First Agreement – BSC Chain First DeFi Excess Lending Agreement Goes Online

With the development of DeFi sector, the application of blockchain segment is becoming more and more abundant, and the liquidity digital currency lending market is exploding. The total value of the dollar locked in in the DeFi lending agreement has risen by 75% over the past year. As of June 29, in the first half of 2022, the average loan size (median) of the five major loan markets increased by 293.36%. Among them, AAVE V2 (ETH) and Venus loans grew by more than 1,000%, especially AAVE V2 (ETH) loan loans increased by 82 times.

First Agreement arises at the historic moment. First Agreement is a multi-guarantee system contract agreement independently on the BSC smart chain, providing the demand for decentralized financial products and derivative applications. Develop products and services based on digital asset payment, financial management, lending and cross-border transactions for the public. The birth of First Agreement marks a shift from a decentralized P2P lending strategy to a peer-to-peer-based strategy.

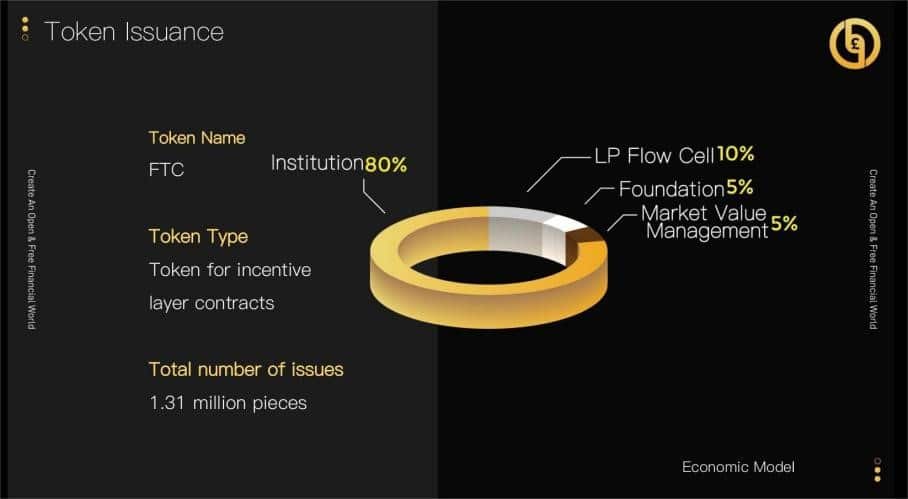

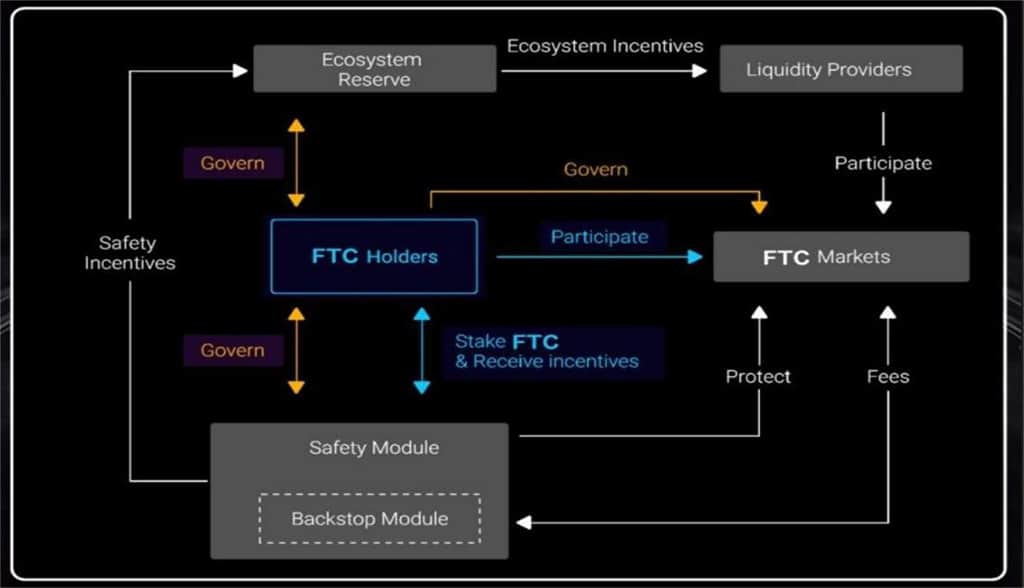

When the user loans, the user earns the interest, and when the user borrows, the user pays the interest. First Coin (FTC) is an incentive layer contract Token, which is used to pledge and repay the interest and other ecological circulation for use.

First Agreement has won a lot of favor from many VC venture capital firms, receiving $10,000 from Singapore ANTS Capital300 (0x8dd78f3fbec56a39954f5e50aa7a1e4c910f89fc) back in June.

First Agreement Advantages

- High utilization rate of funds

- Low capital occupancy rate

- Reduce the cost of holding positions

- Increase the number of positions

- Reduce risk of holding positions

First Agreement socials: Discord, Twitter, Medium.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.