Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

Several large-cap crypto assets are already nearing key support levels which could offer excellent buying opportunities.

Large-cap crypto assets broke below key support levels late Monday, driven by macroeconomic concerns that triggered a broad-based decline across global financial markets.

The Bitcoin price momentarily fell to $86,800 on Binance, down nearly 10% from its weekly open.

Most altcoins are down by double-digits as nearly $150 billion has been wiped out from the crypto market over the past 24 hours, data from CoinGlass reveals.

However, whales are once again buying the dip and prominent analysts are convinced the crypto market crash is just another shakeout before the eventual push towards new all-time highs.

Several large-cap crypto assets are already nearing key support levels which could offer excellent buying opportunities.

Several macroeconomic factors are contributing to the selling pressure on the crypto market.

For starters, the tech rally is losing momentum. The tech-heavy NASDAQ-100 has dropped 3.72% over the past 5 days, and early futures data suggests the index is poised to extend its 3-day losing streak. Bitcoin remains strongly correlated with $QQQ.

Meanwhile, the steep rise in US CPI and PPI data, coupled with the expected decline in US PMI Services for February have resulted in “stagflation” worries. Donald Trump’s tariff talk and the growing strength of the Japanese Yen vs the US Dollar are making matters worse.

However, prominent crypto analysts are also offering a far simpler explanation. Bitcoin could simply be tracking the Global Money Supply with a slight lag, an indicator of global liquidity which it has a very strong correlation to.

Interesting.

Looks as if this macro scenario for #Bitcoin is in play after all…

h/t @RaoulGMI @BittelJulien pic.twitter.com/Jzip5MC4ay

— André Dragosch, PhD | Bitcoin & Macro ⚡ (@Andre_Dragosch) February 25, 2025

The global M2 has already started going back up, suggesting that the top isn’t in for Bitcoin just yet.

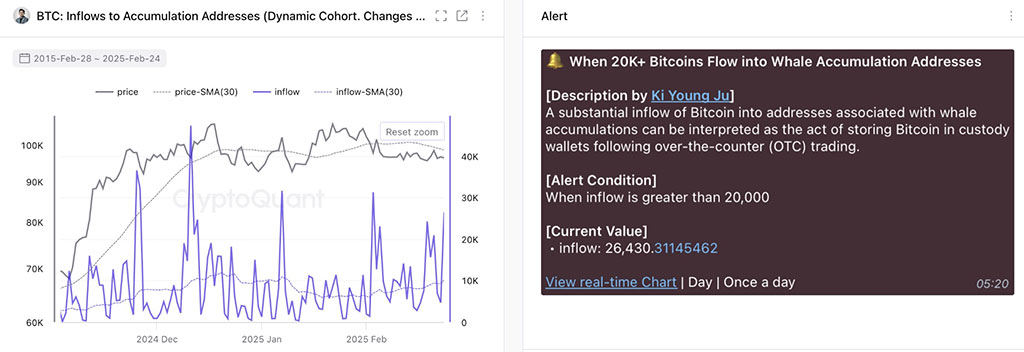

Indeed, whales are already buying the dip, data from CryptoQuant reveals.

Experts support a straightforward crypto investment strategy – buy at support levels and sell at resistance.

For Bitcoin, this means buying in the $85,000-$87,000 range. Prominent analyst Nebraskangooner, who predicted the Bitcoin price crash after it fell below the $95,500 support level, reveals that his rounding top breakdown target has been reached.

Rounded top breakdown target reached 🎯🎯🎯 https://t.co/xIv825CgDZ pic.twitter.com/WWyAmtP05c

— Nebraskangooner (@Nebraskangooner) February 25, 2025

This suggests that sidelined investors and swing traders may already see an excellent buying opportunity in Bitcoin at the current levels.

If BTC is tracking the global money supply, it could see a further correction to $75,000. Therefore, the optimal strategy would be to deploy a portion of the capital now and use DCA for the remainder in case of further downside.

Ethereum is also showing a strong correlation with Bitcoin currently. Every BTC buying opportunity also presents a chance to buy the dip on ETH.

However, Solana hasn’t reached its downside target yet. Prominent analyst Bluntz believes SOL will likely bottom when SOLBTC tags the 0.786 Fib level, or at least the 0.618. Sidelined investors should wait for a correction to $117 to buy the dip.

Low-cap crypto coins have once emerged as excellent investments, considering they show little correlation with the broader market liquidity.

For instance, Solaxy (SOLX) continues to add nearly $1 million to its presale every 5 days and has already surpassed the $24 million market in its ICO.

The first prominent Solana layer-2 coin has become a favourite of whales, with $50k buys almost a daily occurrence. Recently, a deep-pocketed investor purchased over $400k worth of SOLX in 5 separate transactions.

Considering the multi-billion dollar valuations achieved by Ethereum layer-2 coins, it is no surprise that early buyers are eyeing 10x to 100x returns from Solaxy.

Similarly, Meme Index (MEMEX) has raised nearly $4 million in the early stages of its presale.

The project is building meme coin baskets, an index-fund-like investment vehicle just for meme tokens. The use case has created quite a buzz among smart money investors, considering MEMEX holders can vote on which coins to include in each of the 4 baskets.

Meme Index is a small-cap coin, with a unique value proposition. Consequently, many analysts have called it the next 100x crypto.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.