DeCredit’s Mainnet 1.0: LIVE on 1st of November 2021

DeCredit has built up it’s first version of credit oracle on Chain and implemented it.

The DeCredit team consists of personalities with several years experience in the credit field. All the team members have rich industry resources in the fields of credit agreement, big data in credit, industrial funds, data risk control, etc.

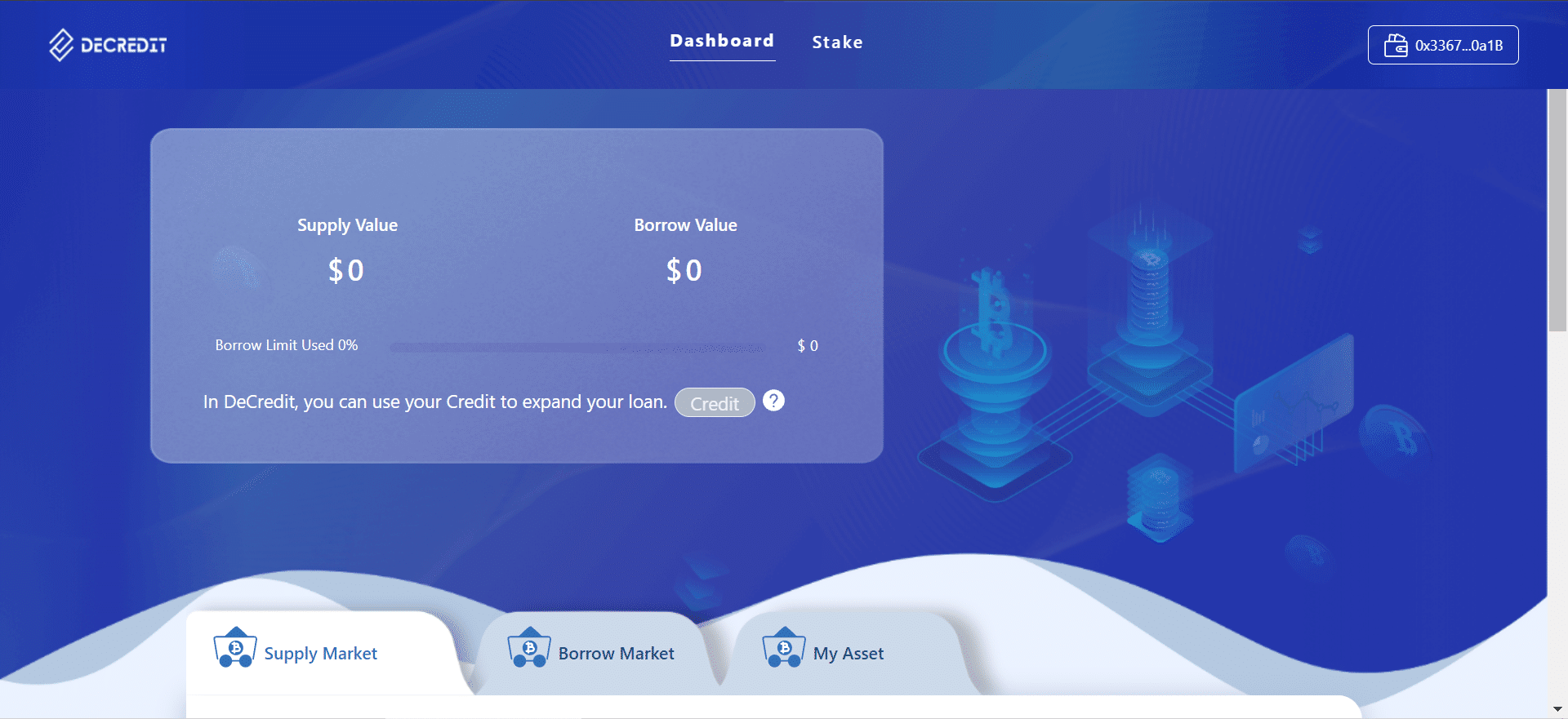

- DeCredit’s mainnet 1.0 launched on BSC on the 1st of November 2021 (UTC+0). Once the mainnet is launched, several cryptocurrencies will be accepted such as ; $USDT, $BNB, $ETH, $BTC, $BUSD. These crypto currencies will be available for deposit & withdrawal to the wallet.

- Stake the $CDTC to earn more on DeCredit

- Users can trade the DeCredit Token $CDTC on CEX- BitMart as well with the $USDT trading pair.

The primary essentiality is to work with the DeCredit Credit loan models on the mainnet; to deliver credit lending service to users and empower other DeFi projects in the future with the off-chain credit information.

DeCredit Credit loan model consists of 6 sub-models. These are :

- Debt ratio

- Asset analysis

- Query analysis

- Lending or borrowing history analysis

- Overdue analysis

- Other analysis

The key relevance of staking is to verify the identification for eligible users who staked already. The eligible user has to stake and submit the application form, then the Credit oracle will refer to the submitted information for each individual applicant to raise the amount & limitation of loan with the same mortgage rate.

The whole verification and it’s final result (Individual Credit Status) will be conducted by the ‘DeCredit Scoring System’. It is an optimized procedure for DeCredit to process that credit data with an algorithm of Credit-Scoring & Credit-Matching.

The Credit Oracle is a bridge connecting the blockchain and the real world, and supplements the off-chain credit data to on-chain.

The Credit oracle will conduct its special feature development with DeCredit and it’ll come to us in the near future.

DeCredit aims to expand and implement more application scenarios and accelerate the construction of global credit oracles. Based on open source , DeCredit will provide powerful credit data services for other DeFi projects, NFTs, and Metaverse in the future to empower the entire ecosystem.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.