Conflux to Bring Uniswap v3 and Curve to China’s Public Blockchain

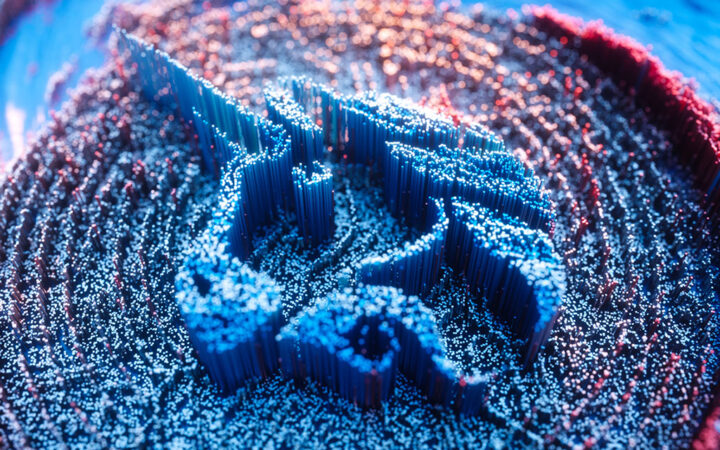

Conflux, the only regulatory-compliant blockchain in China, has proposed deploying Uniswap v3 on its network alongside CNH (offshore Chinese Yuan) stable currency, and joining the Curve Wars with its mainnet token CFX bridged to Ethereum mainnet, known as eCFX. This proposal comes after Binance’s announcement that it will support Conflux Network’s (CFX) mainnet integration. The hope is to attract more initiatives, establish liquidity pools to facilitate the exchange of CFX tokens, and implement incentives that promote liquidity, ultimately increasing the network’s worth and usage.

By deploying Uniswap v3 on Conflux eSpace, the Uniswap community gains access to a wider range of trading opportunities with both USD- and CNHC-based pairs. This development is particularly timely in light of regulatory restrictions facing USD-based stablecoins. Furthermore, projects operating in currencies other than USD will benefit greatly from this deployment, especially Asian projects that can now use CNH for settlements without worrying about currency fluctuations.

Conflux has opted to participate in a highly intricate Defi ecosystem in parallel, with the aim of drawing the attention of ETH DeFi players. Conflux’s cross-chained $CFX on Ethereum, $eCFX, offers a liquidity pair with ETH on Curve. Following an on-chain vote by the Curve DAO, the Curve pool (eCFX-ETH) has been officially approved and added to the Curve Gauge. You can find the vote results here.

Furthermore, the aforementioned pool is now available for staking on Conflux, enabling DeFi users to operate deeper within the Curve ecosystem. While Curve has been deployed on several other networks before, none of these networks initially launched a pool on Curve (Ethereum) prior to welcoming Curve on their platform. Conflux’s choice to do so indicates their efforts to establish contact with the Curve community while on Ethereum and offer a new Curve pool for Asian DeFi projects before a possible launch of Curve on Conflux eSpace.

The intersection of US and EU regulatory barriers on blockchain and the recent supportive regulations on blockchain in Hong Kong emphasize how crucial the Chinese market is for the development of Web3 projects.

Over 84% of global blockchain applications have been submitted in China, dwarfing submissions in the UK (11%) and the US (14%), which confirms that China represents one of the most innovative markets in Web3.

Christian Oertel, Global Expansion Manager, says:

“By integrating eCFX with the Curve ecosystem, our team aims to demonstrate a strong commitment to robust DeFi. As Uniswap prepares to launch on Conflux, more tokens developed by Asia-based teams will be incentivized to build bridges into this burgeoning ecosystem. Once Conflux reaches an appropriate scale, our team plans to natively deploy Curve Finance, bringing the efficient stablecoin AMM-giant to Asia’s own DeFi-centric blockchain.”

About Conflux Network

Conflux is a permissionless Layer 1 blockchain connecting decentralized economies across borders and protocols. Recently migrated to hybrid PoW/PoS consensus, Conflux provides a fast, secure, and scalable blockchain environment with zero congestion, low fees, and improved network security.

As the only regulatory-compliant public blockchain in China, Conflux provides a unique advantage for projects building and expanding into Asia. In the region, Conflux has collaborated with global brands and government entities on blockchain and metaverse initiatives, including the city of Shanghai, McDonald’s China, and Oreo.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.