With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Options trading on Deribit surged to $743 billion, marking a 99% year-on-year growth and reinforcing its position as the leading crypto options exchange.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

Deribit, a crypto exchange known for its dominance in options trading, experienced a groundbreaking year in 2024. Trading volumes surged to an unprecedented $1.185 trillion, nearly doubling the $608 billion seen in 2023. That 95% leap underscores the exchange’s increasing appeal to professional traders and institutional investors.

Options trading took center stage, accounting for $743 billion in total volume. That represents a striking 99% year-on-year growth, solidifying Deribit’s position as the leading crypto options exchange since introducing Bitcoin options in 2016. The company’s Chief Commercial Officer, Luuk Strijers, attributed the uptick to key market events.

“Deribit saw an increase in activity throughout the year, particularly in Q4 as institutional investors demonstrated heightened optimism around the US presidential election, as well as the $100K Bitcoin bull run that followed,” Strijers told CoinDesk.

November was a milestone month for Deribit. The exchange hit its highest-ever daily trading volume on November 12, with a staggering $14.8 billion in transactions. By November 28, open interest across futures and options reached a historic high of $48 billion, fueled by soaring Bitcoin BTC $107 706 24h volatility: 0.3% Market cap: $2.14 T Vol. 24h: $8.45 B prices.

Spot trading emerged as Deribit’s fastest-growing segment, recording an 810% surge in volume to $7.6 billion, a sharp rise from $837 million in 2023. The rise in activity reflects the crypto market’s increasing maturity. Institutional investors embraced advanced strategies, utilizing options, futures, and volatility trades driven by regulatory progress, including ETF launches in the US.

Meanwhile, Deribit strengthened its regulatory standing by securing a Virtual Assets Regulatory Authority in Dubai and pursuing derivatives licenses in France and Brazil.

The exchange implemented the FATF Travel Rule to enhance security and transparency, improving KYC processes. It also introduced advanced custody options, blending hybrid models with Fidelity, Zodia, and Copper while offering off-exchange custody solutions via Fireblocks.

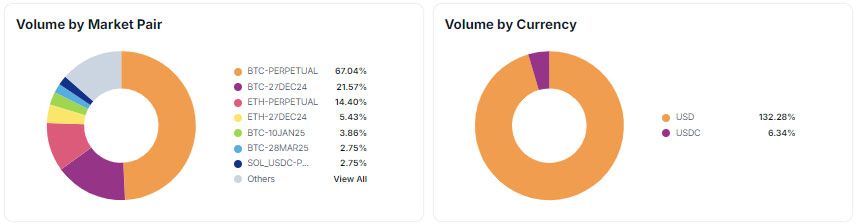

Bitcoin remains king on Deribit, commanding 67.04% of market pair volume. While BTC-perpetual dominates, ETH-perpetual trails at 14.4%, according to CoinGecko. Options like BTC-27DEC24 show growing interest, reflecting traders hedging long-term moves. The spread highlights Bitcoin’s resilience as the primary driver of crypto trading activity.

Photo: CoinGecko

USD dominates currency volume at 132.28%, with USDC trailing far behind at 6.34%. This heavy preference for USD reflects its stronghold in global crypto derivatives. USDC’s smaller slice hints at a cautious stance toward stablecoins amid regulatory uncertainty, keeping traders tied to the dollar’s safety net.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.