Account

Open the wallet app and follow the prompts to create an account. Usually, you’ll need to provide an email address, username, and password.

Step 3: Write Down Your Seed Phrase

If your wallet provides a seed phrase, it’s important to write it down on a piece of paper and store it somewhere secure. You will need this seed phrase to restore your wallet on another device if you ever lose your device or your wallet password.

Step 4: Activate Multi-factor Authentication

Next, turn on multi-factor authentication. Different wallets offer different options, but fingerprint or facial recognition is best. Be sure to activate SMS authentication at a minimum.

Step 5: Buy, Sell, or Trade Crypto

Now your wallet is set up and you’re ready to start buying, selling, or trading cryptocurrency. If you already have crypto in another wallet, you can easily import your tokens to your new decentralized wallet.

Decentralized wallets offer a safe way to store your cryptocurrency and access the wide world of Web3. However, because of how central your wallet is to your crypto journey, it’s incredibly important to choose the right platform. We recommend Best Wallet as the overall best decentralized wallet for 2025, but we think you’ll have a great experience with any of the top eight wallets we highlighted.

References

FAQ

What does decentralized mean in crypto?

Decentralized refers to any crypto-related software that is not owned by a centralized entity. It can refer to decentralized wallets, which are owned by individuals who manage their own private keys. It can also refer to smart contracts, which run autonomously on a blockchain without requiring a centralized entity to manage them.

Are decentralized crypto wallets better?

Decentralized crypto wallets offer a number of advantages over centralized crypto wallets, the most important of which is full control over your tokens. No one can block your transactions or take tokens from your wallet without your permission. However, with a decentralized wallet, you are fully responsible for keeping your wallet secure, so there is some additional work and knowledge required.

What is the best decentralized crypto wallet?

Based on our testing, the best decentralized crypto wallet is Best Wallet. It supports more than 60 blockchains and offers multi-layered security options, plus has tons of Web3 features to help you get the most out of your cryptocurrency. We especially like Best Wallet’s Upcoming Tokens crypto launchpad, which lets you easily discover and invest in hot new crypto projects.

Are decentralized wallets secure?

Decentralized crypto wallets can be fully secure, but it’s up to you to keep your wallet safe. Only use trusted wallets that are open-source or have undergone security audits. In addition, you must keep your wallet’s seed phrase safe and activate multi-factor authentication to keep your decentralized wallet fully secure.

Is Binance a decentralized wallet?

Binance is a centralized crypto exchange that also offers a decentralized crypto wallet called Binance Wallet. Binance Wallet gives users full self-custody over their tokens, but it can be linked with a centralized Binance account to make buying and trading cryptocurrencies easier.

Is Coinbase a decentralized wallet?

Coinbase Wallet is a decentralized wallet. However, Coinbase the crypto exchange is centralized, and tokens held in a Coinbase account are held in centralized (also called custodial) wallets. You can link Coinbase Wallet to Coinbase to enjoy the benefits of a decentralized wallet while still using the centralized exchange to trade.

Is Trust a decentralized wallet?

Yes, Trust Wallet is a fully decentralized crypto wallet, also known as a self-custody or non-custodial wallet. It supports tokens and NFTs from more than 100 blockchains and offers a dApp library so users can take full advantage of Web3.

Is MetaMask a decentralized wallet?

Yes, MetaMask is a decentralized crypto wallet. It is one of the most popular decentralized wallet apps and supports all Ethereum-based tokens as well as tokens on BNB Smart Chain, Polygon, and Avalanche.

We’ve found eight decentralized wallets that stand above the rest. Keep reading to find the best decentralized crypto wallet to us...

This guide is a must-read when exploring the best new crypto in 2025. We reveal the most promising launches to watch.