Sygnum explained that Switzerland’s regulatory framework permits it to act as a crypto custodian for its partner banks, managing crypto assets on behalf of their customers.

Sygnum, a multinational digital assets group with Swiss and Singaporean roots, announced today the addition of 20 new banking partners to broaden access to crypto services and enhance the company’s business operations.

In an announcement on June 27, the company said that by partnering with these lenders, Sygnum continues to expand its reach and provide more comprehensive crypto solutions to its business-to-business (B2B) customers.

Expanding the Partner Network

The new partners include PostFinance, the cantonal banks of Zug and Lucerne, VZ Depotbank, PKB, SocGen Forge, Bordier, and Bison Digital Assets. These institutions span the entire financial industry, from systemically important and cantonal banks to universal, private, and retail financial institutions.

The bank plans to utilize Sygnum’s secure infrastructure and scalable APIs to facilitate crypto transactions for its customers. Their users will have the opportunity to trade digital assets, including sending, receiving, and storing funds on a regulated platform.

“Cryptocurrencies offer an additional investment option and are here to stay. Partnering with a regulated partner like Sygnum Bank has enabled our customers to access digital assets through their primary bank securely and conveniently, 24/7,” said Alexander Thoma, senior executive at PostFinance, one of the new banking partners.

Sygnum said it currently processes up to 1,000 B2B transactions per day for its business partners, with 99% of the transactions completed within a “very short period of time”.

The company plans to continue this tradition with the newly added lenders, enabling more than a “third of the Swiss population to own digital assets with complete confidence”.

Regulatory Clarity and Expansion

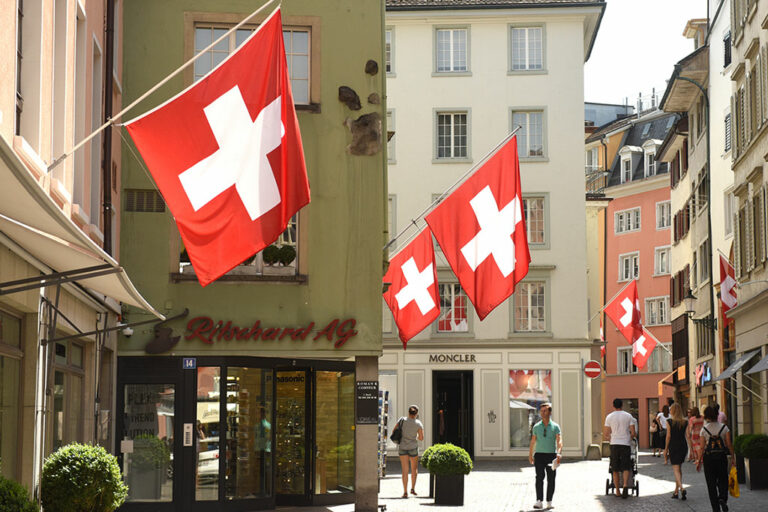

Sygnum disclosed that the enhanced regulatory clarity in Europe, provided by the new Markets in Crypto-Asset Regulation (MiCAR), has facilitated the expansion of regulated digital asset solutions across the 27-member European Union.

The law was introduced to provide a clear regulatory framework for the use and application of crypto, as well as to guide service providers within the European Union to protect consumer interests. Sygnum also noted that crypto regulations in Switzerland have contributed to the increasing adoption of digital assets in the country. The laws provide legal certainty, investor protection, and a positive environment for innovation in the industry.

According to the company, last year, 21% of the Swiss population interacted with the emerging digital economy. This figure represents the highest rate in Europe and more than double the level in the United Kingdom, Germany, and France.

Sygnum explained that Switzerland’s regulatory framework permits it to act as a crypto custodian for its partner banks, managing crypto assets on behalf of their customers. The company stated that it holds these assets “off-balance sheet” to eliminate the risk of counterparty issues.

next