Ethereum demonstrated a huge growth within the past months, gaining interest of the world’s largest financial and technology companies.

Over the past three months, the price of Ethereum, a cryptocurrency that rivals bitcoin, has shown a surge of 1,000 %. The growth of value, the New York Times reports, has attracted attention from such tech giants as IBM, Microsoft and JPMorgan Chase.

The Ethereum system, like the bitcoin one, is based on the blockchain technology, an open ledger of all transactions realized in the bitcoin network. The system eliminates middlemen, what significantly increases the speed of payments and reduces settlement costs.

In addition, the blockchain offers a high level of transparency, as each transaction is stored in a public distributed ledger. The technology can also be used by businesses to build smart contracts that let users to purchase items directly from manufacturers.

The public version of the Ethereum software became available last month. But it still could face some issues that affected bitcoin. The proponents of the digital currency say that the system is likely to have more problems with security due to its complexity. Besides, it suffered fewer attacks in comparison with bitcoin.

This, however, doesn’t stop major tech companies from exploring the applications of the Ethereum software. Last year, IBM began developing an IoT control system with the use of the system. The same year, Microsoft partnered with Consensys to provide platform as a Service (EBaaS) on its cloud computing platform Azure.

The rise of interest in the blockchain technology is observed among the leading banks. JPMorgan has designed Masala, a tool that allows its databases to cooperate with the Ethereum system.

Since the start of the year, the price of Ether, the digital tokens used on Ethereum, has reached almost $12, rising from $1. This brings the total value of all Ether to more than $1 billion. It became the first virtual currency that can now be called a main competitor to bitcoin.

Ethereum has attracted a broad network of followers, who are actively supporting the system. The system had 5,800 nodes last week, while the bitcoin network recorded nearly 7,400 nodes.

“Bitcoin is still probably the safest bet, but Ethereum is certainly No. 2, and some folks will say it is more likely to be around in 10 years,” Joseph Bonneau, a computer science researcher at Stanford, told the New York Times. “It will depend if any real markets develop around it. If there is some actual application.”

Although the growth of Ethereum has been well perceived by the blockchain community, some industry members do not believe in the system’s success. The Community Director at the Counterparty Foundation, Chris DeRose, called Ethereum “100% Hype and No Substance”. According to his Twitter argument with Ethereum crowdsale investor Mark Wilcox, no one needs smart contracts as they are too expensive to maintain.

https://twitter.com/derosetech/status/714300051208728576

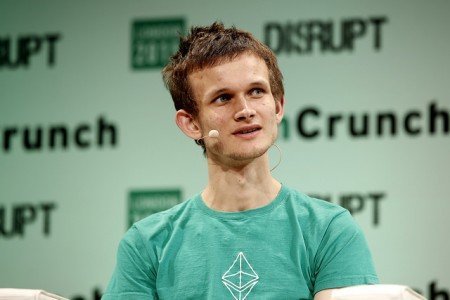

Ethereum was developed by Vitalik Buterin, a 21-year-old Russian-Canadian, who designed the software after he was dropped out of Waterloo University in Ontario.

next