With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Bitcoin faced heavy selling pressure with outflows reaching $571 million. A portion of investors even bet against the flagship cryptocurrency, pouring $2.8 million into short-Bitcoin positions.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

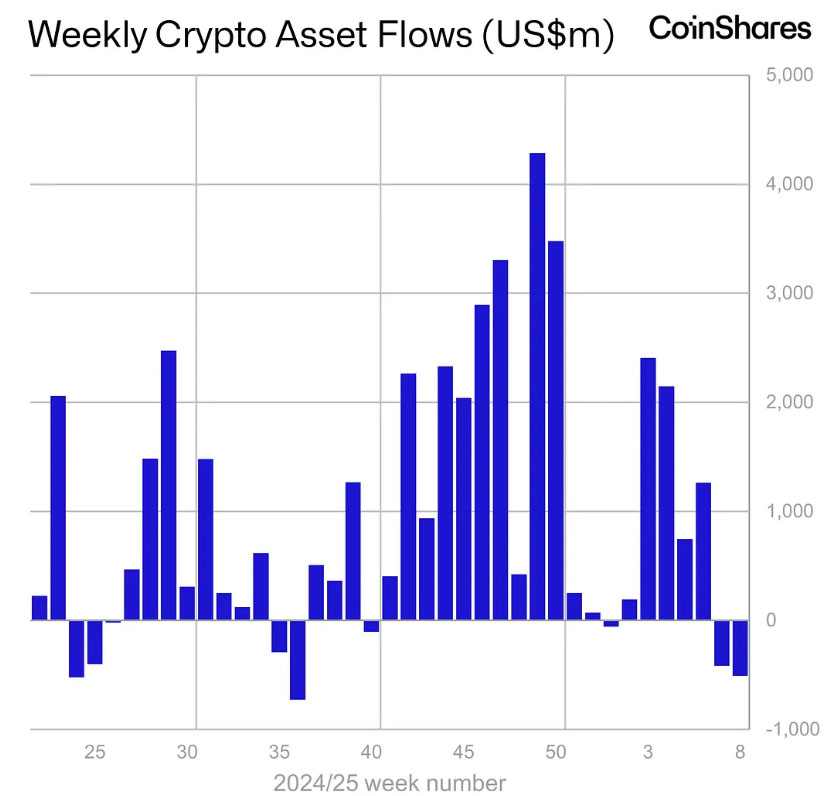

Cryptocurrency investment products saw a significant sell-off last week, with outflows hitting $508 million, marking the second consecutive week of heavy withdrawals. The previous week had already witnessed $415 million in outflows, bringing the two-week total to a staggering $924 million, according to a digital asset investment firm CoinShares report on February 24.

Source: CoinShares

The market instability coincided with growing uncertainty over US economic policies following the presidential inauguration. Investors have been on edge due to concerns about trade tariffs, inflation, and shifting monetary policies, pushing them to reassess their holdings in crypto exchange-traded products (ETPs).

James Butterfill, head of research at CoinShares, pointed to these economic concerns as the key driver of the sell-off, saying:

“Digital asset investment products saw outflows totalling $508M as investors exercise caution following the US Presidential inauguration and the consequent uncertainty around trade tariffs, inflation and monetary policy.”

Bitcoin BTC $107 443 24h volatility: 0.1% Market cap: $2.14 T Vol. 24h: $12.48 B faced heavy selling pressure with outflows reaching $571 million. A portion of investors even bet against the flagship cryptocurrency, pouring $2.8 million into short-Bitcoin positions. That shift in sentiment suggests that many believe further downside may be ahead for Bitcoin.

In contrast, alternative cryptocurrencies, or altcoins, experienced net inflows, signaling a divergence in investor behavior. XRP XRP $2.19 24h volatility: 0.6% Market cap: $129.06 B Vol. 24h: $943.92 M led the pack, drawing in $38.3 million, adding to its impressive $819 million in inflows since mid-November 2025. The sustained interest in XRP comes as investors grow optimistic that the US Securities and Exchange Commission (SEC) may eventually drop its long-running lawsuit against the token.

Solana SOL $150.8 24h volatility: 0.5% Market cap: $80.58 B Vol. 24h: $2.71 B , Ethereum ETH $2 437 24h volatility: 0.0% Market cap: $294.17 B Vol. 24h: $7.05 B , and Sui SUI $2.81 24h volatility: 2.1% Market cap: $9.56 B Vol. 24h: $626.63 M also posted positive inflows, albeit at smaller scales. Solana brought in $8.9 million, Ethereum saw $3.7 million, and Sui registered $1.47 million. The resilience of these assets indicates that investors are selectively rotating their capital rather than exiting the market entirely.

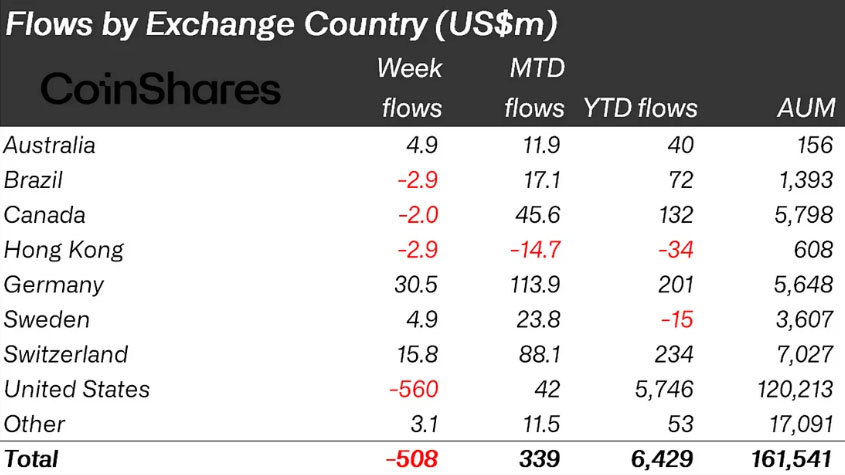

The regional breakdown of flows starkly contrasted the US and European markets. The US saw a massive $560 million outflows. Meanwhile, Europe painted a different picture, with steady inflows continuing across several countries. Germany and Switzerland stood out with inflows of $30.5 million and $15.8 million, respectively.

Source: CoinShares

Trading turnover has also taken a sharp hit. Two weeks ago, market turnover stood at $22 billion, but that figure plunged to $13 billion last week, a sign that many traders are moving to the sidelines. The drop in liquidity further exacerbates volatility, making the market more susceptible to sudden price swings.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.