Bitcoin price has reached its 2-year high while investors are increasing their contribution in blockchain and bitcoin development.

Chinese retail investors have been showing increased interest in new digital payment systems and cryptocurrencies such as bitcoin. However, large companies understand the real value of the blockchain and make considerable investments in the technology too. Bitcoin price surged to 2-year high last week when it reached $700. Now the price dropped to $598.

USA Today brings the latest news from China and informs that a group of large technology and financial firms has made a $60 million investment in the Chinese unit of Circle, a US-based blockchain-payments startup.

The list of the investors includes Baidu, the Chinese search giant; CICC Alpha, a growth-investing unit of the China International Capital Corp.; the private-equity arm of China EverBright Investment Management Ltd.; CreditEase, an online lender owned by Yirendai, a Chinese financial services firm traded in the U.S., and IDG Capital Partners leading the round.

Circle expressed its gratitude in the blog post: “These strategic partners are betting on Circle’s goal of creating an open, global model for social payments that enables consumers in China, the US and Europe to exchange value the same way we share content and communicate. We are thrilled to have these companies as partners in our global endeavors, and in our nascent expansion into China itself.”

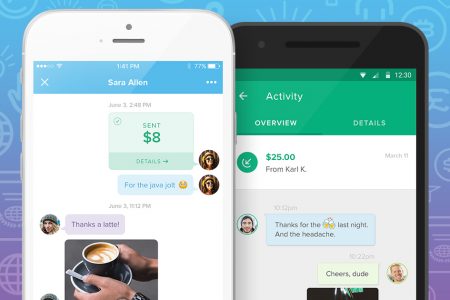

Circle China was launched as an independent Chinese company focused on bringing the benefits of open, global social payments to Chinese consumers. The launch became possible due to a multi-million dollar seed investment from many of the strategic investors.

Circle admits that it was really inspired by Chinese financial services and financial thinking in general. Messaging and payments, p2p lending and novel forms of saving and investment, powered by the internet and software, are developing at a quicker pace in China comparing to the West.

“While we are not yet offering a commercial product and service in China, we are committed to the development of a China-native company, with major Chinese owners and investors in both Circle China and Circle Global. Like our work in the US and UK/Europe over the past couple of years, we must ensure that our products are found compliant with the laws and regulations of the Chinese payments and banking regime. With very strong strategic partners, we are excited about what we can build and deliver for the rising Chinese consumer”, says Circle.

One more big funding brought $9.6m to Tel Aviv-based blockchain startup Colu. Investors include Aleph, Spark Capital, Digital Currency Group and former Thomson Reuters CEO Tom Glocer.

In 2015 Colu raised $2.5m in seed funding. The investment provided by American and Israeli venture capitalists was intended for the development of platform and consumer app for the secure purchase and storage of all kind of items in the blockchain.

next