Grayscale Halts Ethereum ETF amid $56M Injective Lock, BlockDAG’s Dashboard Upgrade Craze Sparks Crypto Whales Excitement

/BlockDAG/ – In the ever-evolving crypto landscape, BlockDAG shines with its remarkable $27.5 million presale achievements and innovative functionalities. While Injective displays notable growth and significant transaction volumes, and Grayscale’s Ethereum ETF withdrawal raises eyebrows regarding SEC involvement, BlockDAG’s strategic marketing and comprehensive investor insights garner substantial attention. Its recent dashboard enhancement and prominent Piccadilly Circus London appearance attract global investors, highlighting BlockDAG’s allure as a compelling investment choice compared to its counterparts.

Injective Hits Staking Milestone: Over 56 Million INJ Locked On-Chain

Injective’s profile on the X platform underscores the escalating enthusiasm surrounding the platform, noting a surge in newcomers and integrations. With each passing day, more dapps, exchanges, and projects embrace the Injective ecosystem, steering the future of finance toward the DeFi revolution.

Remarkably, Injective witnesses over 56 million INJ staked on-chain, a notable rise of 5 million within a fortnight. Additionally, transaction volumes impress, with Injective boasting 600 million total transactions, rivaling BTC’s 1 billion. Furthermore, Injective refines its burn auction, facilitating contributions from both dApps and community members, fostering inclusivity and community engagement. This deflationary tactic curtails token supply, fostering sustainable value.

Grayscale Withdraws Ethereum Futures ETF: Suspicions of SEC Influence

Grayscale’s withdrawal of its 19b-4 filing for an Ethereum futures ETF sparks speculation within the crypto community, with some suggesting SEC influence. Analysts like James Seyffart deem the filing a “trojan horse” strategy, akin to GBTC Bitcoin ETF approval tactics. Speculation arises from a possible SEC meeting with Grayscale executives preceding the withdrawal.

Journalist Eleanor Terrett highlights Grayscale’s absence of an S-1 filing for the Ethereum futures ETF, speculating that the SEC may await a finalized application. Moreover, she points to low investor demand for existing Ethereum futures ETFs. The SEC’s deliberation over Spot Ethereum ETF approvals, including an Invesco Galaxy Ethereum ETF extension, mirrors broader regulatory ambiguity. This cautious stance reflects regulators’ struggle to balance regulation with surging crypto investment vehicle demand.

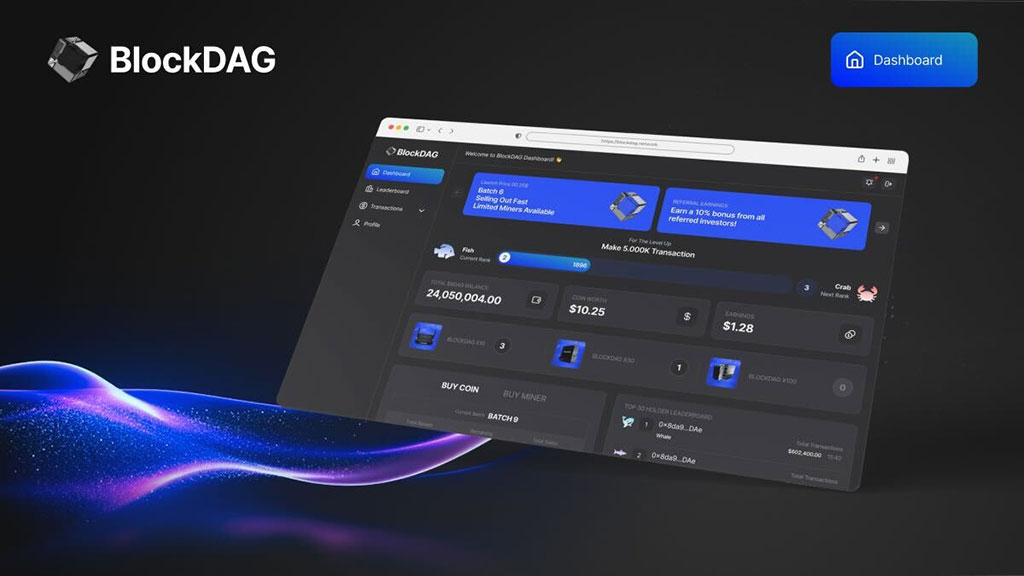

BlockDAG’s Dashboard Upgrade Unveils Surging Whale Activity and Investor Interest

BlockDAG’s recent dashboard upgrade and added features offer intricate insights into whale activity, indicative of robust investor interest. Notably, the upgraded dashboard features a ‘Leaderboard’ spotlighting the top 30 investors, categorized by investment amounts, enhancing user experience and facilitating investor tracking.

BlockDAG’s presale triumphs, accumulating $27.5 million from over 9.2 billion BDAG coins sold and $2.5 million from 5,500 miners, underscore its success. Noteworthy price surges from Batch 1 to Batch 13, witnessing a 700% increase, substantiate BlockDAG’s strategy of progressive price increments, garnering significant market attention.

Additionally, BlockDAG’s strategic marketing endeavors, including a prominent Piccadilly Circus presence in London, attract global investor interest, bolstering the presale’s triumph and reaffirming BlockDAG’s allure as a lucrative investment avenue.

In Conclusion

BlockDAG’s recent strides, coupled with its $27.5 million presale performance and strategic marketing endeavors, position it strongly in the crypto domain. While Injective displays resilience and growth, and Grayscale’s decisions evoke regulatory speculation, BlockDAG’s focus on investor engagement and transparency sets it apart. Its capacity to allure substantial global interest and furnish invaluable insights into whale activity underscores BlockDAG’s potential as a standout investment especially after its display at Piccadilly Circus, promising a bright future for its community and stakeholders.

Join BlockDAG Presale Now: Website, Presale, Telegram, Discord.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.